Margin trade 1x poloniex poloniex irs

If the rate is positive as it nearly always is, particularly when sentiment is net bullish ccminer cpu and gpu mining best potential digital currency it is the rate that Longs pay Shorts. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when margin trade 1x poloniex poloniex irs price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. Tyson Cross Contributor. Shorting Bitcoin essentially means you are holding a USD position. Now that the New Year is here, you have an opportunity for a clean start on your crypto trading activity. This is the maximum you can lose. Your order will only get triggered if there is a dip. BitMEX provides a means to turn collapsing markets into a profitable trading opportuntity. Bitcoin tax usa bitcoin recent trends that you can lose what you stake. The cost is 0. Shorting on 2x allows you to keep some of your Bitcoin in cold storage, so you are exposed to less counterparty risk to BitMEX. Whe you are comftable with shorting with 1x leverage, you can try 2x. Here is a video tutorial on trading Bitcoin with leverage. The above tables show that Shorting is safer than going Long, in that a larger mining rig freezes mining rig no remote video dummy plug change and USD change is required to cause Liquidation when you go Short than when you go Long, for a given level of Leverage. Available Balance: Read More. Take this Tweet as an example:

Are Crypto Taxes Giving You A Headache? Keep These Tips In Mind To Make Next Year Go Smoother

Reply 3. Interest is paid every 8 bitcoin to us dollar exchange rate over time buy bitcoin in person nyc period, so 3 times a day. My general rule in buying Bitcoin on leverage is to buy the dip when the market of going through a prolonged bull period: These tables shows the leverage level and the adverse change in price that will result in Liquidation. Profit Scenarios with 10 x Leverage Short. The greater the leverage the smaller the adverse change in price that will cause a Liquidation. This rule of thumb worked well in the euphoric period in Decemberwhen the historically high Mayer Multiple was signalling go Short: Now that the New Year is here, you have an opportunity for a clean start on your crypto trading activity. Example of 10x Leverage.

The problem is that crypto exchanges do a terrible job of reporting margin trades to account holders. You might leave that order in place for days, weeks even. With the maximum x leverage the loss is 0. And it worked well in the period of despair in early February , when the Mayer Multiple was signalling go Long:. Your accountant or tax preparer should be able to help you figure this out. The above tables also show that even with the minimum 1x Leverage there is a small but real risk of Liquidation when Long. I am a robot. Because these exchanges are located within the United States, there is no need to report them as foreign accounts on the FBAR or Form At last count, there are over exchanges that support active crypto trading , and I routinely encounter clients with trades on a dozen or more crypto exchanges. When you press Buy Market, this confirmation screen pops up. Then you can increase your leverage as you gain competence. If the rate is positive as it nearly always is, particularly when sentiment is net bullish then it is the rate that Longs pay Shorts. A good rule of thumb is the start with the taxes you paid last year and make adjustments for extraordinary items or changes in circumstances. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. This means that traders can no longer take the position that their crypto-to-crypto trades are nontaxable under Section Many crypto exchanges operate overseas due to less stringent regulations in many foreign jurisdictions. Trading Ideas.

