Profitability btc - apologise, but

Bitcoin Mining Profit Calculator

Why Our Calculator is the Most Accurate

There are many factors that affect your mining profitability. Two of the main factors that influence your profitability are:

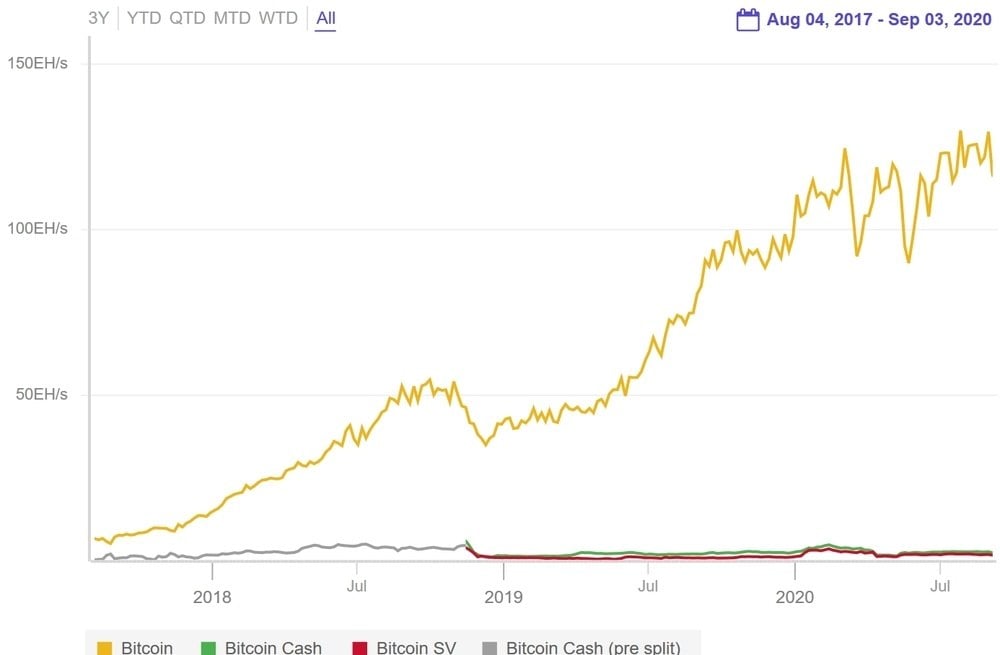

The Bitcoin price and the total network hash rate.

The Bitcoin network hash rate is growing at a rate of 0.4527678% per day. This means if you buy 50 TH/s of mining hardware your total share of the network will go DOWN every day compared to the total network hash rate.

Our calculator assumes the 0.4527678% daily increase in network hash rate that has been the average daily increase over the past 6 months.

Without factoring in this growth, most Bitcoin mining calculators show results that appear MUCH, MUCH more profitable than reality.

The Bitcoin Price

Even though the network hash rate will cause your share of the network hash power to go down, the Bitcoin price can help make up some of these losses.

The Bitcoin price is rising at a slightly lesser 0.3403% per day over the past year. We suggest you enter a custom Bitcoin price into our calculator based on what you expect the average price to be over the next year.

The price has gone down for most of the past year, which is a factor that should be strongly considered in your calculations.

What our Calculator Assumes

Since our calculator only projects one year out, we assume the block reward to be 6.25. We also use the current Bitcoin price in our calculations, but you can change the Bitcoin price to anything you'd like to get better data.

Factors That Affect Mining Profitability

Mining can be an effective way to generate passive income. However, there are numerous factors that affect mining profitability, and often times they are out of your control.

Some seem to believe they will be able to quit their nine-to-five job after investing in a few Bitcoin miners – unfortunately, that is not necessarily the case.

How do you know if mining is right for you?

It is important to understand the constantly changing dynamics that play into mining profitability, especially before you invest your hard-earned money. Nevertheless, a proper passive income can be generated if you play your cards right. Let's explore the factors that you need to consider before you buy mining hardware:

Quick Tip

Mining or buying bitcoins? You can't do either without a Bitcoin wallet.

Our guide on the best bitcoin wallets will help you pick one. Read it here!

