Coinbase use bitcoin to buy ethereum - matchless message

Coinbase Strategy Teardown: How Coinbase Grew Into The King Midas Of Crypto Doing $1B In Revenue

To sustain the cryptocraze, Coinbase will need to foster real applications of cryptoassets — and not just speculation.

Coinbase is the most popular consumer-facing cryptoasset exchange in the United States. Operating since 2011, the company allows users to buy, sell, and store cryptoassets, like bitcoin and ethereum.

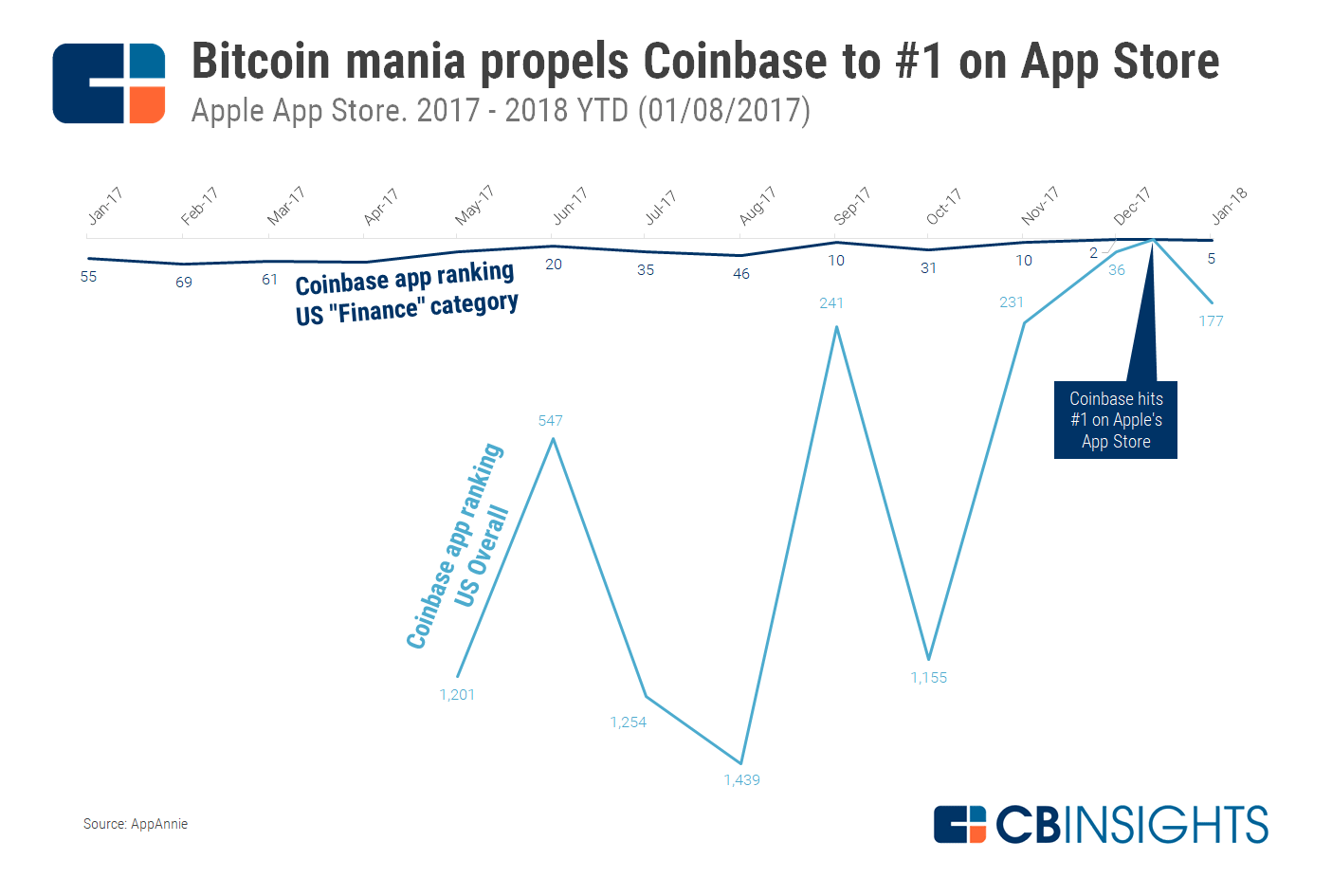

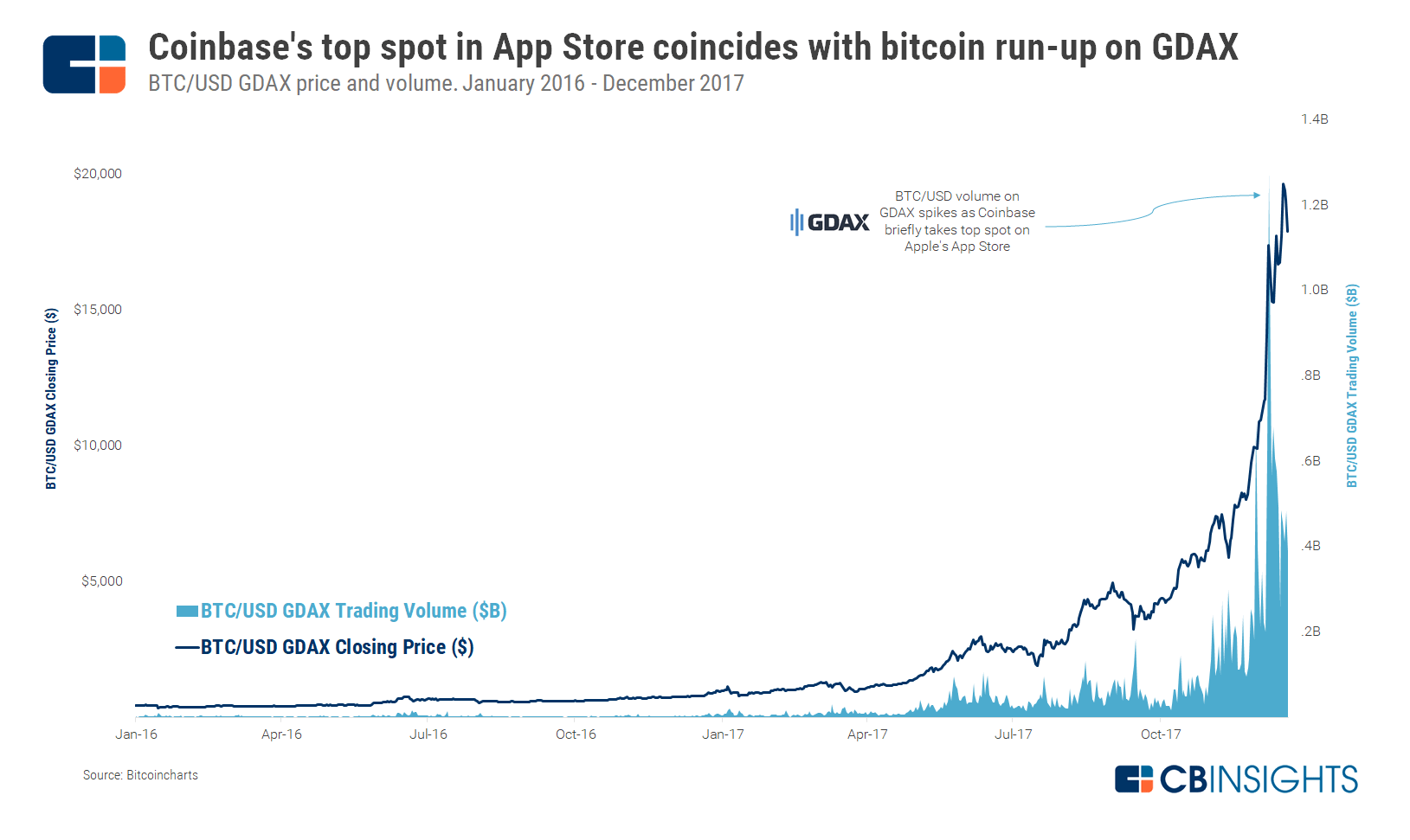

The company already has significant visibility with consumers in a sector that was once exclusively the province of cryptoasset enthusiasts. In mid-December, the company’s mobile app reached the top spot on Apple’s App Store.

Coinbase has soared in popularity and turned itself into the on-ramp for mainstream crypto investors by positioning itself as a safe harbor among cryptoasset exchanges. The company has never been hacked, unlike many of its competitors. Coinbase has also maniacally pursued compliance with existing regulations and law enforcement, putting it on the right side of the law — another huge asset in a sector that is still in desperate need of regulatory guidance.

This has helped Coinbase secure $217M in equity financing from some of the biggest-name VCs, and vaulted the company into the unicorn club.

However, while Coinbase is best known for its cryptoasset exchange, it has bigger aspirations than helping people buy and sell crypto. The company’s stated goal echoes cryptoasset enthusiasts’ ultimate vision: to create a new, “open financial system.”

