Welcome to Mitrade

Bitcoin’s massive bull run of 2017 saw it move from 1BTC to $900, to a high of $20,000. It closed below $15,000 for the year, but the huge volatility brought a great deal of attention to the cryptocurrency. All over the web, people began looking for how to profit from the fast and deep swings.

Check Bitcoin newest price on Mitrade:

Start Trading BTC/USD Today ›

The BTC fever led to the introduction of Bitcoin CFDs ( Contract For Difference) across many forex broker platforms.

CFD is a financial derivative that allows experienced traders to capitalize on the sharp swings to make potential money regardless of the direction of the BTC price. Investors will not actually own bitcoin, but only trade based on bitcoin prices.

CFD provides the opportunity to profit by going long or short.

→ You think bitcoin price may rise ↗, so you buy bitcoin (BTC/USD). If the market price meets your expectation, you may profit from the price rising. This process is called ‘going long’.

→ You think bitcoin price may fall↘, so you sell bitcoin (BTC/USD). If the market price meets your expectation, you may profit from the price falling. This process is called ‘going short’.

With the combination of leverage and margin, bitcoin is one of the favorite tradable financial instruments for many traders.

How can you join these traders? How can you earn money from bitcoin with leverage and margin trading? This piece has all you need to know.

★ Leverage allows you to control much larger positions than what you have deposited in your account.

For example, a broker offers you 1:100 leverage for trading any particular instrument, it means that for every $1 in your trading account, you can control another $100.

So if you have a $1,000 in your account, you can potentially buy or sell $100,000 worth of any tradable instruments. The broker hypothetically lends you the rest of the money that allows you to take such large positions. Without leverage, you have to come up with the full $100,000.

★ Apart from allowing you to take on much larger exposure, leverage magnifies your potential profits.

If you had deposited $1000 to open a $100,000 position (1:100 leverage), and your position moved into 1% profit, your gain is $1000 or a massive 100%. Without leverage, it is only a 1% gain on your $100,000 investment.

Bitcoin leverage trading refers to trade bitcoin with the leverage offered by brokers.

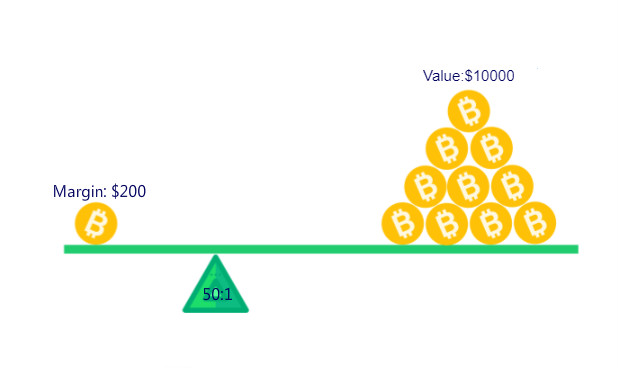

If you are trading bitcoin with a broker that offers 50:1 leverage, you can hypothetically trade $10,000 worth of bitcoin at only $200.

Many brokers offer different levels of leverage for bitcoin trading. You can expect to get leverage from 1:5 to 1:100, but you need to know the risks of leverage. You should pay special attention to the leverage and assets volatility to avoid losses caused by excessive leverage.

Want to join the Bitcoin leverage trading? At Mitrade, you can use 1: 10 leverage to trade crypto.

Bitcoin leverage trading allows you to control more sizable positions and make more profits. In many cases, you can control 10 to 20 times the amount required to open the position.

The amount put down to open a trade in bitcoin leverage trading is known as margin. So if the broker requires 2% margin to open a 50:1 leverage trade, you need to have 2% of the trade size to open the position. If you want to open a $50,000 worth of bitcoin position and the margin required by the broker is 2%, you need to have at least $1,000 in your account.