Initial Investment

The initial investment in efficient mining hardware is probably one of the things keeping you from pulling the trigger, and for good reason. Mining hardware is expensive!

In actuality, the high cost of dedicated mining hardware ASICs (Application Specific Integrated Circuits) is largely to blame for the centralization of Bitcoin mining in China.

In case you were not aware, the vast majority of mining operations are in China, primarily because of cheap electricity (more on that later.) Since ASICs are expensive, many average consumers do not have the capital to invest.

The result?

Large mining corporations operate mining farms with thousands of ASICs. The average Joe can't even afford one ASIC, much less thousands of them.

Instead of mining being spread out across the world, the validation process is controlled by fewer people than first anticipated upon Bitcoin's inception.

ASICs' impact on Bitcoin aside, it is important to determine your ROI timeline before investing. Some hardware might not pay itself off at all. The additional factors below are largely responsible for determining your ROI period.

You can use the calculator above to determine your projected earnings based on the ASIC you're using, and your electricity cost.

Block Rewards and Transaction Fees

Every time a block is validated, the person who contributed the necessary computational power is given a block reward in the form of new-minted BTC and transaction fees.

Bitcoin's block time is roughly 10 minutes. Every 10 minutes or so, a block is verified and a block reward is issued to the miner. When Bitcoin was first created, miners received 50 BTC for verifying a block. Every 210,000 blocks – roughly 4 years – the amount of BTC in the block reward halves.

50 BTC per block may seem high, but it is important to consider the price of Bitcoin at that time was much less than it is today. As the Bitcoin block reward continues to halve, the value of Bitcoin is predicted to increase. So far, that trend has remained true.

First, the amount of newly minted BTC (often referred to as coinbase, not to be confused with the Coinbase exchange) halved to 25 BTC, and the current coinbase reward is 12.5 BTC. Eventually, there will be a circulating supply of 21 million BTC and coinbase rewards will cease to exist.

If BTC is no longer minted, mining won't be profitable anymore, right?

Wrong.

Bitcoin transaction fees are issued to miners as an incentive to continue validating the network. By the time 21 million BTC has been minted, transaction volume on the network will have increased significantly and miners' profitability will remain roughly the same.

Of course, block rewards have a direct impact on your mining profitability, as does the value of BTC – since the value of BTC is volatile, block rewards will vary. Additionally, successfully confirming a block is the only way you will generate any revenue whatsoever by mining.

Hashrate

On a simple level, hashrate is the way we measure how much computing power everyone around the world is contributing toward mining Bitcoin. Miners use their computer processing power to secure the network, record all of the Bitcoin transactions and get rewarded in bitcoin for their efforts.

The higher the hashrate of one individual Bitcoin mining machine, the more bitcoin that machine will mine. The higher the hashrate of the entire Bitcoin network, the more machines there are in total and the more difficult it is to mine Bitcoin.

At the end of the day, mining is a competitive market.

Another way of looking at it, is that hashrate is a measure of how healthy the Bitcoin network is.

It’s good for Bitcoin if the overall hashrate is high, because it makes the network more secure. Somebody who wanted to attack Bitcoin would need at least 51% of all the hashrate in the world and that gets pretty expensive when there are millions of mining machines running.

It’s also healthy if those machines are being operated in different countries by different people, because it means it would be very hard for the entire network to be shut down. Bitcoin is like a many headed hydra, at this point in time it is more or less unstoppable.

QUICK TIP

Before we get too deep into the Bitcoin Mining topic, please note that mining isn’t the fastest way to get bitcoin. Buying bitcoin with a debit card is fast and efficient.

eToro

eToro- Start trading fast; high limits

- Easy way for newcomers to get bitcoins

- Your capital is at risk.

Coinmama

Coinmama- Works in almost all countries

- Highest limits for buying bitcoins with a credit card

- Reliable and trusted broker

eToro

eToro- Supports Bitcoin, Ethereum & 15 other coins

- Start trading fast; high limits

- Your capital is at risk.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

OK, but what does hashing actually mean?

Underneath the hood, Bitcoin mining is a bit like playing the lottery. Roughly every 10 minutes the Bitcoin code creates a ‘target’ number that the mining machines try to guess.

Typically we call this finding the next block. Like many things connected to Bitcoin this is an analogy to help things be a little bit easier to understand. The deeper you go into the Bitcoin topic, the more you realise there is to learn.