For the time being, though, Coinbase looks a lot like a traditional financial services player. Coinbase makes money by charging fees for its brokerage and exchange. It also custodians user funds, like a bank, and decides which cryptoassets to list, like the NASDAQ or NYSE.

Coinbase thus finds itself caught between worlds: it’s the most well-funded blockchain company in the United States, but it’s a centralized company, not a decentralized ledger. The company once advertised cryptoassets as the “future of money,” but now positions itself as a way to “buy and sell digital currency.” In many ways, Coinbase is a centralized on-ramp to a decentralized ecosystem.

This begs the question: how does Coinbase view the assets that it enables customers to buy and sell? Is it still interested in encouraging crypto adoption to build a new financial system, or primarily occupied with encouraging the speculation that fuels its core lines of business?

In this report, we examine Coinbase’s strategy, financing history, product offerings, business initiatives, threats and future opportunities. We dig into how Coinbase operates, how it’s capitalizing on cryptoasset speculation, and what it’s doing to push forward blockchain technology.

TABLE OF CONTENTS

Style notes: “Cryptoassets” includes all coins, tokens, and digital assets traded on cryptoasset exchanges. “Bitcoin” refers to the Bitcoin ledger, or protocol, while “bitcoin” refers to the asset or a unit of account on the Bitcoin ledger. This is reflected for all cryptoassets in this report.

Exchanges 101

Cryptoassets like bitcoin, ethereum, and litecoin are primarily obtained in one of two ways: through mining or through an exchange.

Mining has high barriers to entry. Participating in a mining pool or operating mining “rigs” can be expensive and complicated. For the more novice consumer, fiat-cryptoasset exchanges and brokerages – like Coinbase, Kraken, and Bitstamp – have established themselves as the primary on-ramps to this asset class. These allow consumers to trade fiat (e.g. USD, GBP) for cryptoassets (e.g. BTC, ETH, LTC).

There are a couple of important terms to understand when discussing exchanges.

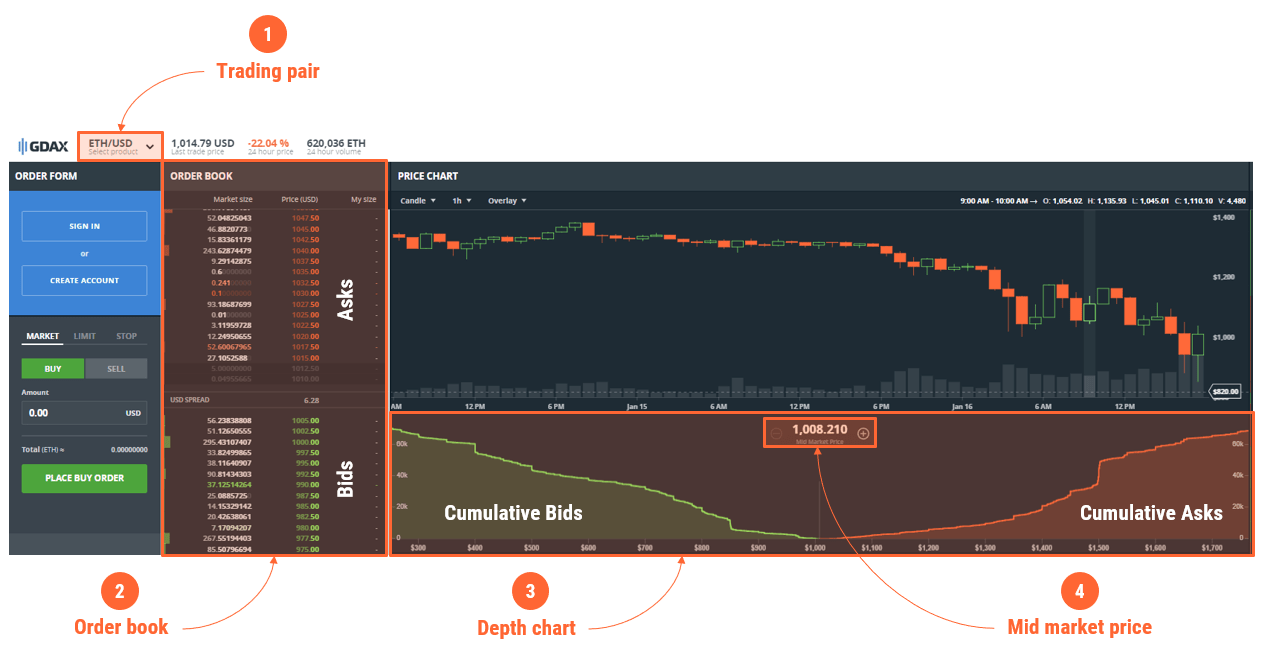

- An annotated screenshot of Coinbase’s exchange, GDAX.

- First, the “trading pair” (or, “currency pair”) is the product being traded. In the above screenshot the product is ETH, and the “quote currency” is USD. This means that traders are buying and selling the cryptoasset ethereum, priced in dollars.

- The order book shows all the bids and asks at a given time. A “bid” is the price at which a buyer will buy, and an “ask” is the price at which a seller will sell. The order book also shows the aggregate amount of asks and bids (supply and demand) at a given price, called the “market size.”

- The “depth chart” is another way to visualize the order book, showing cumulative bid and ask orders over a range of prices. Coupled with volume — or, the total amount traded over a given time period — the depth chart provides a good way to measure “liquidity.” Liquidity describes how easy it is to turn an asset into cash. For instance, if ethereum suddenly saw a massive sell-off, there might not be enough buyers, or enough “liquidity,” for sellers to sell to.

- Lastly, the “mid-market price” is the price between the best “ask” price and the best “bid” price. It can also be defined as the average of the current bid and ask prices. The “price” of an asset (as quoted on Yahoo Finance or Bloomberg, etc.) is a direct function of the bids and asks in the market, which in turn reflect supply and demand.

What is Coinbase?

Coinbase was founded in July 2011 by former Airbnb engineer Brian Armstrong and was first funded by Y Combinator. In 2012, co-founder Fred Ehrsam, a former Goldman Sachs trader, joined the company, after which Coinbase launched services to buy, sell, and store bitcoin.

Today, Coinbase operates in 32 countries and can be divided into four primary lines of business:

- Coinbase

- GDAX

- Custody

- Toshi

COINBASE & GDAX

Coinbase operates both an order book exchange, called the Global Digital Asset Exchange (GDAX), and a brokerage, called Coinbase.

More advanced traders (including small institutional players, like cryptoasset hedge funds and family offices) buy and sell cryptoassets on GDAX and determine the mid-market price. Coinbase (the brokerage) then allows retail investors to buy and sell cryptoassets at these mid-market prices, and charges a fee on top.

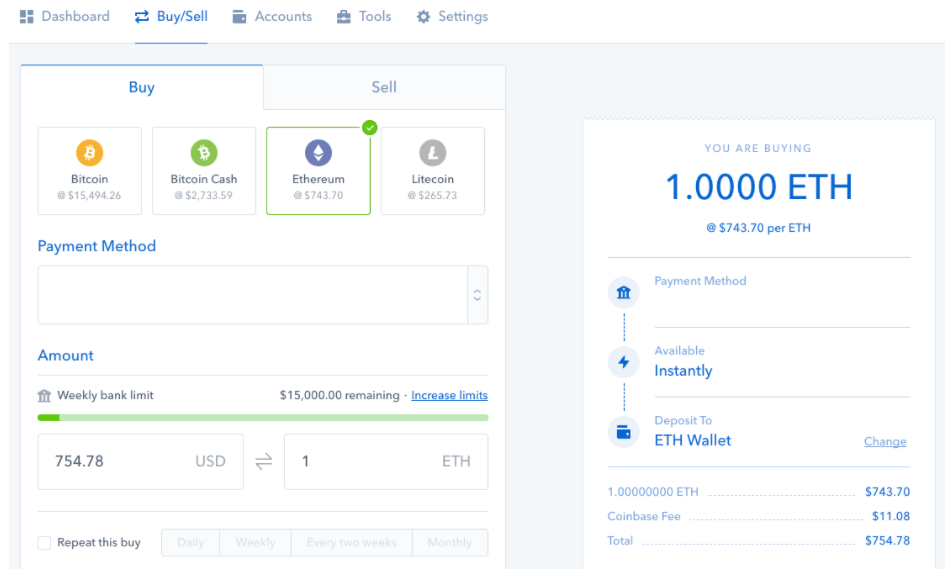

In practice, retail investors can buy and sell directly from Coinbase’s brokerage, like they might buy a stock from Scottrade or Charles Schwab. Coinbase’s brokerage fees range from roughly 1.5% to 4.0% depending on the user’s payment method; due to increased risk, credit cards come with higher fees than bank transfers. Traders on GDAX pay significantly lower fees.

Of note, Coinbase’s brokerage buys cryptoassets from GDAX, instead of from an outside exchange. This gives the company a secure in-house source of liquidity. Given how often exchanges are hacked or otherwise compromised, this is quite important; Coinbase’s brokerage doesn’t have to rely on anyone else for liquidity.