Example of Bitcoin Trading With and Without Leverage

Continuing our example above, if you bought $50,000 worth of real bitcoin at $8,065 per BTC and resold when BTC hit at $8,865, it means you needed $50,000 to make a $4,874 profit. This is unleveraged bitcoin trading and can also happen in the CFD space with a broker that does not offer any leverage on bitcoin trading.

A bitcoin CFD trader trading a $1,000 account with a broker that offers 1:50 leverage would have made the same profit by only putting down $1000. This is leveraged bitcoin trading.

Unleveraged | Leveraged |

Capital Required= $50,000 | Capital Required=$1,000 |

Profit= $4,874 | Profit= $4,874 |

Bitcoin leverage trading allows you to accomplish a lot more with less. However, it is important to note that the reverse is also the case when you enter a position, and it does not go in your favor. In our example above, the unleveraged trader will lose less than 10% of their capital if bitcoin’s price went against them by 10%. The leveraged trader, on the other hand, will lose 100% of the $1000 margin requirement. Depending on the total amount in the trading account, this can lead to a margin call.

Losing 100% of your deposit may sound extreme, but the volatility of bitcoin prices means that it is fairly common for its value to swing 10% within a single week. At the peak of the volatility, bitcoin’s value once dropped 30% within a single week. In contrast, most currency pairs will barely move 1% all week.

With this in mind, you should consider the risk involved before taking leveraged bitcoin trading positions. Even when a broker offers more than 50:1 leverage, you don’t have to bet your entire account on a trade. By simply reducing the position size for each position you take, you can reduce the leverage on your specific position.

Here is an example: Jack and Jill both have $10,000 trading accounts with a broker that offers up to 50:1 leverage for bitcoin trading.

Jack | Jill | |

Capital | $10,000 | $10,000 |

Leverage Used Per Position | 50:1 | 5:1 |

Value of Transaction | $500,000 | $50,000 |

Loss after a change of $100 in BTC value | -$5,000 | -$500 |

% of capital lost | 50% | 5% |

% of capital remaining | 50% | 95% |

% of remaining capital needed to get to breakeven | 100% | 5.5% |

Jack chooses to go all-in with a BTC sell position by taking the full 50:1 leverage (50 x $10,000 or 50 lots). This means selling $500,000 worth of Bitcoin. If the value of bitcoin was at 8070 at the time of the trade entry and increased by $100 to $8170, Jack will lose $5,000 or 50% of the capital in his trading account.

Jill, on the other hand, is wary about high leverage and wants to trade with minimal risk and only takes on 5:1 leverage on the same trade (5 x $10,000 or half a standard lot which is 0.5 lots). After losing the trade, Jill would have lost only $500 or 5% of his trading account.

So while Jill still has 95% of her capital intact to take on other positions, Jack is already down by 50% and will need to make back a massive 100% of his remaining capital just to break even. Jill, however, will breakeven once she wins a trade that returns 5.5%.

Keep this comparison table in mind as you embrace leveraged bitcoin trading.

With our illustration above, you can see how leverage can hurt your trading account when it goes against you. So what should you do?

1. Don’t bet the farm

In our example, Jack risked half his capital on a position. This is wrong. Regardless of the success rate of your trading strategy, every trade you open in forex trading can go against you. Bitcoin trading is worse because it can go against you VERY quickly. Therefore, you need to be like Jill or even better, by only risking a reasonable fraction that allows you to withstand a losing trade. If you are risking more than 5% of your account on any trade, you have taken on too much leverage.

Additionally, huge losses like the one suffered by Jack above can trigger a wide range of emotional behaviors. There is a higher chance of him losing the remaining $5,000 than taking it back to breakeven.

2. Use Stops

Also known as stop-loss, this is the price level at which the broker is expected to close out a losing position for you. By having a fixed stop-loss, you know exactly how much money you are risking on any open trade. The position of your stop loss should be determined by your trading strategy. At what point is your position invalidated?

