How to Cash Out Bitcoin

Wondering how to cash out Bitcoin to your local currency?

Wondering how to cash out Bitcoin to your local currency?

Well look no further, here I’ve found ways for you to turn Bitcoin into real-world money.

Even if you consider yourself a Bitcoin HODLer (I’m one for sure) and not looking to sell your bitcoins in the near future, it’s still important to know how (and when) to turn your Bitcoin for some fiat money.

Who knows, one day you might want to sell your bitcoins for whatever reason.

In this article, I’ll walk you through the different ways you can convert Bitcoin to USD, EUR, AUD, MYR and other government-issued currency.

Cool fact: Did you know nearly 60% of all Bitcoin have not moved in an entire year?

When it comes to cashing out your bitcoins, you’ll need to consider how you want to receive your fiat money.

You can either use third-party exchanges and deposit your money into a bank account or sell bitcoins in person for physical cash.

Interestingly, if you’re looking to spend your Bitcoin, cashing out is one of the many options.

Services like Lolli and Moon allow you to shop online using Bitcoin and other popular cryptocurrencies.

Even better, you can get maximum discounts as well as earn some bitcoins while you spend. Check out this article to help you spend Bitcoin smarter.

Let’s get back to the topic, if you prefer to have fiat money in your bank account or wallet, here are some of the best ways to sell your Bitcoin for fiat currency.

The easiest way to cash out Bitcoin is through an online cryptocurrency exchange.

These third-party exchanges allow you to easily sell your Bitcoin for USD, EUR, GBP, MYR and other local fiat currency via their websites or user-friendly apps.

To start, you’ll need to find an exchange that supports your country.

The following are a few main options where you can sell Bitcoin based on your country:

- USA: Coinbase, Gemini, Kraken, Bitstamp

- Malaysia: Luno

- Singapore:Luno, Coinhako,Coinbase

- Australia: Independent Reserve

- China: Huobi, OKCoin, BTC China

- Taiwan: Maicoin

- India: Bitbns

- South Africa:Luno

- UK: Coinbase,CEX

- Europe:Coinbase, CEX

- Russia: Coinmama

- Japan:Coinmama,Kraken

- South Korea: Bithumb, Korbit, Coinplug

Here’s how it works:

- Sign up and complete the verification process.

- Deposit (or buy) BTC into your account

- Cash out your BTC to fiat via bank transfer or Paypal(applicable to some services)

It’s simple, easy and secure.

But it’s not the fastest way, as it can take 1-5 days to receive your fiat money depends on the platform you’re using and your country.

Also, for cryptocurrency newcomers who don’t already have an account with the crypto exchange, it can take weeks, if not months to get your account approved.

At the moment, some restricted countries don’t have cryptocurrency exchanges.

If you have limited exchange option and prefer more anonymous, there’s another option to sell Bitcoin for cash using a peer-to-peer platform via LocalBitcoins.

Founded in June 2012, LocalBitcoins is a P2P Bitcoin exchange that facilitates direct trading between potential buyers and sellers.

Serving more than 1.35million people from 15,000 cities across 249 countries, LocalBitcoins is available in almost every country.

In fact, only New York state has suspended their services due to local financial regulations.

What’s particularly great about LocalBitcoins is that you’re dealing directly with buyers, with no intermediary.

Plus, it offers escrow service to protect both buyers and sellers of Bitcoin.

Apart from that, you can decide how much you want to sell your Bitcoin for, as well as request any payment method that you like.

You can choose from a variety of payment methods, including cash deposit, bank transfer, Payoneer, Paypal, gift vouchers, Western Union or in-person cash.

