Turbotax bitcoin losses - will

How to Report Crypto Losses On Your Taxes

Realized bitcoin and crypto losses can be written off to lower your overall tax liability. Due to the extreme volatility present within the crypto markets, this gives many investors huge opportunities for significant tax savings. This article discusses how to report crypto losses to the IRS as well as strategies for saving you money and using your capital losses to lower your tax bill.

For an in-depth overview discussing the basics of cryptocurrency taxes, checkout our complete crypto tax guide.

Can You Write Off Crypto Losses On Taxes?

Yes. Cryptocurrencies such as bitcoin are treated as property by the IRS, and they are subject to capital gains and losses rules.

This means that when you realize losses after trading, selling, or otherwise disposing of your crypto, your losses get deducted from other capital gains as well as ordinary income (up to $3,000).

<div id="om-eeywu2knpo981nccukze-holder"></div>

Example 1:

Lucas buys 1 bitcoin for $10,000. Six months later, he sells that 1 bitcoin for $8,000.

In this example, Lucas realizes a $2,000 capital loss after selling his bitcoin. This $2,000 first gets deducted from any other capital gains Lucas may have (like gains from other investments such as stocks).

If he doesn’t have any capital gains, this full $2,000 loss gets deducted from Lucas’s income—thus lowering his overall taxable income and reducing his tax bill.

Example 2:

Mitchell earns $50,000 per year from his job. He also sold some Apple stock this year, and made a $5,000 capital gain on the sale. On top of this, Mitchell invested in Ethereum at its height, and wound up selling all of his ETH for a total loss of $6,000.

In this example, Mitchell’s $6,000 loss in ETH completely deducts against his $5,000 gain from the stock market/Apple stock. After this offset, Mitchell is left with a $1,000 net capital loss on the year.

This $1,000 capital loss reduces Mitchell’s total taxable income to $49,000 for the year.

When Do You Incur A Crypto Loss?

Remember, you need to actually realize your loss for it to count as a capital loss that can be written off on your taxes. To realize a loss, you must incur a taxable event—in other words, you need to actually dispose of your crypto to realize the loss.

According to the IRS, you incur a cryptocurrency taxable event whenever one of the following occurs:

- Trade or sell crypto for fiat currency (like USD)

- Trade one crypto for another cryptocurrency

- Spend crypto to buy a good or service

So simply buying and holding does not realize any gains or losses. You must actually dispose of your crypto either by selling or trading it to realize your gain or loss in the investment.

Example 1:

Sara purchased 1 BTC for $15,000 at the beginning of 2018. By the end of 2018, Sara was still holding her bitcoin, but it is now worth only $7,000.

In this example, Sara has an unrealized loss of $8,000 (15,000 - 7,000), and she cannot write this off at this time.

Remember, Sara only realizes her loss in the asset when she disposes of it.

Do You Have To Report Crypto Losses to the IRS?

Yes, you need to report crypto losses on IRS Form 8949.

For each of your taxable events, calculate your gain or loss from the transaction and record this onto one line of 8949. Once you have filled out lines for each of your taxable events, sum them up and enter your total net gain or loss at the bottom of 8949 (pictured below).

Many investors believe that if they only incur losses and no gains, that they don’t actually have to report this to the IRS. This is not true, and the IRS makes it clear that cryptocurrency losses need to be reported on your tax return.

For a step-by-step walk through detailing how to report crypto on 8949, checkout our blog post: How To Report Crypto On Taxes.

The Huge Opportunity For Tax Loss Harvesting - AKA Saving $$$

Many cryptocurrency investors are hard-core Hodlers (holders), meaning they have simply bought and held their crypto over the years, never incurring any taxable events.

Because of this, many investors are often sitting on huge unrealized capital losses that could be used to offset other capital gains and reduce their taxable income.

By strategically trading those cryptocurrencies that have large unrealized losses and thus incurring a taxable event, investors can at times realize significant tax savings.

This is a common strategy called Tax Loss Harvesting that is used by wealth managers all of the time. In the world of crypto, this strategy of tax loss harvesting works even better, and you can save a lot of money by strategically harvesting losses throughout the year.

We discuss this tax loss harvesting process and how you can be using it to save money in our complete blog post: The Cryptocurrency Guide to Tax Loss Harvesting.

Today, many crypto investors are using cryptocurrency tax software to help them tax loss harvest and automatically detect their biggest tax savings opportunities within their crypto portfolio.

The Challenge For Traders

If you have been trading quite often, calculating your losses for each of your cryptocurrency trades and reporting them on your taxes can become quite tedious.

Cryptocurrency trades are mostly quoted in other cryptocurrencies, making the reporting of gains and losses in USD terms (or your home fiat currency) very difficult.

On top of this, crypto exchanges like Coinbase and Binance actually don’t have the ability to give gains and losses reports to customers. This problem stems from the transferable nature of crypto itself.

Cryptocurrency Tax Software

Instead of tracking down the historical USD prices for each cryptocurrency trade in order to do the gain/loss calculation by hand, many crypto investors are leveraging crypto tax software platforms like CryptoTrader.Tax to automate the entire reporting process.

By connecting your cryptocurrency exchanges and importing all of your historical trades, CryptoTrader.Tax can generate your crypto tax reports based on your data with the click of a button.

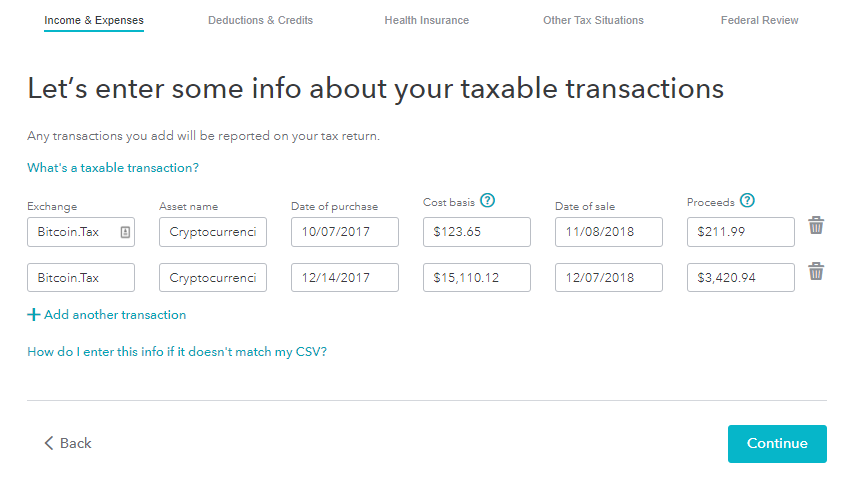

You can use these reports to file your crypto losses with your tax return. You can even import the reports that CryptoTrader.Tax generates directly into your TurboTax or TaxAct account for easy filing.

In addition to your reports, CryptoTrader.Tax offers a full tax loss harvesting module that will help you identify which cryptocurrencies in your portfolio have the most significant unrealized losses and offer the largest tax savings potential.

One trader saved over $10,000 on his tax bill by leveraging the CryptoTrader.Tax tax loss harvesting tool. You can learn more about how CryptoTrader.Tax works here.

Conclusion

It’s important to be filing your crypto losses with your taxes each year. Not just because it is required by the IRS, but more importantly, because it can save you a substantial amount of money on your tax return!

Disclaimer - This post is for informational purposes only and should not be construed as tax or investment advice. Please speak to your own tax expert, CPA or tax attorney on how you should treat taxation of digital currencies.

-

-

-