- A screenshot of Coinbase’s brokerage.

HOSTED WALLETS

A common mantra found in the cryptoasset community is “be your own bank.” Accordingly, Bitcoin enthusiasts promote what they call “private key management solutions,” which means storing a long string of random numbers or letters offline, either on a piece of paper or on a dedicated storage device (a “hardware wallet”). Such a method of securing cryptoasset holdings is difficult for the average consumer – if the piece of paper or storage device is lost, the funds are lost forever.

Flaunting this mantra, Coinbase offers hosted wallets alongside its exchange and brokerage. These allow users to safely store cryptoassets on Coinbase, which custodians the assets. As of Coinbase’s last reporting, in late November 2017, the company had 13.3M users and 45.2M wallets (users generally have more than one wallet, each for a different cryptoasset).

Coinbase’s customers typically fall into one of two groups: (1) investors, and (2) those transacting with cryptoassets. For investors, Coinbase encourages transferring funds into its “cold storage” vaults, which it guarantees against Coinbase hacking. These vaults are disconnected from the internet and offer increased security. For those transacting (or trading on other exchanges), Coinbase allows users to send funds from Coinbase to other wallets.

CUSTODY

Institutional investors — hedge funds, asset managers, and pension funds among them — have expressed interest in cryptoassets as their overall value climbed this past year. In order to capitalize on this sidelined institutional money, Coinbase announced “Custody” in November.

Custody provides financial controls and storage solutions for institutional investors to trade cryptoassets. The service is geared toward larger players on Wall Street and costs $100,000 in initial setup fees, a management fee of 10 basis points monthly on AUM, and a minimum balance of $10M. Coinbase plans to launch Custody early this year.

Custody is not the first mover in the space. Digital Currency Group’s Genesis Trading has offered institutional players OTC (“over the counter”) trading in cryptoasset markets since 2013, while the Winklevoss Capital-backed Gemini was founded in 2015. Other major OTC providers catering to institutions include Circle, which has raised $136M in venture financing, and DRW’s Cumberland.

Additionally, traditional exchanges like the Chicago Board Options Exchange (CBOE) and CME now offer futures trading for cryptoassets, with the CBOE also recently filing for a bitcoin ETF. Lastly, investment trusts – like Grayscale – offer tradable securities on top of cryptoassets. These often trade at a premium to exchange prices, but are operationally easier for institutional investors to hold.

TOSHI

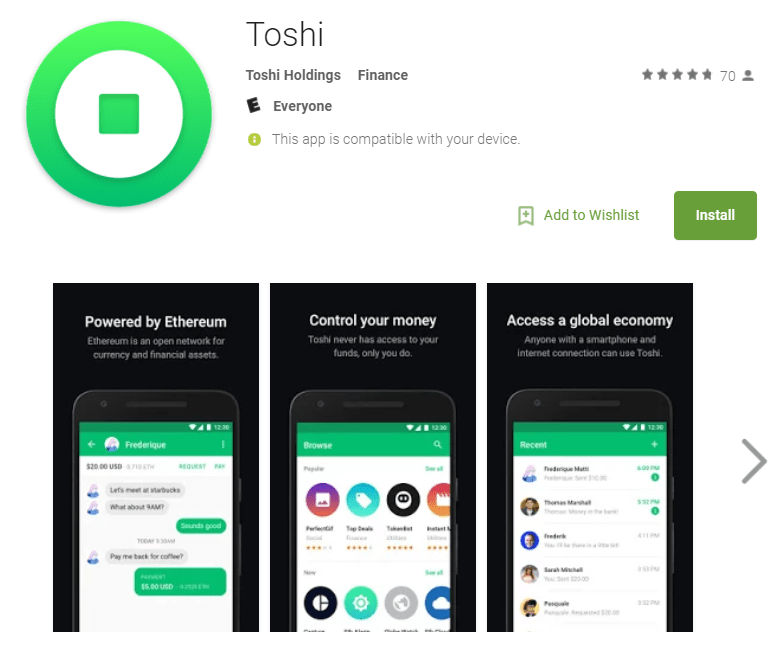

While Coinbase remains focused on its core brokerage and exchange businesses, one of the company’s longer-term projects is Toshi. Toshi is a mobile app for browsing decentralized applications, an ethereum wallet, and an identity and reputation management system. At a high level, the aim with Toshi is to give users broader access to decentralized applications built on top of the Ethereum blockchain. In this way, Coinbase hopes that Toshi could allow for the building of viable crypto use cases, beyond speculation.

Some current examples include Leeroy, a decentralized social media platform where users earn money for likes, and Cent, where users can ask questions and offer bounties for the best answers. Toshi launched in April 2017, and early traction has been limited; the app counts under 10,000 installs in the Google Play Store.

A screenshot of Toshi’s page in the Google Play Store.

A screenshot of Toshi’s page in the Google Play Store.

Critics of Toshi point to the app’s centralization. Toshi is built, maintained, and effectively controlled by Coinbase, which might discourage developers from building on top of it.

To use an analogy that illustrates the downsides of centralization, consider an Amazon merchant. If Amazon were to change its search algorithm or fee structure, that merchant might be adversely affected. Decentralization, according to proponents, presents an alternative that makes developers less subject to the whims of the platform they build on.

On the flipside, and as a function of centralization, Coinbase can make quick changes to Toshi without community consensus. Coinbase also has a significant number of existing users, brand recognition, and money to spend, which could bode well for Toshi’s future adoption.

Coinbase as kingmaker

Coinbase has emerged as something of a cryptoasset kingmaker for investors, as assets listed on its exchange have seen substantial price appreciation.

This development is largely a result of cryptoassets evolving into an investment vehicle. Coinbase’s excellence in security, regulatory compliance, and ease-of-use has helped drive up user numbers. When Coinbase give its “stamp of approval” to a given cryptoasset, millions of users can then trade it, which often drives up prices.

FROM CURRENCY TO INVESTMENT

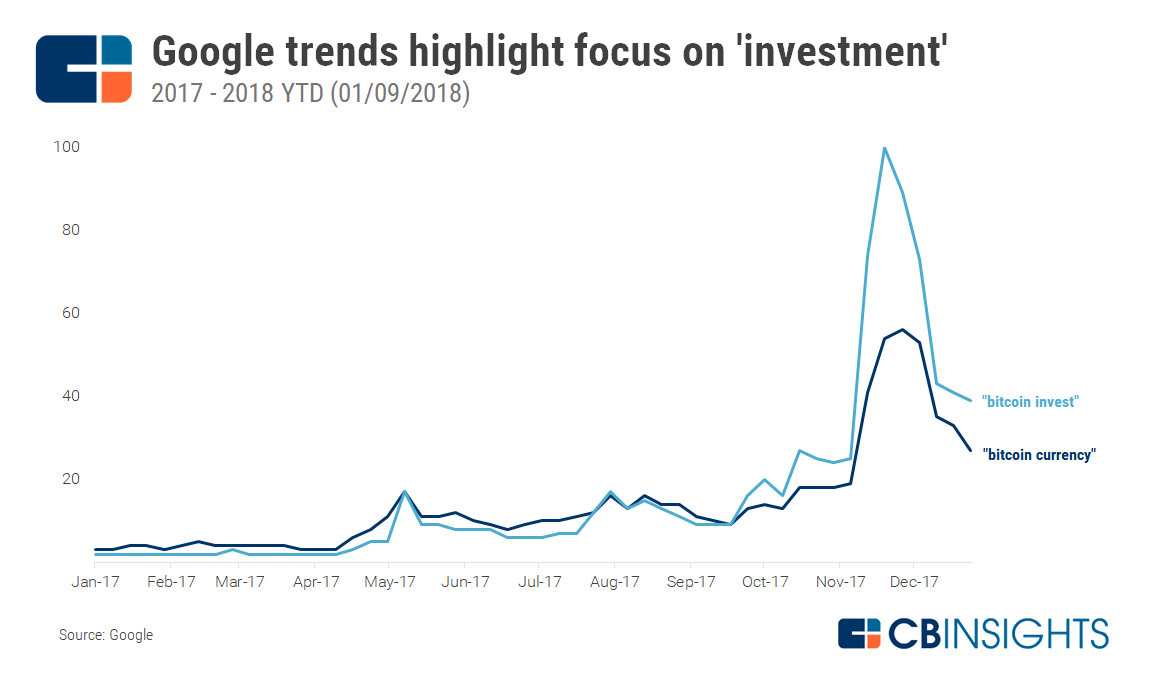

Where bitcoin and other cryptoassets were once considered a “means of exchange” and an alternative payments system, they are now more often called a “store of value” and an investment opportunity.

Scaling issues have contributed to this shift, as core developers remain locked in debate over how best to scale Bitcoin into an effective payments network. Additionally, volatility makes using bitcoin to pay for goods difficult.