Whichever machine guesses the target number first earns the mining reward, which is currently 6.25 BTC. They also earn the transaction fees that people spent sending bitcoin to each other.

Just like winning the lottery, the chances of picking the right hash is extremely low. However, modern bitcoin mining machines have a big advantage over a person playing the lottery. The machines can make an awful lot of guesses. Trillions per second. Each guess is a hash, and the amount of guesses the machine can make is its hashrate.

Is hashrate just a Bitcoin thing?

No. Other cryptocurrencies, like Litecoin, that use mining to support and secure their networks can be measured in hashrate. However, different coins have different mining algorithms which means that the chance of a mining machine guessing the target, writing the block onto the blockchain and getting the reward is different from one cryptocurrency to the next.

We can still compare the amount of hashrate between two different cryptocurrencies, and the Bitcoin network has a lot more computing power than all the other currencies put together. This is why it’s pretty easy to argue that Bitcoin is the most stable and secure, and why it’s very unlikely that a new coin will take over its crown.

The algorithm that Satoshi Nakamoto implemented for Bitcoin is called SHA-256. So when we talk about the hashrate of the Bitcoin network, or a single Bitcoin mining machine, then we are really talking about how many times the SHA-256 algorithm can be performed. The most common way to define that is how many hashes per second.

You’ll see it listed as H/s or more commonly TH/s, which is one trillion hashes per second!

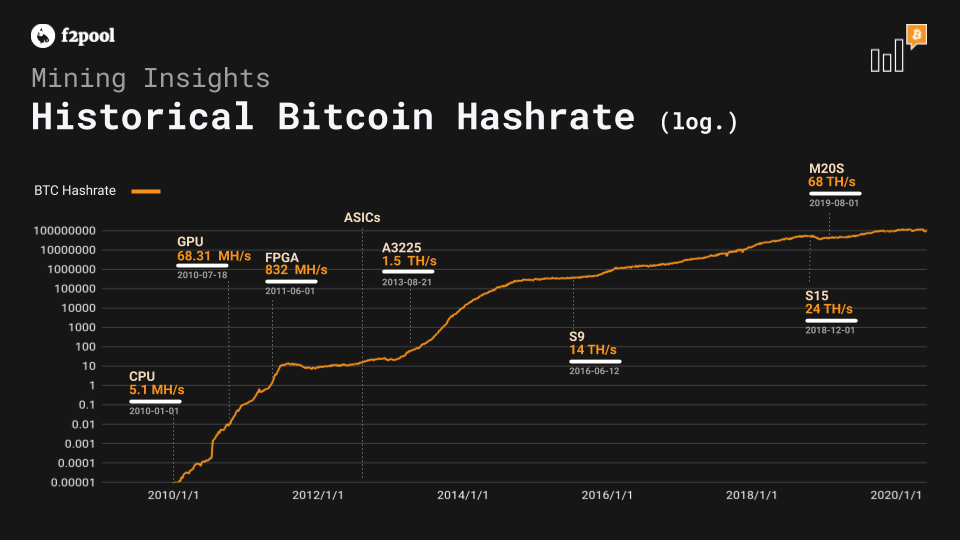

Hash Rate Units

When Satoshi gave the world Bitcoin back in 2009, it was easy enough to measure hashrate in hashes per second because the computing power on the Bitcoin network was still relatively low. You could mine Bitcoin on your home computer and it was quite possible and likely that you would occasionally earn the then 50 BTC block reward every so often.

Today the block reward is only 6.25 BTC and hashrate is measured in trillions, quadrillions and even quintillions of hashes per second.

Here’s a list of the standard units for hashrate:

| Kilohash | KH/s (thousands of Hashes/second) |

| Megahash | MH/s (millions of Hashes/second) |

| Gigahash | GH/s (billions of Hashes/second) |

| Terahash | TH/s (trillions of Hashes/second) |

| Petahash | PH/s (quadrillions of Hashes/second) |

How do we estimate the total hashrate of the Bitcoin network?

It is surprisingly tricky to work out the exact hashrate of the Bitcoin network because the mining machines don’t need to identify themselves in order to contribute their computing power to the network. The machines are simply hashing away locally and then communicating to the network (usually via a pool when they have found the latest block.