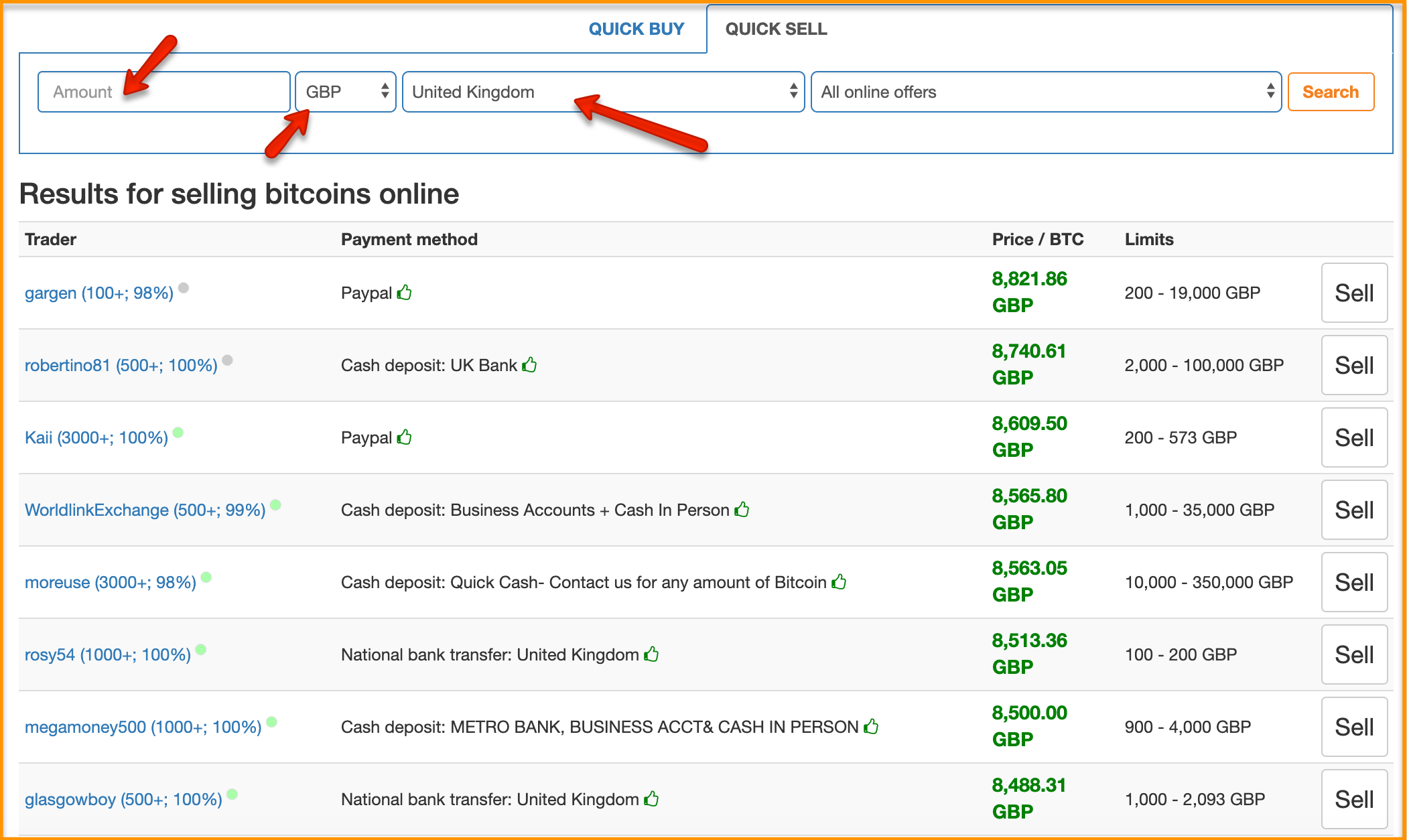

Here’s a quick look at how it works:

Here’s a quick look at how it works:

- Create an account at LocalBitcoins.

- Verify your identity (As of 2019, KYC (Know Your Customer) laws may apply in your country.)

- Select “Quick Sell”.

- Filter your country and choose the payment mode.

- LocalBitcoins will instantly give you a list of relevant buyers based on your location.

- Choose your buyer carefully. (Tip: Always go for a reputable buyer/seller with high feedback rating)

Confirm the amount of BTC you want to sell, enter your payment details (for example, provide your PayPal email address or bank account)

Once the buyer accepts your offer, send your BTC to LocalBitcoins escrow.

Wait for the buyer to send the payment.

Complete transaction once the fund is received.

The best part? Buying and selling bitcoins on LocalBitcoins is completely free.

But if you’re posting an ad to promote your Bitcoin for sale, you’ll be charged 1% of the bitcoin traded.

Undoubtedly, LocalBitcoins is the fastest and easiest way for people from around the world to buy/sell bitcoin safely.

Remember, even though you can trade directly offline with another person, it’s important to conduct transactions through P2P platforms. This is because they provide escrow, mediate transactions and resolve any dispute.

If you don’t like the thought of going through a lengthy sign-up and ID verification process on major exchanges, then getting physical cash with a Bitcoin ATM is a good alternative for you.

If you don’t like the thought of going through a lengthy sign-up and ID verification process on major exchanges, then getting physical cash with a Bitcoin ATM is a good alternative for you.

Bitcoin ATM is a hassle-free way to convert Bitcoin into cash.

Unlike the traditional ATMs where you can withdraw your country’s currency like USD, AUD, EUR etc with your debit card.

Bitcoin ATM is rather a physical centre, allowing you to buy Bitcoins with fiat money. And the good news is some ATM machines let you sell your Bitcoins for local currency too.