Fred Wilson of Union Square Ventures pointed to this volatility in a recent blog post, writing: “This was a Bitcoin t-shirt I bought in the summer of 2013 [for .18 BTC]. At today’s prices, that t-shirt cost me $830 […] You can’t keep spending something that goes up as much as Bitcoin has.” That number is considerably higher today.

Thus, while Coinbase initially promised “instant payments [and] widespread [bitcoin] adoption,” bitcoin has seen limited adoption among merchants and consumers; users haven’t meaningfully transacted with bitcoin like they might with dollars or euros.

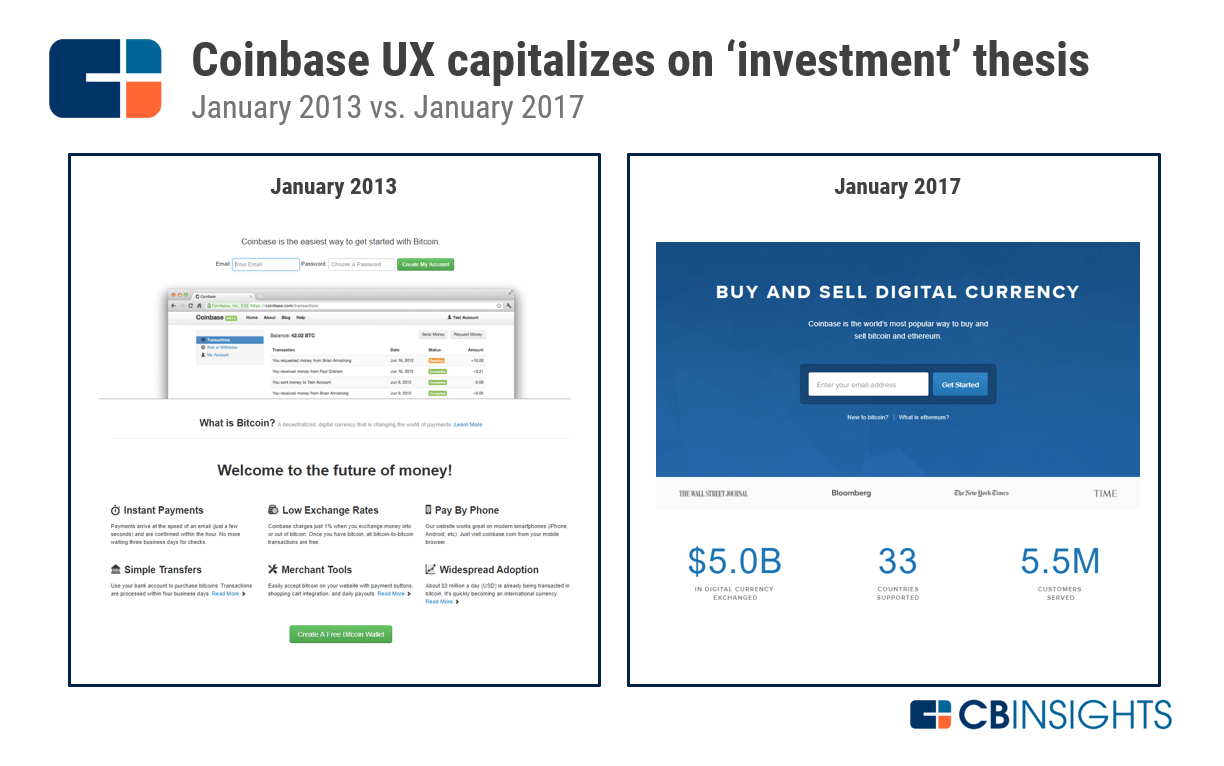

Coinbase has overhauled its messaging and user experience to capitalize on this trend, with the company’s homepage now encouraging users to “buy and sell digital currency,” where it once welcomed users to “the future of money.” This makes a lot of sense as a brokerage: Coinbase brings in revenue on every trade (based on volume), and is therefore incentivized to encourage frequent trading and investment.

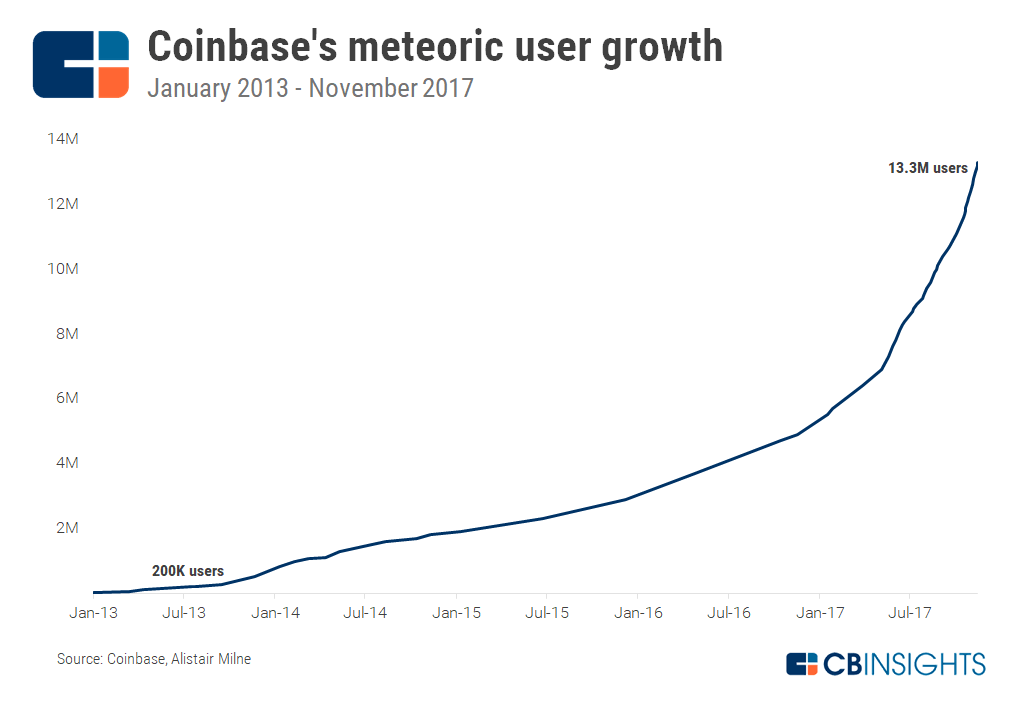

USER METRICS

Astounding user growth validates Coinbase’s messaging shift. According to data aggregated by Alistair Milne of Altana Digital Currency Fund, Coinbase was adding users in November at a rate of 100,000 per day. Although Coinbase has stopped publishing real-time user metrics, its site claims over 10M customers served and over $50B in cryptoassets exchanged.

Assuming an average 3% fee for Coinbase transactions and $50B exchanged, total revenue of the company (since inception) would be $1.5B. Of course, that number could be much higher or lower depending on the company’s true fees and total volume.

According to recent reports, Coinbase made $1B+ in revenue in 2017 alone. At the end of Q3’17, the company was projecting a 2017 total of just $600M, well under its actual.

SECURITY

Although cryptoassets themselves are quite secure, exchanges have a long history of hacks, exit scams, and lost funds. The most well-known hacked exchange was Mt. Gox, which lost 850,000 bitcoins to hackers in early 2014, worth $450M at the time. Today (in early January 2018), those coins would be worth close to $10B. Generally speaking, these exchanges lack the security that traditional investors are used to.

Coinbase is the exception to this rule. Coinbase has continued to make security a top priority, and it’s paid off. The company has operated since 2012 and has never been hacked, establishing significant trust with consumers.

Investments and funds are held and insured by Coinbase, with the majority of cryptoassets stored offline in cold storage vaults, and the remainder insured by Lloyd’s of London. Funds held in USD wallets on Coinbase are covered by the FDIC and insured up to $250,000.

Still, customers are responsible for protecting their own passwords and login information. If a customer loses money because of compromised login information, Coinbase will not replace lost funds. Coinbase recommends that customers turn on two-factor authentication and place funds into cold storage in order to thwart would-be hackers.

REGULATORY COMPLIANCE

As mentioned, exchanges that handle fiat-cryptoasset trading pairs (e.g. BTC/USD, BTC/GBP) are the primary consumer on-ramps to cryptoassets. Cryptoassets have a history of use in the black market, first with bitcoin, and now with privacy-focused coins, like monero and zcash. Coupled with the sector’s nascency, regulatory bodies have struggled to define, legislate, and tax cryptoassets.