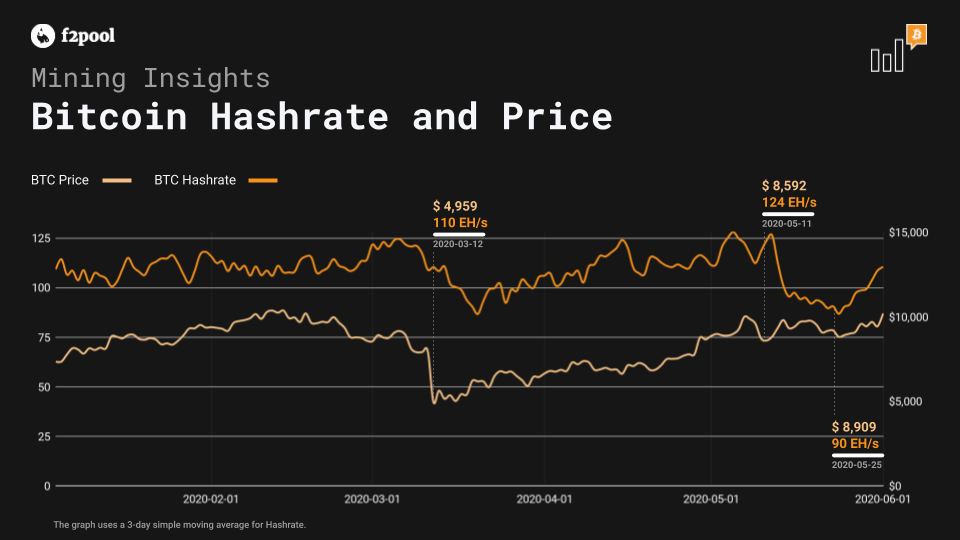

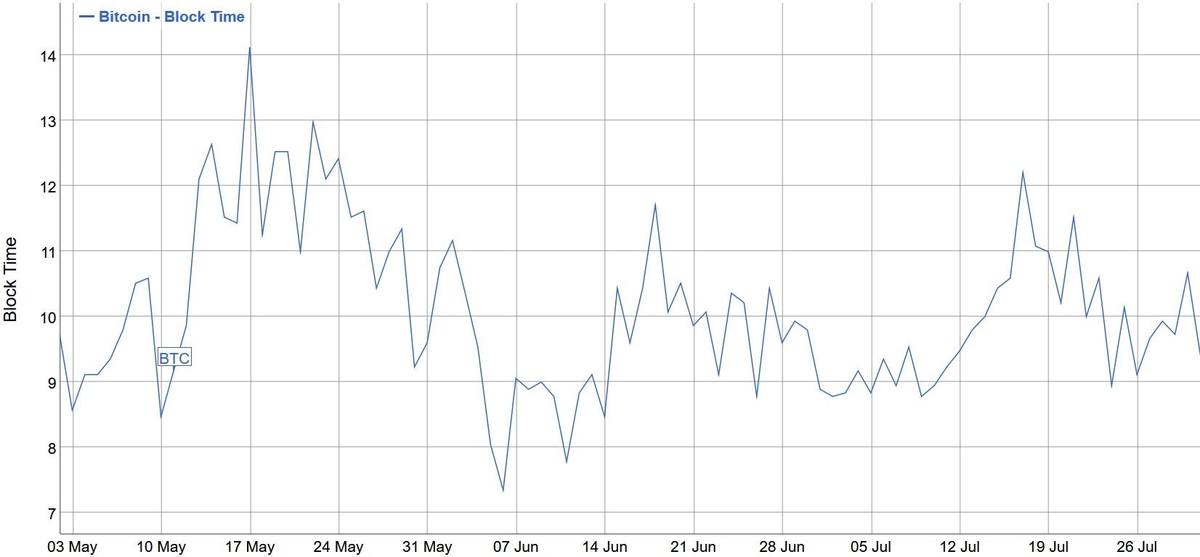

It's hard to accurately measure the hashrate of all machines in the network. Hashrate charts are reverse engineered by comparing block frequency and network difficulty.