As of writing, there are over 4990+ crypto ATMs across 76 countries. It’s getting easier to find a Bitcoin ATM nearby you, around the globe.

First of all, use Coin Radar to find a Bitcoin ATM nearest to you. It will show you a live worldwide Bitcoin ATM map.

Then search for a Bitcoin ATM that offers the option to sell bitcoins for cash.

Keep in mind that not all machines are the same, each offers different buy/sell limits, fees and supported cryptocurrencies.

However, this method is only suitable for small transactions. This is because (1)most ATM machines have deposit and withdrawal limits between $1000-$10,000, and (2) It’s cumbersome to carry large stacks of cash around.

Still, the biggest drawback of using Bitcoin ATM is its high transaction fee. Compared to online exchanges which charge an average 0.1%-1% fee, Bitcoin ATMs typically charge 7-12% for selling bitcoins!

Clearly, convenience comes at a higher cost.

In other words, you will get fewer dollars if you’re selling bitcoins using ATM compared to other options on this list.

In case you need to cash out bitcoins quickly, Bitcoin ATM can be the most feasible option.

Strictly speaking, Bitcoin debit card won’t turn your bitcoins into hard cash. I’d describe it as more of a way to allow you to use your bitcoins just like any regular debit card.

Strictly speaking, Bitcoin debit card won’t turn your bitcoins into hard cash. I’d describe it as more of a way to allow you to use your bitcoins just like any regular debit card.

You can load your BTC into these cards and they’ll automatically convert your Bitcoin into fiat currency such as USD, EUR, GBP, AUD etc.

Holding a Bitcoin debit card allows you to spend, buy and pay for anything (both offline and online) or even withdraw cash at ATMs anywhere in the world as long as VISA/MASTER cards are accepted.

Access to these borderless bitcoin-funded debit cards is crucial for anyone (especially for frequent travelers), allowing you to make purchases online and/or offline, anywhere in the world without the hassle of expensive fees.

Some popular Bitcoin debit cards are Crypto.com, Wirex, Cryptopay. Each card comes with different features, fee structures and services. To help you make better decision, I’ve written a Bitcoin debit card comparison post here.

Before you rush into cashing out your bitcoins and realize your profits, there’s one important question to ask yourself: Should you convert Bitcoin to fiat currency?

Don’t forget that you’ll need to pay tax for the profit you made from selling bitcoins into fiat money.

Here’s the thing: The beauty of Bitcoin isn’t about the blockchain technology behind it. It’s the decentralized digital scarcity.

There’ll be only 21 million bitcoins in the world.

Take a look at Bitcoin’s yearly lows:

2012 – $4

2013 – $65

2014 – $200

2015 – $185

2016 – $365

2017 – $780

2018 – $3200

As more people are getting into the world of crypto, more businesses are accepting bitcoins, demand for Bitcoin is going through the roof. Despite the price volatility and government regulations, Bitcoin will only appreciate its value over time…

Consider this…

A decade ago, 10,000 bitcoins bought you a pizza.

Today, 10 bitcoins would buy you a high-performance Tesla Model X.

In the next decade, with 1 bitcoin (BTC) you’d be considered pretty wealthy.

Perhaps you should also allocate a portion of Bitcoin for long-term HODLing.

There you go. By now you should know exactly how to exchange Bitcoin into cash.

If you need to convert Bitcoin to fiat to pay the day-to-day bills or even reward yourself, sell it via exchanges such as Coinbase. Cashing bitcoins with a cryptocurrency exchange can be more convenient, easier and safer for crypto beginners.

If you want to sell your Bitcoin at a higher price, try LocalBitcoins.

If you want to get quick cash in emergencies, withdraw cash from a Bitcoin ATM can be a good choice.

It’s no harm to get a VISA/MasterCard linked-bitcoin debit card accepted by all merchants across the globe. It allows you to easily spend and withdraw Bitcoin for cash when you need it.

How do you cash out Bitcoin for cash? Do you have experience or tips to share with us? Feel to leave a comment below

Like this article? Share it with your friends and families.

Here are some helpful articles that you can read next:

Author: jenny

http://www.coinzodiac.comJenny Tan has extensive experience in sales, marketing, finance, business development, retailing businesses, vision care and consultancy. Jenny always has the spirit of entrepreneur at heart, who believes absolutely nothing is impossible in life and every human being has been born with talent and potential. After years of experience and obstacles along the way, Jenny has co-founded Think Maverick with a group of like-minded and determined internet entrepreneur.

0 thoughts on “Best way to cash in bitcoin”