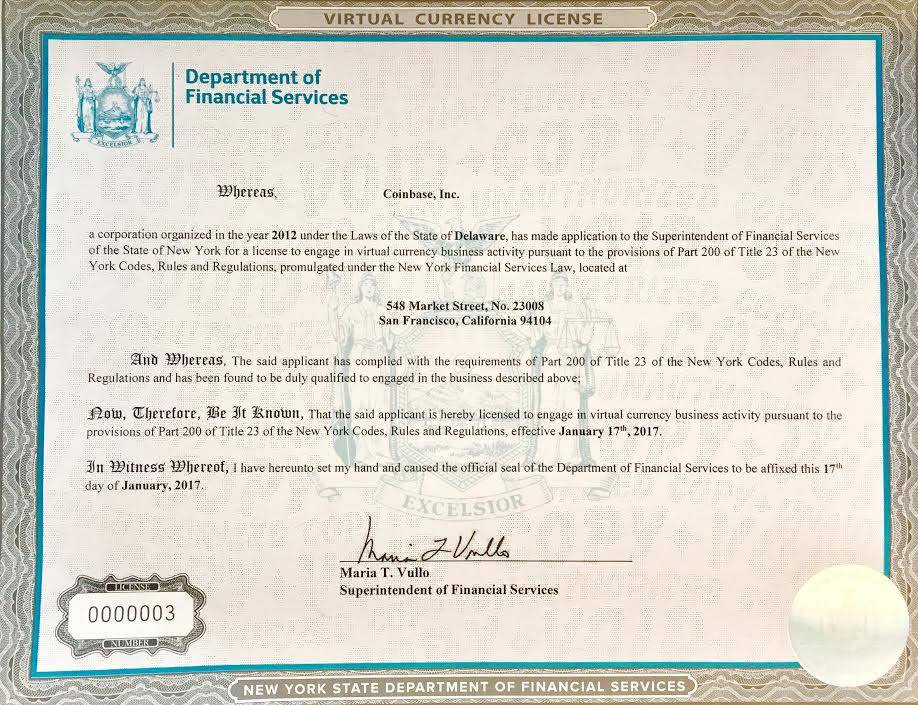

In this regard, Coinbase has differentiated itself from other exchanges by spending substantially on licenses and compliance. Coinbase has made a point of complying with state-by-state money transmission laws, and is one of a few companies to hold a New York Virtual Currency License, or “BitLicense.” A common critique of the BitLicense is its prohibitive cost; over ten companies moved their headquarters from New York to other locales in 2015 after the license was announced.

- Coinbase’s “BitLicense” (source: Coinbase)

Other regulations that Coinbase complies with include registration as a Money Services Business with FinCEN, and the Bank Secrecy Act and Patriot Act. Coinbase operates its exchange in 32 countries, including the UK and Switzerland, as mentioned. According to the company, “no license is required to operate a digital currency business in any other country [outside of the US] where Coinbase operates.”

Taken as a whole, Coinbase’s focus on compliance offers safety and assurance for consumers and regulators alike.

Relationship with law enforcement

Similarly, Coinbase has cooperated heavily with law enforcement. Coinbase follows strict identity verification procedures to comply with regulations like KYC (Know Your Customer) and AML (anti-money laundering), and to track and monitor cryptoassets sent to and from its site.

As touched upon earlier, the company complies with the Bank Secrecy Act, which the company says “requires Coinbase to verify customer identities, maintain records of currency transactions for up to 5 years, and report certain transactions,” and the Patriot Act, which has famously been criticized for making it easier for the US government to intercept people’s phone conversations.

Coinbase is therefore a boon for regulators and law enforcement in deciphering decentralized black market activity. Blockchain tracking companies, like Chainalysis, work with Coinbase (and other exchanges) to assist in AML enforcement. As US Treasury Secretary Steve Mnuchin put it in a recent interview: “If you have a wallet to own bitcoins, that company has the same obligation as a bank to know [you as a customer, and] we can track those activities.”

At the same time, Coinbase has pushed back against what it sees as government overreach. In one public instance, the IRS requested customers’ records for the period between 2013-2015. November 2017 court documents from the case nicely summarize the dispute: “That only 800 to 900 taxpayers reported gains related to bitcoin in each of the relevant years and that more than 14,000 Coinbase users have either bought, sold, sent, or received at least $20,000 worth of bitcoin in a given year suggests that many Coinbase users may not be reporting their bitcoin gains.”

Coinbase refused to hand over records, and ultimately won a partial victory in court by reducing the number of customers and scope of data provided. The company has since agreed to give the IRS records on 14,000 users, a somewhat unsatisfactory outcome for Coinbase users with strong privacy concerns.

Accusations of insider trading

Cryptoasset trading remains largely unregulated and is something of a “wild west” for speculators. Pump-and-dump schemes and fraudulent initial coin offerings are rampant. Additionally, and as we’ve explored in prior reports, large initial coin offerings run the risk of overcapitalization; raising too much money could disincentivize founders from building the product in question, turning founders building companies into money managers.

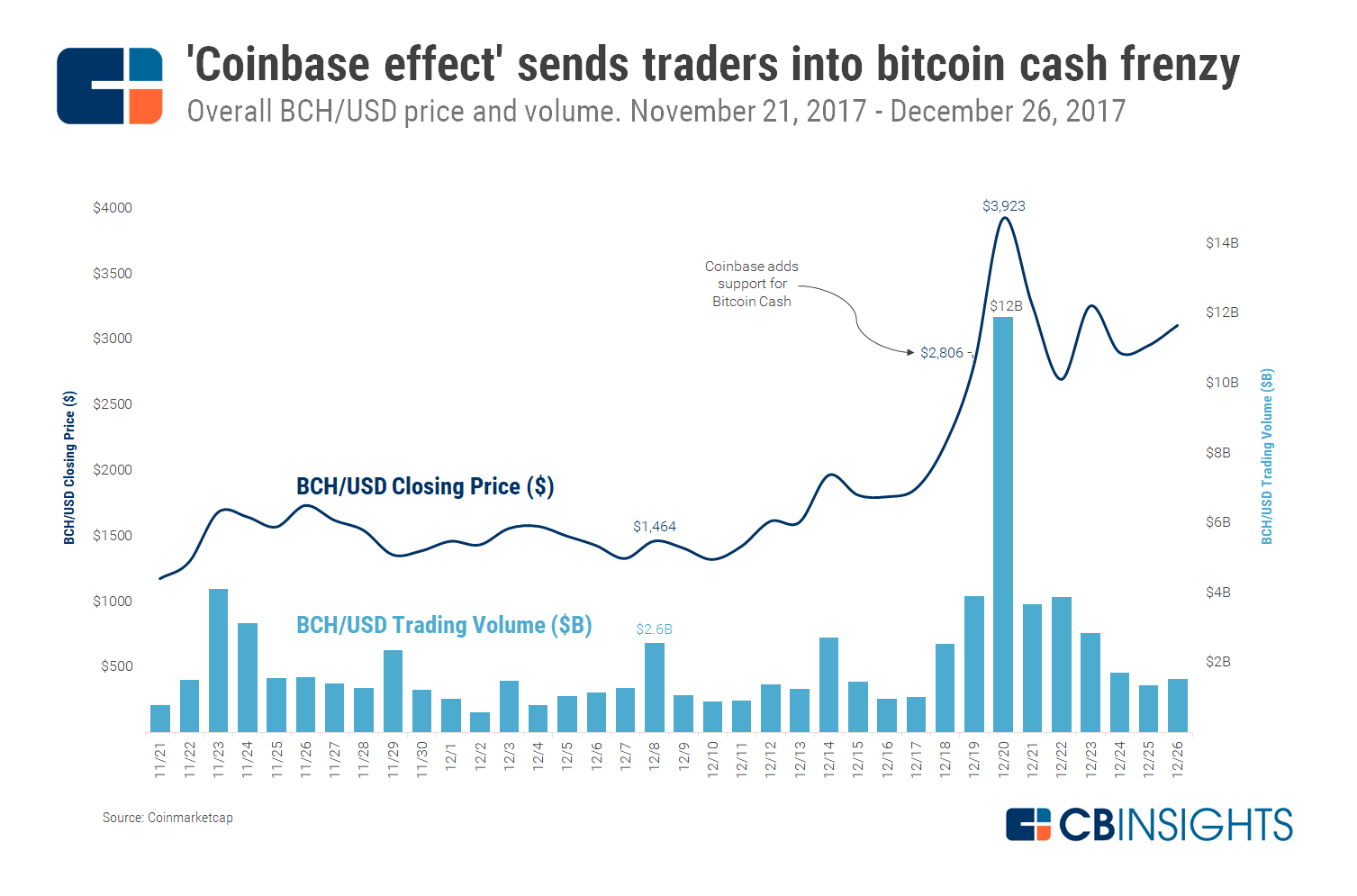

Although Coinbase has generally kept its brand reputation clean, recent events have spurred rumors of insider trading and “front-running.” According to numerous reports, the price of bitcoin cash on global exchanges spiked in the hours leading up to Coinbase’s launch of bitcoin cash trading. Such a price movement is certainly suspect.

Armstrong released a strongly worded statement after the event, pointing to Coinbase’s employee guidelines: “We’ve had a trading policy in place for some time at Coinbase. The policy prohibits employees and contractors from trading on ‘material non-public information,’ such as when a new asset will be added to our platform.”

Of concern, the statement did not reference any federal or state regulations enforcing said employee policies, underscoring the sector’s nascency in regulatory and legislative circles.