The oscillations exist because difficulty is constant in two weeks but block frequency varies greatly. At F2Pool, we find that estimated Network Hashrate is best represented as a moving average.

Thomas Heller Global Business Director at F2Pool

Thomas Heller Global Business Director at F2PoolQUICK TIP

For a refresher on what difficulty is in the Bitcoin blockchain, read our explainer on difficulty or take a brief look at the video below:

The daily estimation of hashrate is calculated by comparing the number of blocks that were actually discovered in the past twenty four hours with the number of blocks (144) that we would expect would be discovered if the speed stayed constant at one block every ten minutes.

The formula looks like this:

It’s a little bit more complicated than just dividing the amount of blocks, because it includes the concept of mining difficulty. Bitcoin is programmed to mine a block about every 10 minutes. It maintains this rate of production by adjusting the “mining difficulty” in line with the overall hashrate of the network. In short, it becomes more difficult for miners to find the target. As hashrate increases, so does Bitcoin’s mining difficulty.

The main point is that the answer that this formula produces is not entirely accurate, and can lead to hashrate charts that look a little strange if they aren’t averaged out. The Tweet below is a good example of the kind of confusion hashrate data can create when it is not presented as a moving average.

Look at this Bitcoin chart. Why is the BTC hash rate oscillating so much? The amplitude seems to have increased in recent months, does that imply hash rate centralization? Or are #Bitcoin PoW pools gaming the difficulty calculation? (to collect more rewards?) pic.twitter.com/pgFmgLXtcZ

— NΦAH (@NoahPierau) March 18, 2020

The chart below shows Bitcoin Hashrate as a three day moving average vs the price of Bitcoin itself, without the wild oscillations.

How does Hashrate relate to mining revenue?

To put it bluntly, the more hashrate you have, the more you’re going to earn from Bitcoin mining. That’s because you are increasing your chances of getting rewarded for discovering a block with every TH/s you add in terms of computing power.

In 2020, modern machines produce between 60 and 100 TH/s. The Whatsminer M20S produces 68 TH/s. Compared to the entire Bitcoin network that one machine is a drop in the ocean. There are millions of machines, in multiple countries hashing away trying to discover the next block.

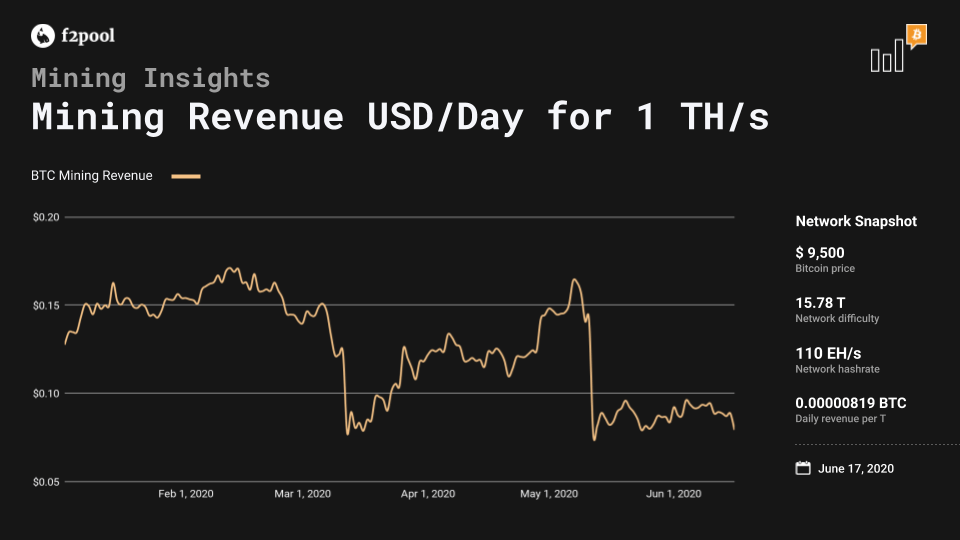

This means that over time, as can be seen in the following chart, the revenue for 1 TH/s has fallen dramatically.

In June 2020, 1 TH/s will earn less than 10 cents in USD per day. So one M20S will earn around $6, and that’s before you have paid your electricity bill. Mining is a margins game, where every cent counts.

