Year 0 Year 1 Year 2 Year 3 PANEL A Before-tax cash flow($1,000) $100 $100 $1,100 (CF) Basis $1,000 $1,000 $1,000 $1,000 Taxes on coupons ($28) ($28) ($28) After-tax CF ($1,000) $72 $72 $1,072 After-tax yield (IRR) 7.20% PANEL B Basis $918.71 $956.52 $1,000 Accrued interest 81.29 Taxes on accrued ($22.76) interest Capital loss -81.29 Tax shield from $22.76 capital loss After-tax CF ($1,000) $94.76 $72 $1,049.24 After-tax yield (IRR) 7.31% Incremental after-tax CF $22.76 $0 ($22.76) EXHIBIT 3 Incremental After-Tax Cash Flows of Increasing-the-Basis- Above-Par Strategy The bond has 10% annual coupon, three-year maturity, is purchased at par, and the yield changes from 10% at the beginning of the Year 1 to 5% at the end of Year 3.

Taxes and bond returns

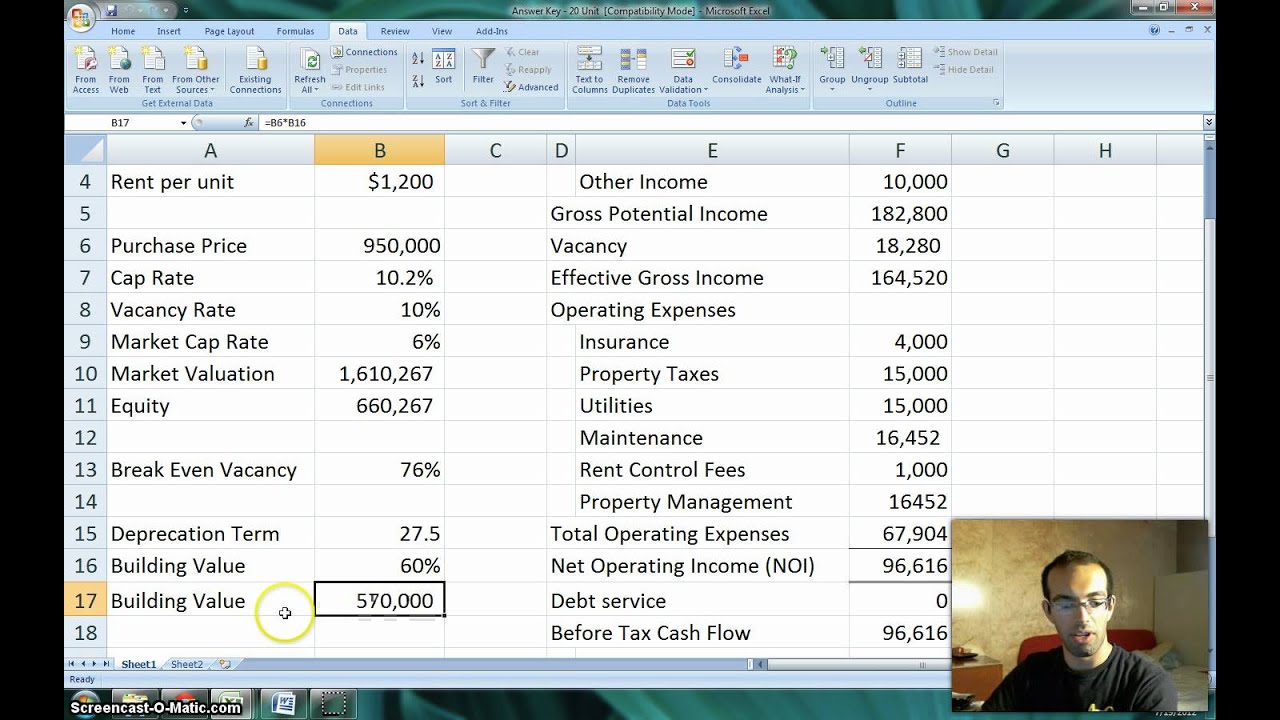

PGI = Potential gross income V&RL = Vacancy and rent loss EGI = Effective gross income OE = Operating expenses NOI = Net operating income DS = Debt service + interest BTCF = Before-tax cash flowTAXES = Federal and state income taxes ATCF = After-tax cash flow

Project feasibility using breakeven point analysis

Subtracting $80 interest expense, before-tax cash flow is $20.

Interest expense (10% of an $800 loan) is also subtracted, to result in annual before-tax cash flow of $20.

That tax is then subtracted from the before-tax cash flow. If taxable income is zero, there is no income tax in that year, so after-tax cash flow is the same as before-tax cash flow.

Again, it should be noted in Table 2 that the property generates $20 of before-tax cash flow. Because of the non-cash deduction for depreciation, a tax loss of $9.09 is provided each year.

Other simulations were run in which before-tax cash flow was less than the benchmark, and accordingly, tax losses were greater.

Implications of the 1993 Tax Act for real estate investments

0 thoughts on “The before-tax cash flow (btcf) is also called”