Unfortunately, standard stops are not always honored. The broker will only close the trade at the best available price after reaching your stop. During extreme volatility, the best available price can be hundreds of pips away from your chosen stop. This is another reason why you should risk very little per trade. If you risked 1% on your open trade, price overshooting your stop by 2% would only increase your loss from 1% to 3%. However, if you are risking 10%, such a scenario will lead to a 30% loss of your capital.

3. Guaranteed Stops

Guaranteed stops do the same thing as the conventional stops with an added twist. Regardless of what happens, the broker will close your position at your designated stop loss. This means high volatility or weekend gaps will not affect your positions.

Depending on the broker you have chosen, you can get anything from 1:5 to 1:1000 leverage. However, as a beginner, you should not get swayed by these figures. Low leverage brokers make it harder for you to take on excessive risk. For bitcoin leverage trading, do not use more than 1:5 leverage. For other less volatile instruments, you can go as high as 1:10.

Remember, it is not compulsory to use the full leverage advertised by the broker. By varying your trade sizes appropriately (like Jill in our example), you can still trade with 1:5 leverage even when a broker offers 1:1000 leverage.

The best leverage for you is your decision. When you settle for a leverage level, find a broker that gives you the flexibility to trade at that level. Remember, the leverage allowed for bitcoin trading will typically be lower than the maximum leverage advertised on the broker’s website. Find out the details before you commit to any broker.

There are many forex brokers today offering bitcoin and other cryptocurrency CFDs. Review each one and select any that appeals to you. Don’t forget to review each broker based on important points like the spread charged for BTCUSD, the speed of execution as well as commissions.

The Mitrade Experience

Mitrade is one of the best options for bitcoin leverage trading in the CFDs space today. The broker perfectly understands the need to protect traders from the volatility of bitcoin by limiting the leverage on the crypto to 1:10. Even for standard forex currency pairs, Mitrade offers a maximum of 1:200 leverage.

To start crypto leverage trading on Mitrade, follow these 4 steps:

〉 Go to Mitrade trading platform

〉 Search the markets you want to trade and select it

〉 Open a Long or Short position

〉 Set up your position size and Confirm the trade

【 Reliable and Regulated】 Mitrade is regulated by the ASIC in Australia. Its proprietary platform makes it easy for anyone to access bitcoin leverage trading.

【Competitive Cost, 24-hour Trading】Zero commissions, low overnight fees, and competitive and transparent spreads. All costs will show on your deals order.

【Low Deposit High Leverage, Trading Anytime Anywhere】The minimum size per trade is as low as 0.01 lots for many markets. Leverage up to 200:1. You will enjoy seamless trading via both iOS and Android mobile apps along with web platform.

【Good liquidity, efficient and convenient】Provide more than 100 popular global trading instruments. T+0 settlement, more flexible and efficient.

>>> Practice on Mitrade platfrom!

Cryptocurrency leverage trading can be richly rewarding if you have an understanding of trading CFDs. The volatility of the instrument increases the chances of making more profits than you’d ordinarily get by trading currency pairs. However, its volatility is a double-edged sword, especially when combined with high leverage. Bitcoin CFD traders, therefore, have to keep a lid on their risk at all times to ensure long-term success.

Read more:

>>> How To Day Trade with Cryptocurrency CFDs For Potential Profits?

>>> 10 Ways You Can Do To Make Money with Cryptocurrency

>>> Top 10 Best Cryptocurrencies Worth Investing In 2020, 2021

The content presented above, whether from a third party or not, is considered as general advice only. This article does not contain and should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments. Mitrade does not represent that the information provided here is accurate, current or complete. Mitrade is not a financial advisor and all services are provided on an execution only basis. Before making any investment decisions, you should seek advice from independent financial advisors to ensure you understand the risks. *CFD trading carries a high level of risk and is not suitable for all investors. Please read the PDS before choosing to start trading.

0 thoughts on “Margin trading bitcoin meaning”