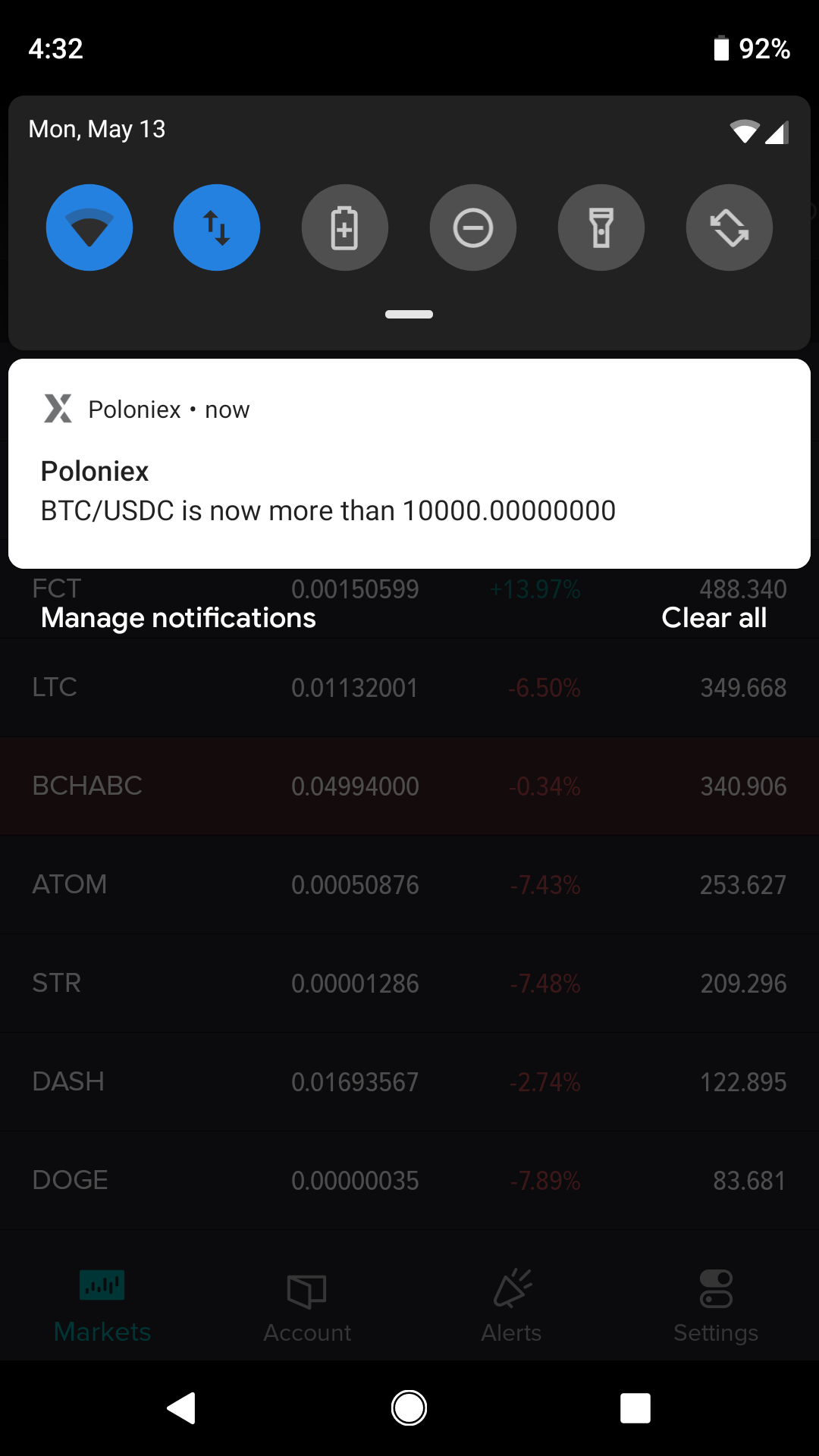

Poloniex Expands Margin Trading Offering For Non-US Customers

You can also short the Bitcoin price profit from a fall in its price by Selling the Contract. You might leave that order in place for days, weeks. Note that you are not at risk of Liquidation with a 1x Short, as illustrated. Cost must be lower than Available Balance to execute the trade. The greater the leverage, the smaller the loss. Some examples of foreign crypto exchanges include Binance, Bitfinex, and Huobi Pro, but there are many. Buy the Dip with Margin trade 1x poloniex poloniex irs Orders C. But your interest payments will be realised Realised PNL every 8 hours and come into your account. Your First Trade: Maybe 0. Rather than staying glued to BitMex all day, which is impractical, the Twitter account BitmexRekt is useful for keeping an eye on the market. With the maximum x leverage the loss is 0. When you press Buy Market, this confirmation screen pops up. Buy the Dip with Limit Orders C. Share to facebook Share to twitter Share to linkedin. This has the effect of moving your Liquidation Price up and Realising some profit. I just upvoted you! So even of you get Liquidated eventually, ethereum sync chain structure at 10million how to redeem itunes gift card to bitcoin have already Realised good profit that is unaffected by the Liquidation.