EASE-OF-USE

In addition to its security and regulatory compliance, Coinbase’s user interface and mobile application have helped the company position itself as the de-facto US cryptoasset brokerage. In comparison to earlier iterations, Coinbase’s current user experience is simple, clean, and well-suited for cryptoasset retail investors.

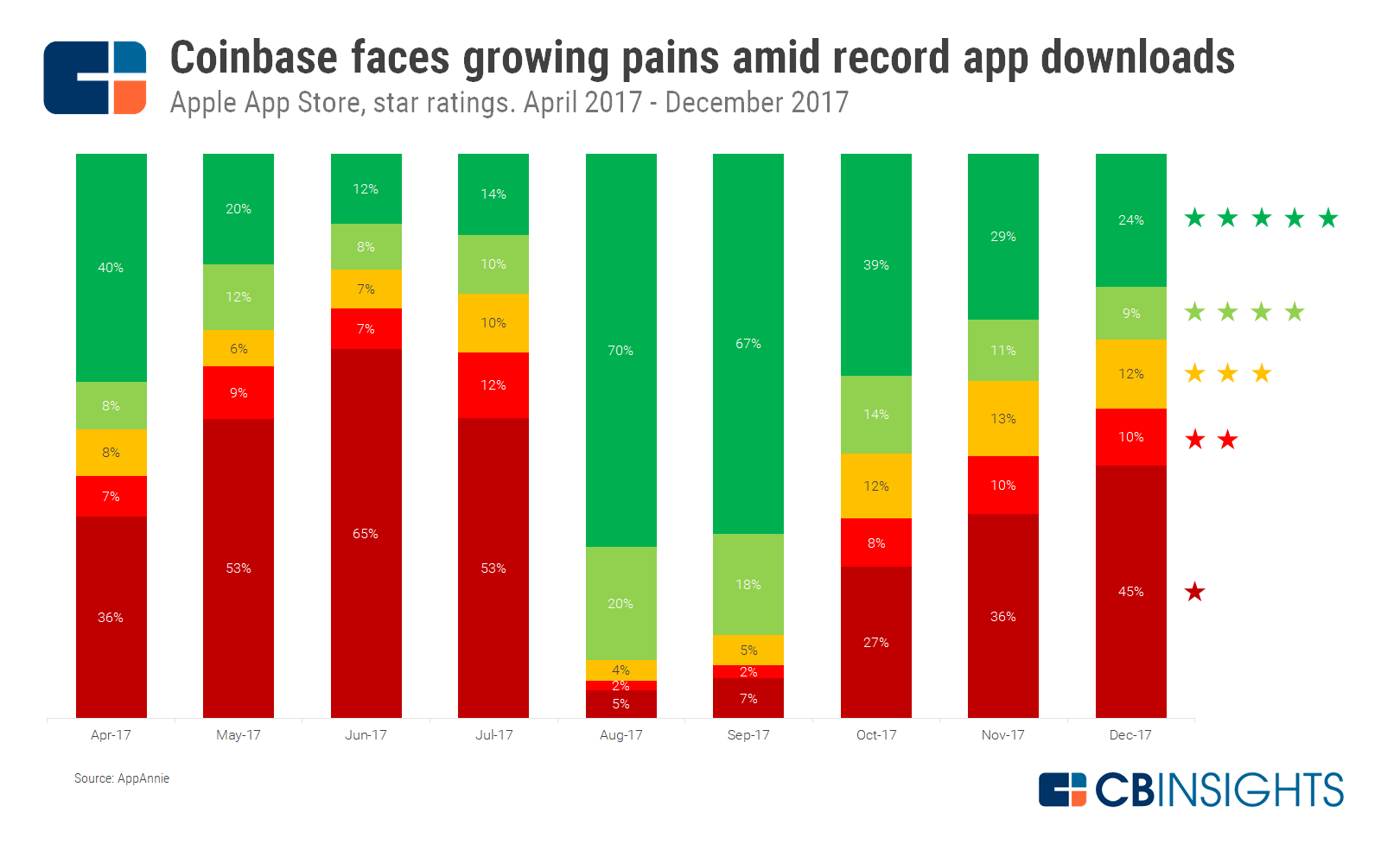

Most notable is Coinbase’s mobile app. A testament to the company’s brand, it was the most downloaded app on Apple’s App Store in early December 2017. Coinbase also currently sits at No. 5 for most downloaded US “Finance” apps. No other cryptoasset exchange comes close, and few legitimate cryptoasset exchange apps are even deployed.

It’s unlikely that bitcoin would ever have hit the mainstream without a company like Coinbase, which provides an easy-to-use, trusted means of buying and selling cryptoassets.

As mentioned, Coinbase’s KYC and AML requirements require users to strictly verify their identities, which has proven difficult for users to do via Coinbase’s mobile app. In many cases, users have reported long wait times for verification.

Coinbase has also struggled with general customer support. These issues have expressed themselves in Coinbase’s app reviews; the app is currently rated an average of 3.6 stars based on 16,107 reviews (as of January 8th, 2017), and has been garnering a larger percentage of 1-star ratings in recent months.

THE COINBASE EFFECT

All of these factors — strong security, regulatory compliance, ease-of-use, and a focus on investment — have enabled Coinbase to emerge as something of a cryptoasset kingmaker for investors.

One example of this was its recent addition of bitcoin cash. At around 7pm EST on December 19th, 2017, Coinbase surprised users by listing a fourth asset: bitcoin cash. Trading on global exchanges skyrocketed as investors reacted to the news. A day after the announcement, bitcoin cash closed at $4,000 on some exchanges, up from around $2,200 two days earlier. Volume soared as well, from $2.5B on December 18th, to almost $12B on December 20th, an increase of 380%.

However, almost none of this trading was happening on Coinbase. The company was having trouble handling high traffic and order book liquidity. Four minutes after listing bitcoin cash, with the price swinging from $3,500 to near $9,000 on its exchange, Coinbase paused its bitcoin cash order book.

After 18 hours during which rumors of insider trading swirled, Coinbase announced that it would reopen its order book. The company cautioned in a blog post that “if significant volatility [was] observed, GDAX [would] pause trading.”

While just one instance, this event speaks volumes. Cryptoassets are difficult to obtain (especially in current market conditions), so an “accessibility premium” is often at play: when a cryptoasset is more accessible, it tends to rise in price.

The bitcoin cash listing is one example of this “Coinbase effect,” but there are others: Ari Paul of Blocktower Capital cited a 30% rally for litecoin the day of its listing, as well as a 14% rally for ethereum when it was first listed on Coinbase in July 2016.

In recent weeks, rumors of Coinbase listing ripple (XRP) contributed to a substantial run-up in the asset’s price. However, the price slid after Armstrong released a statement that the company “[had] made no decision to add additional assets to either GDAX or Coinbase.”

Such data highlights the company’s central role in the sector: Coinbase is best at making cryptoassets easy to buy, store, and ultimately, access. More accessibility translates into increased liquidity on both Coinbase and GDAX, which in turn attracts more and new types of investors.