If you’ve been paying attention you might be asking yourself one more question. If one M20S runs at 68 TH/s, and the entire Bitcoin network is above 100 EH/s what on earth are the chances of one individual machine mining a block.

The chances are astronomically low...

If you ran an M20S on its own then probabilistically you would earn a single block every 16 years. It would be a pretty good pay day (around $60,000 at today’s prices) from a machine that costs about $1000, but it’s a long time to wait, and that’s where mining pools come in.

QUICK TIP

Another aspect of the mining business that affects revenue is taxes. Every miner needs to know the relevant tax laws for Bitcoin mining in his part of the world, which is why it is so important to use a crypto tax software when calculating profits.

How mining pools take the luck out of mining, and reward you for your hashrate

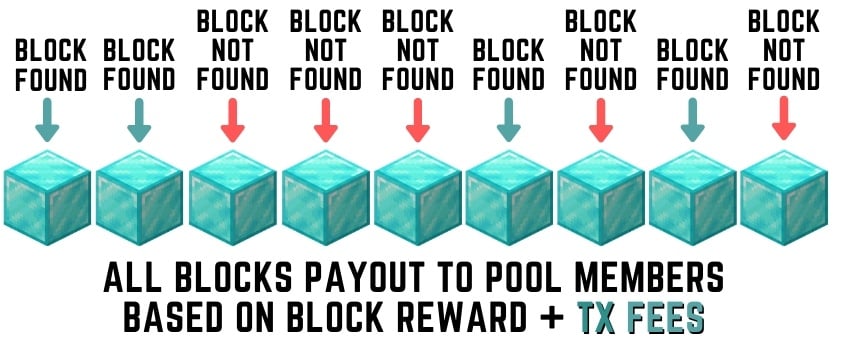

As the hashrate on the Bitcoin network increases, the chances of earning a reward through solo mining decreases. To increase their chances of earning mining revenue, miners connect to a mining pool to pool their computing power and proportionately share the block rewards of any block mined by the pool based on the amount of hashrate they contributed.

A PPS+ pool, like F2Pool, takes the variance risk away from miners, as the pool will pay out mining revenue to miners regardless of whether the pool successfully mines a block. Usually, PPS+ pools pay out once per day.

If the Bitcoin Network Hashrate is at 100 EH/s (100,000,000 TH/s), a WhatsMiner M20S ASIC miner with 68 TH/s, earns around 0.001224 BTC per day. It’s guaranteed by the pool regardless of luck.

Hashrate is what keeps Bitcoin secure

When Satoshi created Bitcoin and gave it to the world, he took the idea of hashrate and used it to ensure that Bitcoin would remain decentralized and secure. Miners compete with each other to earn rewards and the computer power they contribute to the network makes it very hard for a bad actor to mess around with people’s transactions.

To attack Bitcoin you need at least 51% of all the hashrate in the world, now that the miners produce 100 quintillion hashes per second that’s becoming a very expensive and unlikely scenario. In short, the more hashing power used to mine Bitcoins, the harder it is for a single person to get 51% of it.

Block Difficulty

Mining difficulty or just “difficulty” is a measure or a network-wide setting that indicates how much effort is required by miners to find a proof-of-work{: target='_blank' }.

In Bitcoin, a proof-of-work is just a piece of data - or more precisely a number - which falls below a predetermined difficulty target that is continually and automatically readjusted by the Bitcoin protocol.

For miners competing in the Bitcoin network, finding or generating this number involves repeatedly hashing the header of the block until the hashing algorithm spits out an output that falls below the aforementioned pre-set difficulty target.

But why do miners do that in the first place?

Miners expend computational energy and compete to find the proof-of-work because finding the proof-of-work is the only way to validate blocks, and validating blocks is how miners in the Bitcoin network make their living.

The first miner to validate a block gets to create a unique transaction, called a coinbase transaction, whereby the miner rewards himself with a set amount of newly minted bitcoins.

How Do Miners Find Proof-of-Work?

The process of hashing is, in fact, quite simple but requires an enormous amount of computational energy.

Put simply, hashing is the transformation of a string of characters (the input) into a usually shorter, fixed-length value or key (the output) that represents the original string.

The trick with hashing is that, while running the same input through the same hashing algorithm always gets us the same output, changing only the smallest bit of the input and running it through the same algorithm changes the output completely.