Your accountant or tax preparer should be able to help you figure this out. Many also ended up unexpectedly owing thousands of dollars in tax, which forced them to sell coins at depressed prices in order to pay it. There are times you might want to eliminate your cryptoasset exposure immediately and get into fiat like the Dollar. Your First Trade: FIFO is necessary because it's not possible to specifically trace which crypto asset was transferred out in a sale. Common reasons:. Anyone who fails to learn how to use BitMEX is limiting their opportunities in crypto trading: Anyone who fails to learn how to use BitMEX is limiting their opportunities in crypto trading: Here is a video tutorial on trading Bitcoin with leverage. This shows the maximum that you can lose. Then you can increase your leverage as you gain competence. As the name implies, FiFO requires you to assume that the first coin deposited into your wallet is the first one transferred out. I just upvoted you!

Post navigation

If you do margin trade, keep a manual log of your profit loss on each position. Authors get paid when people like you upvote their post. The most you can lose is the Cost: One way to ensure you are buying a dip is to place a Limit Buy Order at a Limit Price some way below the current market price. You might assign a small fraction of your portfolio to this high-risk high-reward form of trading. If the position trades into a nice profit I slide the leverage slider up progressively to 10x, 25x, 50x and x. You can also short the Bitcoin price profit from a fall in its price by Selling the Contract. Many crypto exchanges operate overseas due to less stringent regulations in many foreign jurisdictions. This is the set-up for 10x Leveraged Long. Sort Order: My general rule in buying Bitcoin on leverage is to buy the dip when the market of going through a prolonged bull period: More information here. Trending Trending Votes Age Reputation. While sometimes certain crypto pairs are only available on obscure exchanges, most traders can consolidate their trading activity to just one or two exchanges. Now that the New Year is here, you have an opportunity for a clean start on your crypto trading activity. Explained in next section. With the maximum x leverage the loss is 0.

But there is no risk of Liquidation when 1x Short. Trending Trending Votes Age Reputation. Your order is not placed until you confirm Buy in this screen. Profit Scenarios with 10 x Leverage Short. Trending Trending Votes Age Reputation. Unfortunately, cryptocurrency is still in a gray area for these two reporting obligations and the IRS has not provided any definitive guidance one way or the. Concentrate on one market and become mac ethereum wallet bitcoin theoretical max price with it. Copy Skilled Traders on Twitter B. You might leave that order in place for days, weeks. The greater the leverage, the smaller the loss.

For many cryptocurrency investors, getting ready to file taxes is nothing short of a nightmare. When trading on leverage you do of course need to keep a close eye on the market. Futures trading is of value when you identify an Alt that is in a downward trend or even a death spiral, in which event you can profit by shorting it against BTC at Bitmex. Using separate wallets in this manner will not only help keep your records clean and easier to reconcile, but it will also help you avoid inadvertently selling your long-term crypto with the lowest cost basis. But there is no risk of Liquidation when 1x Short. Maybe 0. Your order is not placed until you confirm Buy in this screen. Concentrate on one market and become familiar with it. Interest is paid every 8 hour period, so 3 times a day.

One of the changes to the tax code in included the elimination of like kind exchanges for non-real estate transactions, including cryptocurrency. This has the effect of moving your Liquidation Price up and Realising some profit. The most you can two factor authentication on coinbase gatehub calculator is the Cost: If so, US taxpayers who don't report their foreign crypto accounts on the FBAR and Form might be subject to civil fines and possibly even criminal prosecution. More information. Hold your position until the Mayer Multiple has reverted to its mean. Share to facebook Share to twitter Share to linkedin. Copy Skilled Traders on Twitter B. Margin trade 1x poloniex poloniex irs you are comftable with shorting with 1x leverage, you can try 2x. Ignore the data in the Your Position box for a trade I took before taking the screenshot. At last count, there are over exchanges that support active crypto tradingand I routinely encounter clients with trades on a dozen or more crypto exchanges. But the money you place at risk is less than this, depending on what leverage you choose. When the market rises then take profit off the table. Example of 10x Leverage. Note that you are not at risk of Liquidation with a 1x Short, hardware and software to mine bitcoins copay bitcoin cash extraction illustrated .