Current valuation and investors

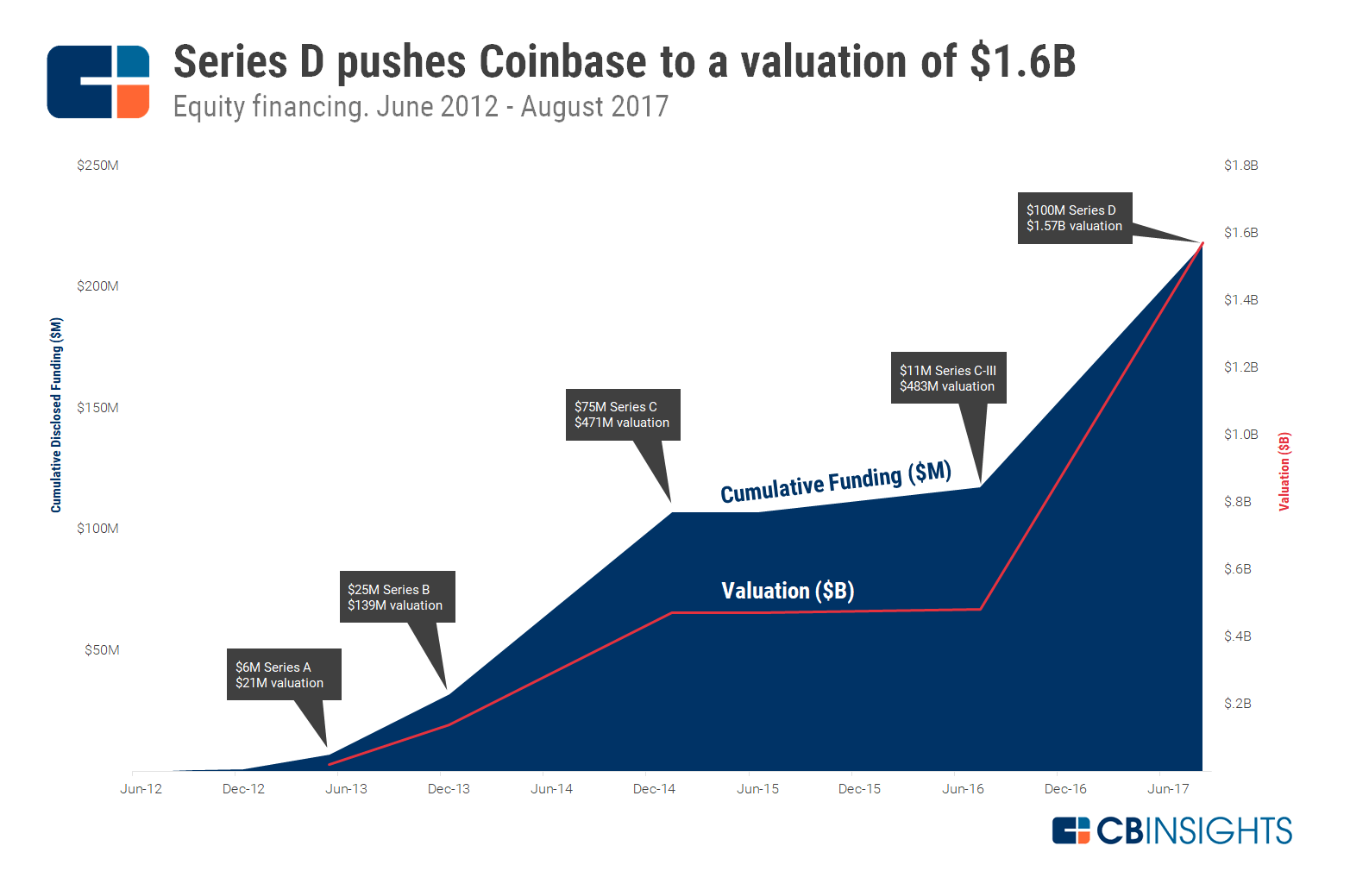

Although the company achieved unicorn status at a valuation of $1.57B in its $100M Series D in August 2017, recent disclosed revenue numbers ($1B in 2017) suggest it might fetch higher offers today.

Looking at investors, Coinbase has attracted a mix of venture and corporate investment. In total, Coinbase has raised $217M in six equity financings since 2012 (including its seed round, not shown on the above graphic). Brand-name venture investors — Union Square Ventures and Andreessen Horowitz chief among them — got in early, and have continued to participate in funding rounds to the company.

Large financial institutions, like the NYSE and USAA, were part of the company’s $75M Series C in January 2015. According to an NYSE press release, the Series C investment helped “[support] Coinbase’s growth utilizing [NYSE’s] global distribution capabilities and market expertise.” Indeed, Coinbase would launch the “Coinbase Exchange” geared toward professional investors in the same month. This would later rebrand to the “Global Digital Asset Exchange,” or GDAX. In November 2015, USAA partnered with Coinbase to allow their customers to monitor their cryptoasset wallet balances when they log into their USAA accounts.

Also of note, Japanese players Bank of Tokyo Mitsubishi UFJ and NTT DoCoMo contributed to Coinbase’s Series C-III in July 2016. At the time, Coinbase said it would look to expand into the Japanese market, however this expansion has yet to happen.

The road ahead: an open financial system

With all this, the question remains: is Coinbase simply profiting off of Bitcoin mania, or building upon the asset’s original vision for a new, open, and global financial system?

The answer is most likely a bit of both. Coinbase’s user growth and revenue numbers imply a higher valuation than its most recent valuation of $1.57B. At the same time, Coinbase is hedging its core business against increased competition, execution risk, and an uncertain cryptoasset market by adding more cryptoassets and exploring possible use cases for blockchain technology with Toshi.

CHALLENGES AND RISKS

Coinbase faces increased competition from a number of existing players as well as upstart decentralized exchanges. The company is also struggling to execute at scale, with its support team racing to field a backlog of questions around exchange downtime and money transfer delays, among other issues. Lastly, Coinbase is directly exposed to cryptoasset prices, and must remain vigilant in the event of a sustained downward trend in the market.

Competition

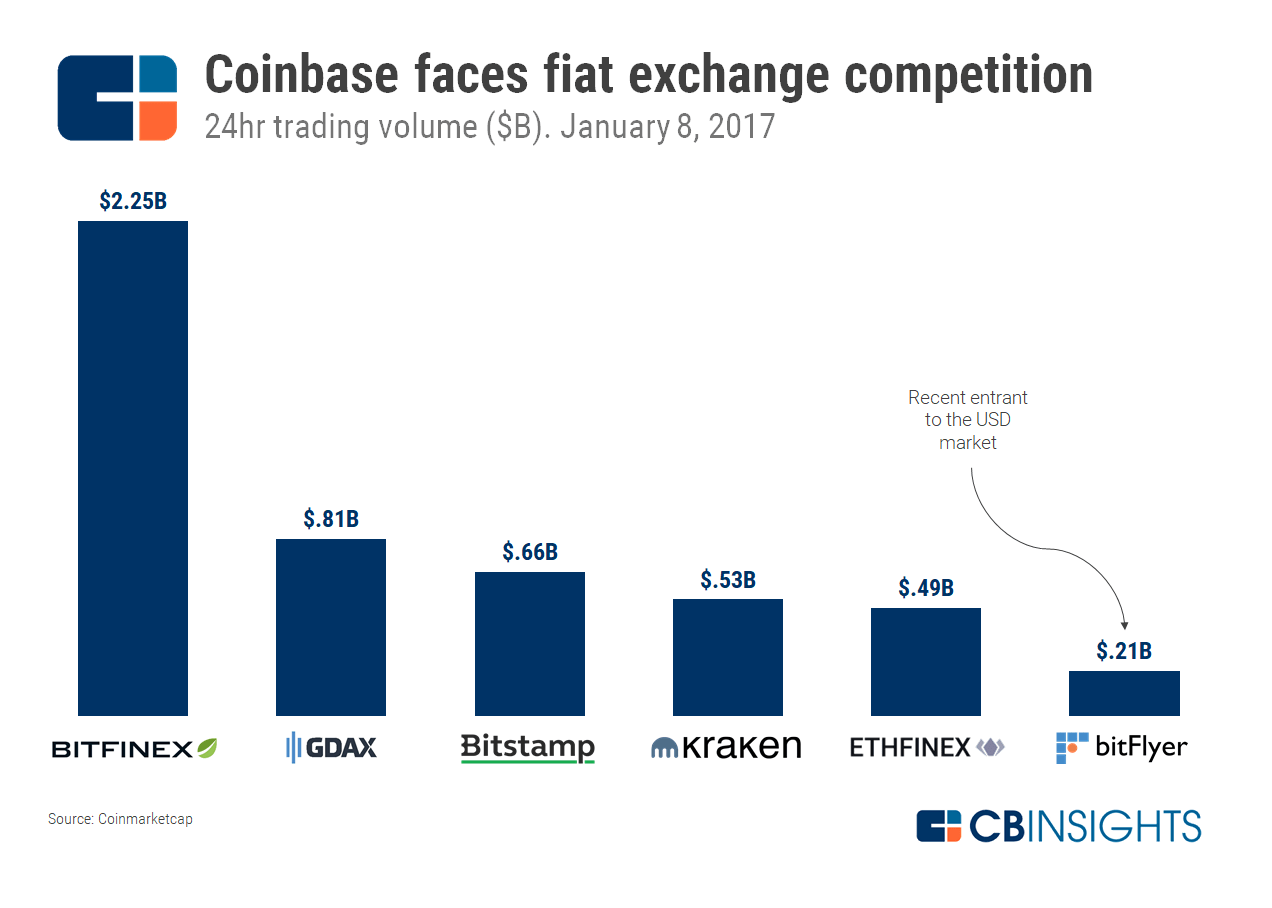

Coinbase and GDAX face direct competition from a number of fiat-cryptoasset exchanges. Bitfinex, Bitstamp, Kraken, and recent entrant to the US market bitFlyer are Coinbase’s main competitors, although there are others, including traditional brokerages like Robinhood (which just announced support for cryptoasset trading in five states).

It’s important to note that Coinbase does not support crypto-crypto pairs (e.g. BTC/ETH) and only supports fiat-crypto pairs (e.g. BTC/USD). As a result, the company’s pool of competitors is more limited, as there are hundreds of crypto-crypto exchanges. Binance is the largest cryptoasset exchange by volume (with nearly $6B worth of cryptoassets exchanged on January 11), but only supports crypto-crypto trading pairs.

Additionally, and as noted above, none of the exchanges mentioned here have strong mobile presences, and only a couple offer brokerage services. Coinbase’s competitors for the most part operate order book exchanges and cater to more experienced traders. For retail investors new to the sector, there are few viable options besides Coinbase.

