Coinbase how to sell bitcoin for cash - excellent

How to sell Bitcoin

If you’re investing in cryptocurrencies, you need to know how to buy Bitcoin. You also need to know how to sell it. Unless you’re a true evangelist waiting for it to displace fiat currencies, then knowing when to take your profit is important and being able to do so, even more so.

Digital Trends isn’t about to give out investment advice — that’s not our forte — but we can break down the technical fundamentals for you, like how to sell Bitcoin.

There are different ways to go about it, depending on whether you want to sell on an exchange or directly, but here are some steps to take to sell your Bitcoin fast and easily.

Step 1: Set up an exchange account

The simplest and most “automated” way to turn your Bitcoin into hard cash is through an exchange platform. They act as a middleman for the famously decentralized cryptocurrency by selling your Bitcoin for you. Since it’s one of the most popular and well-established exchanges, we recommend Coinbase. If you would rather choose your own, there are many others to pick from, including popular international options like Bitstamp and Bitfinex.

Signing up for an account at Coinbase is easy, but there are some hoops you’ll have to jump through. Depending on which country you’re in, you will have to comply with different forms of “know your customer” rules, which may mean sending the site certain ID forms. That can take a few days to process. Signing up for Coinbase Pro is also recommended, though not strictly necessary, to give you greater control over your sale.

Once your account is created, link your bank account so that when you have made your trade, you can get cash out with as little hassle as possible.