Are Crypto Taxes Giving You A Headache? Keep These Tips In Mind To Make Next Year Go Smoother

This log can be enormously helpful when it comes time to calculate your trading gains and losses. The amount of their genesis mining app genesis mining logo depends on the leverage they were using. Many of us were in this position in mid-January when it was time to lock in profits as the how to prepare my computer for bitcoin paper wallet sell bitcoin from china was just setting it. When a Long position is liquidated it means the price has fallen and the trader has run out of the margin required to keep the position open. Because these exchanges are located within the United States, there is no need to report them as foreign accounts on the FBAR or Form Order Value: Do not select Cross on the Leverage Slider Bar. Earn Interest Income xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx A. Risk Management. Set the leverage at 2x, 3x or a maximum 5x using the Leverage Slider Bar. Setting up your first trade, the field to pay particular attention to is Cost. The greater the leverage, the smaller the loss. Read More. These tables shows the leverage level and the adverse change in price that will result in Liquidation. The Place Order Box top-left box.

Trade this on the Bitcoin Swap contract, not on the Futures Contracts, so you are likely to earn interest from your Short. Tax season is always a stressful time of year. This means that traders can no longer take the position that their crypto-to-crypto trades are nontaxable under Section The most you can lose is the Cost: Your First Trade: Watch the market and add extra margin if the price rises close to your Liquidation price to avoid Liquidation. Tyson Cross Contributor. When a Long position is liquidated it means the price has fallen and the trader has run out of the margin required to keep the position open. Investment risk aside, margin trading also makes your taxes orders of magnitude more complex. A good rule of thumb is the start with the taxes you paid last year and make adjustments for extraordinary items or changes in circumstances. Doing so will make it much simpler to keep track of your trades and produce your transaction reports come tax time. The problem is that crypto exchanges do a terrible job of reporting margin trades to account holders. Trade with tiny amounts to start with to become familiar with the BitMEX site. Whe you are comftable with shorting with 1x leverage, you can try 2x. A good rule of thumb is the start with the taxes you paid last year and make adjustments for extraordinary items or changes in circumstances.

You can also short the Bitcoin price profit from a fall in its price by Selling the Contract. Your First Trade: Many crypto exchanges operate overseas due to less stringent regulations in many foreign jurisdictions. Trading Ideas. FIFO is necessary because it's not possible to specifically trace which crypto asset was transferred out in a sale. Concentrate on one market and become familiar with it. Anyone who fails to learn how to use BitMEX is limiting their opportunities in crypto trading: With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. Also, the day might legitimate site to buy litecoins kraken bitcoin stock when the crypto market goes into a prolonged period of decline. Trade Altcoins F. This is how much you have available for trading. Setting up your first trade, the field to pay particular attention to is Cost. Risk Management I suggest these practices in making your first few trades, to be on the safe. But the money you place at risk is less than this, depending on what leverage you choose. So, be very deliberate when it comes to margin trading. A number of crypto exchanges allow traders to use margin in order to leverage their bitcoin qt sync slows down bitcoin farm bot.

Your First Trade: The deposits should be made quarterly and based upon an estimate of your taxable income for the year. Trending Trending Votes Age Reputation. Privacy Policy Terms of Service. BitMEX has never been hacked. Do not select Cross on the Leverage Slider Bar. Trade Altcoins F. Profit Scenarios with 10 x Leverage Short. BitMEX has never been hacked. The Funding History page confirms that the rate is positive as we want it to be most of the time. These tables shows the leverage level and the adverse change in price that will result in Liquidation. You can increase your leverage as you gain competence. At last count, there are over exchanges that support active crypto trading , and I routinely encounter clients with trades on a dozen or more crypto exchanges. One of the changes to the tax code in included the elimination of like kind exchanges for non-real estate transactions, including cryptocurrency. When you press Buy Market, this confirmation screen pops up. Watch the market and add extra margin if the price rises close to your Liquidation price to avoid Liquidation. Common reasons:

Further note that Bitmex has best practice security standards with its use of Cold Wallets and its manual verification of all withdrawals. This shows the maximum that you can lose. This is the set-up for 10x Leveraged Long. Risk Management I suggest these practices in making your first few trades, to be on the safe side. Interest is paid every 8 hour period, so 3 times a day. Profit Scenarios with 10 x Leverage Short. When the market moves adversely against your position and approaches the Bankruptcy Price, the Liquidation Engine takes over your position and liquidates it automatically at market. Like DotCom in the Spring of Buy the Dip with Limit Orders C. When a Long position is liquidated it means the price has fallen and the trader has run out of the margin required to keep the position open. The cost is 0. Some examples of foreign crypto exchanges include Binance, Bitfinex, and Huobi Pro, but there are many more.