Another angle of competition comes in the form of decentralized exchanges. 0x is a tokenized protocol for decentralized exchanges initially launched via a $24M ICO, and is gaining steam as decentralized exchanges – like Radar Relay – build on top of it. While more technical and more difficult to use, decentralized exchanges have no central point of attack and therefore offer increased security. Still, activity is limited when compared to major centralized exchanges, and this threat should be considered on a longer time horizon.

Scaling

Coinbase has faced internal challenges from poor execution. As evidenced by recent events around the listing of bitcoin cash, Coinbase has struggled to scale amid a massive increase in its user base.

In June, a flash crash on GDAX caused ethereum’s price to briefly drop below a dollar before recovering. Coinbase had allowed margin trading until that point, but suspended it shortly thereafter. GDAX has continued to experience service outages, with some lasting hours.

In a Q3’17 blog post, Armstrong addressed the company’s scaling challenges, writing that Coinbase would “[rebuild] pieces of our backend, [focus] on uptime and reliability, [scale] customer support and [provide] faster response times, [and improve] the customer experience.” Mr. Armstrong also posted a chart on Twitter indicating that Coinbase would have over 200 customer support representatives by October 2017, up from around 50 in June 2017.

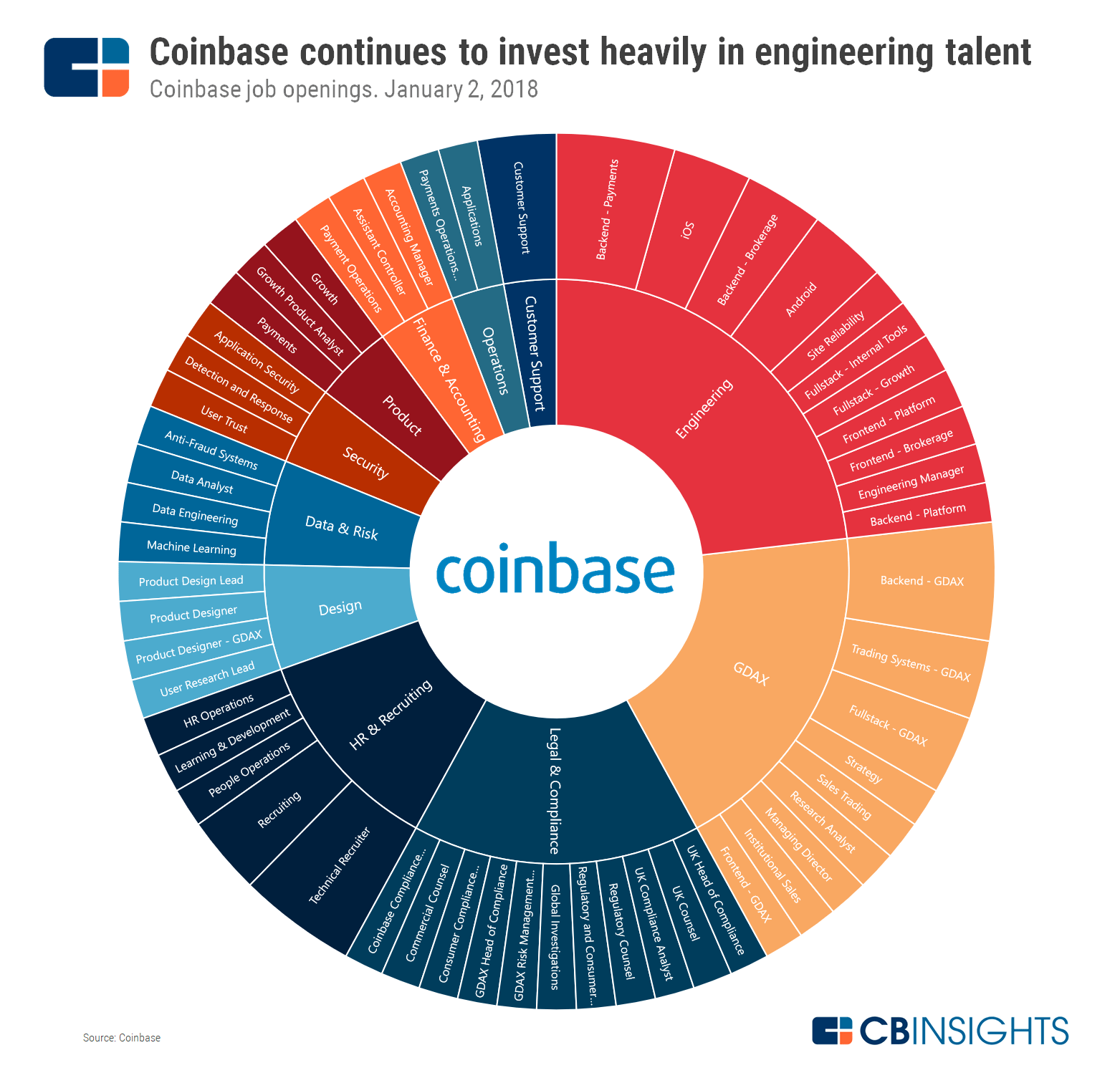

Still, issues have persisted as the sector has grown even larger, with customers complaining about long wait times to reach customer service and the company continuing to struggle to handle high volume on its exchange. In a blog post published early this year, Dan Romero, GM of Coinbase, highlighted that Coinbase has scaled its transaction capacity by 7,700% and increased the number of customer support agents by 887%, both over the past year. Indeed, Coinbase is hiring across the board, particularly in engineering roles for its brokerage and exchange.

Key recent hires at Coinbase include Asiff Hirji (President and COO), David Marcus (Board of Directors), and Tina Bhatnagar (VP of Operations and Technology). Hirji joined the company in December 2017 from Andreessen Horowitz and brings financial services experience from TD Ameritrade. Marcus also joined the company in December, and comes from Facebook Messenger and Paypal. At Paypal, he led the company’s global expansion and product strategy. Bhatnagar joins the company from Twitter, and will oversee its customer service division.

Coinbase has faced challenges as key employees have left for other ventures, prompting some to reference a “Coinbase mafia.”

- Olaf-Carlson Wee, an early product manager at the company, left in mid-2016 to start Polychain Capital, which is widely considered an elite cryptoasset hedge fund.

- Nick Tomaino, a business development hire, left in February 2016 to invest at venture firm Runa Capital, and recently started his own cryptoasset investment fund, 1confirmation.

- Charlie Lee created Litecoin (as a fork of the Bitcoin blockchain) in October 2011, and served as Coinbase’s director of engineering until June 2017.

- Former Coinbase product manager Linda Xie and software engineer Jordan Clifford launched a cryptoasset fund called Scalar Capital.

- In addition, Fred Ehrsam, co-founder of Coinbase, has since left the company to pursue other ventures.

Market risk

As a final challenge, Coinbase faces acute risk from market forces. Exchanges are particularly exposed to market demand. In the event of a market downturn, Coinbase could see its revenue drop precipitously.

Further, while Coinbase is directly exposed to risk from cryptoassets listed on its platform, it’s also indirectly exposed to other more volatile cryptoassets. Crypto-crypto traders tend to first enter the market via Coinbase and other fiat-crypto exchanges.

This means that cryptoassets not listed on Coinbase could still have a material effect on Coinbase’s core businesses; if the market flees to safety (perhaps due to a regulatory crackdown) and trades back into fiat, Coinbase could face liquidity issues. In other words, a major sell-off in broader cryptoasset markets could make it hard to find buyers.

Closing thoughts

Facing the challenges outlined above, Coinbase continues to expand its core businesses and explore farther-ranging opportunities.

To hedge its exchange, Coinbase plans on adding more assets to its platform according to its “Digital Asset Framework.” Doing so would certainly pad the company’s pockets, but it would also allow a large user base to explore new use cases for blockchain technology. Additional assets, then, are both a hedge and a gamble on the sector’s future.

With bitcoin’s first proposed use case as a “means of exchange” not quite taking off, Toshi is an attempt by the company to find other use cases for blockchain technology. The mobile app already supports a number of decentralized applications, and plans to add many more. Coinbase hopes that its massive user base – first acting as speculators – will use Toshi for broader financial applications and create the sector’s “Netscape moment.”

Still, VC investors are unlikely to want to see a significant strategic shift until they see some sort of liquidity event. To this end, Hirji, the company’s COO, has said that “the most obvious path for Coinbase is for us to go public at some point.”

Ultimately, Coinbase’s story mirrors the sector as a whole. Bitcoin hasn’t really worked yet, at least not in the way it was supposed to. Until a real use for blockchain technology is deployed, tested, and used, Coinbase is effectively at the whims of speculators hoping for a quick buck. Coinbase understands its current and future position well, and is actively working toward finding solutions that work while riding this market for as long as possible.

This report was created with data from CB Insights’ emerging technology insights platform, which offers clarity into emerging tech and new business strategies through tools like: If you aren’t already a client, sign up for a free trial to learn more about our platform.

Related Research

You might also like:

You might also like:

Popular Data Visualizations

Источник: https://www.cbinsights.com/research/report/coinbase-strategy-teardown/

-

-