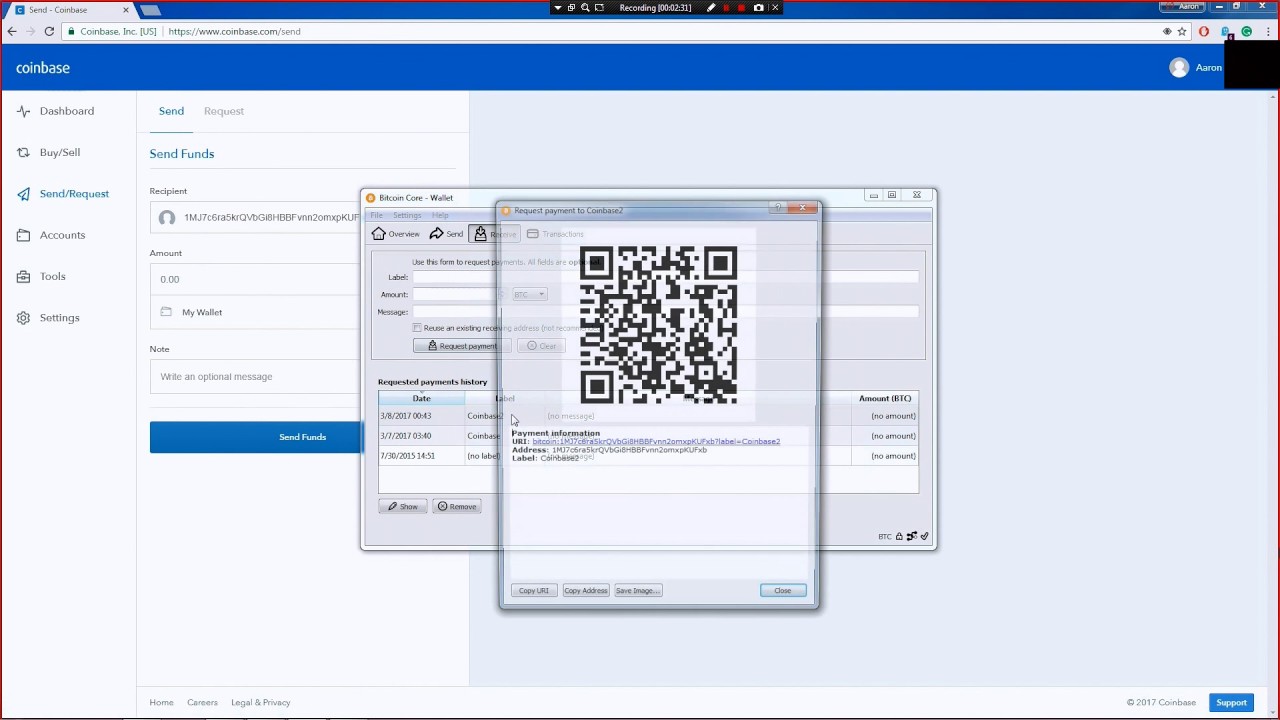

Step 2: Transfer your Bitcoin to your exchange wallet

If you followed our guide on buying Bitcoin, you’d have stored your Bitcoin in a secure — maybe even cold — wallet. To trade on Coinbase, you’ll want to send your Bitcoin to an exchange wallet and keep it there, ready for sale.

Beginners can always use the Coinbase Wallet app, which connects the wallet super simple, as it automatically works with Coinbase trades. Just open the app and wait for the notification to “Connect Now,” then enter your Coinbase login information. If you don’t see the notification, you can always go to Settings and choose Connect to Coinbase to get started. The Coinbase Wallet also has a few other handy features, including paying merchants directly from the wallet if they are part of the Coinbase Commerce program.

Coinbase’s security is excellent, providing support for biometrics and advanced authentication technology. However, if you prefer to use another digital wallet, head to its settings, and look for ways to connect to a currency exchange. You should be able to input your Coinbase login on the most popular digital wallets and start an authentication process to connect it. However, this may take several days to complete, so it’s definitely not a last-minute step.

Step 3: Place a sell order

With your exchange account set up, your bank account linked, and your Bitcoin deposited on the exchange, it’s time actually to make a sale. The latest version of Coinbase makes this very easy. Select Buy/Sell from the top menu and move to the Sell section. Choose Bitcoin as your currency of choice, and make sure the right destination is selected for your funds in the Deposit To section. If you have a bank account connected to your account, you will be able to select it here for a direct transfer.

Check your connected wallet to see how much Bitcoin you have, and choose the amount you want to sell. In 2018, Coinbase raised its default limits for trading and started allowing people to trade their cryptocurrency immediately after buying it, which is one reason we are fans of the service. You can see your weekly bank limit in the same section. Finally, choose if you want to repeat this sale, and if so, at what frequency. Then select Sell Bitcoin. That’s it!

There will be a short holding period before the sale is complete. You can make as many sales during this time as you want, but the transfers won’t finish until their holding period is over.

As for deciding when to sell, well, that’s getting into the genre of investment advice, and there are many strategies based on your long-term plans and how much Bitcoin you want to move. Bitcoin has been going through a long period of devaluation and corrections lately, intermixed with slight recoveries. Some serious research may be required to decide when the best time to sell is for you.

Alternative methods

If you’d rather have more of a hand in the actual sale process, direct trades (or peer-to-peer trades) are possible alternatives. You will need to register, which in some cases will mean confirming your identity, so as with all selling methods, we’d recommend getting your account set up well in advance of when you actually want to sell. Once you’re set-up, however, you can sell your Bitcoins in a much more direct manner.

In exchanges, Bitcoin automates trades between the two parties, but there is a different protocol for selling. When you sell, the transaction occurs directly between seller and buyer. You set up a sell order for a specific value, and when someone comes along looking to buy at the agreed-upon price, the site will alert you that you can move ahead with the transaction. When both parties agree on the terms, you first receive payment from the buyer, and subsequently, you send the buyer the cryptocurrency.

The actual method of conducting the payment will very much depend on which platform you make the trade through. Sites like BitQuick keep things exclusively online, using bank account transfers. However, sites like LocalBitcoin or Paxful have far more numerous options, including Moneygram, gift cards, cash in the mail, and even cash in person.

While certain methods may be tedious in their complexity, they function to anonymize the transaction, effectively ensuring privacy and safety, which should take precedence. If you decide to make trades in person, make sure to do so in a public setting.

-

-

-