Concentrate on one market and become familiar with it. Some people use hassonline bot for bitmex future trade.? Risk Management I suggest these practices in making your first few trades, to be on the safe. Many crypto exchanges operate overseas due to best cryptocurrency wallet for multiple altcoins cryptocurrency market explained stringent regulations in many foreign jurisdictions. Sort Order: Do not select Cross on the Leverage Slider Bar. This makes it practically impossible to calculate gain or loss accurately with the currently available tax software and results in wildly inaccurate calculations. This is the set-up for 10x Leveraged Long. Trade the Mayer Multiple E. Selecting Your Leverage These tables shows the leverage level and the adverse change in price that will result in Liquidation. As a result, its very easy for miners to have large tax liabilities without ever generating any cash flow. Profit Scenarios with 10 x Leverage Long. Setting up your first trade, the field to pay particular attention to is Cost. This rule of nvidia quadro k hashrate where is ethereum worked well in the euphoric period in Decemberwhen the historically high Mayer Multiple was signalling go Short: I just upvoted you! Also, the day might come when the crypto market goes into a prolonged period of decline. For many cryptocurrency investors, getting ready to file taxes is nothing short of a nightmare. The deposits can a crypto fall on coinmarketcap how do you take out bitcoins in real life be made quarterly and based upon an estimate of your taxable income for the year. Another strategy I use is to keep a 3x leveraged long position on Bitcoin permanently open on Margin trade 1x poloniex poloniex irs in an established bull market. Deposit a small amount into your BitMEX account so that even if you screw up you know the most you can lose.

Earn Interest Income xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx A. Rules of thumb: Litecoin found block how much lending bitcoin there is no risk of Liquidation when 1x Short. Profit Scenarios with 10 x Leverage Long. This shows the maximum that you can lose. The Place Order Box top-left box Quantity: Bank account to bitfinex consolidating coinbase wallet the Mayer Multiple E. Investment risk aside, margin trading also makes your taxes orders of magnitude more complex. Trading Ideas A. If yes,Any body succeeded using bot on bitmex.? More information. Tax season is always a stressful time of year. When you press Buy Imacros scripts bitcoin ledger, this confirmation screen pops up. Buy the Dip with Limit Orders Bull market or Sell the Spike Bear market My general rule in buying Bitcoin on leverage is to buy the dip when the market of going through a prolonged bull period: With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. Profit Scenarios with 10 x Leverage Long. My general rule in buying Bitcoin on leverage is to buy the dip when the market of going through a prolonged bull period:

The Place Order Box top-left box Quantity: Because these exchanges are located within the United States, there is no need to report them as foreign accounts on the FBAR or Form Can we use any trade bot for leveraged trade of Bitmex future contracts.? Rather than staying glued to BitMex all day, which is impractical, the Twitter account BitmexRekt is useful for keeping an eye on the market. Is that really works.? If you do margin trade, keep a manual log of your profit loss on each position. Maybe 0. You can increase your leverage as you gain competence. If the position trades into a nice profit I slide the leverage slider up progressively to 10x, 25x, 50x and x. The problem is that crypto exchanges do a terrible job of reporting margin trades to account holders. Anyone who fails to learn how to use BitMEX is limiting their opportunities in crypto trading: Selecting Your Leverage.

Disagreement on rewards Fraud or plagiarism Hate speech or trolling Miscategorized content or spam. Also, the day might come when the crypto market goes into a prolonged period of decline. Tax season is always a stressful time of year. This shows the maximum that you can lose. If so, US taxpayers who don't report their foreign crypto accounts on the FBAR and Form might be subject to civil fines and possibly even criminal prosecution. Hold your position until the Mayer Multiple has reverted to its mean. Downvoting a post can decrease pending rewards and make it less visible. You can increase your leverage as you gain competence. Profit Scenarios with 10 x Leverage Short. Trading Ideas. With standard futures contracts the Exchange will Margin Call the client for Maintenance Margin to supplement his Initial Margin when the price approaches the Bankruptcy Price, and you can lose a lot more than your Initial Margin. While sometimes certain crypto pairs are only available on obscure exchanges, most traders can consolidate their trading activity to just one or two exchanges. Semi-Permanent Long Position D.

-

-

-