In order to find the proof-of-work, miners must repeatedly change the input (which is consisted of the block header - the part that stays the same - and a random number called a nonce - which is the variable that miners change to get a different output) and run it through the SHA256 cryptographic algorithm until they find a hash that meets the preset difficulty target.

Using sophisticated mining hardware called ASICs (Application-Specific Integrated Circuits), miners can make hundreds of thousands of these calculations per second.

It takes the entire network of miners roughly 10 minutes to find and validate a new block of transactions.

Why Is Difficulty Important?

The moving or self-readjusting difficulty target is a crucial component of Bitcoin security for several reasons, but mainly because it ensures the network’s neutrality by preventing any single miner from taking full control over the protocol.

The ever-changing difficulty target ensures that the Bitcoin protocol runs smoothly and that a new block is validated and added to the Bitcoin blockchain roughly every 10 minutes on average. This 10-minute interval between blocks is better known as block time.

Difficulty matters for more than just protocol security. Maintaining a stable block time has substantial monetary implications. If miners start mining blocks faster, they’ll generate bitcoins faster, which in turn translates into a higher inflation rate.

Maintaining a low, fixed and predictable inflation rate is essential for a scarce digital asset such as Bitcoin.

How Does Bitcoin Difficulty Change?

In order to keep the block time fixed as more miners join and/or leave the network, the Bitcoin protocol must keep pace and continually readjust the mining difficulty accordingly.

The average block time of the Bitcoin network is evaluated every 2106 blocks (roughly every two weeks); if the block time is greater than 10 minutes, then the difficulty will be reduced, and if it’s less than 10 minutes, the difficulty level will be increased.

In other words, if the cumulative hash power of the network rises, the Bitcoin protocol will readjust and make it harder for miners to find the proof-of-work. And, conversely, if the cumulative hash power drops, the difficulty will drop to make it easier for miners to validate blocks and keep the interlude between each new block and the previous one fixed at ~10 minutes.

It’s important to note that not every cryptocurrency in existence is designed with the same block time in mind. Ethereum, for example, aims for an average block time of 20 seconds, while Litecoin aims for a block time of 2.5 minutes.

You may be wondering: "How does the Bitcoin blockchain know if block times have been longer or shorter than ten minutes on average? Wouldn't this require an oracle to keep track of block times?"

Good question. The way the blockchain "knows" how much time the average block has taken during this difficulty period is by referencing timestamps left by the miners of each block. To some extent, there are protocol rules in place that prevent a miner from lying about the timestamp. If you want to know more, you can read this guide{: target='_blank' } from Bitmex's blog.

How Does Difficulty Affect Miners?

Difficulty directly impacts miner profitability. Difficulty adjustments make it easier or harder for active miners to find new blocks and earn bitcoins.

Greater difficulty means that miners need more hashing power to secure the same chance of winning a block reward. Since in today’s world nearly all individual miners join mining pools, greater difficulty means that miners will earn fewer bitcoins per unit of hash power contributed to the mining pool or per unit of electricity consumed.

Usually, when the Bitcoin network experiences a drop in mining difficulty, that means that the price of bitcoin was too low and the most inefficient miners couldn’t cover their operating costs and had to stop mining.

QUICK TIP

If you are interested in mining, make sure to check out our mining profitablity calculator before you get started.

When inefficient miners shut their mining rigs off, the efficient miners that survive get to experience greater profit margins — but only for a short period of time. In free markets with relatively low barriers to entry, high margins tend to attract competition.

In that way, the Bitcoin protocol - through the moving difficulty target - acts as a self-stabilizing ecosystem.

- Higher margins attract more miners.

- More miners results in greater difficulty.

- Greater difficulty means lower margins. Lower margins translate into greater sell pressure for inefficient miners.

- The selling pressure then further lowers the price by increasing the bitcoin supply while the demand (presumably) stays the same.

QUICK TIP

Another aspect of the mining business that affects profiit is taxes. Every miner needs to know the relevant tax laws for Bitcoin mining in his part of the world, which is why it is so important to use a crypto tax software when calculating profits.

Cool, isn’t it?

Is There a Maximum Difficulty?

Yes, but getting to the maximum difficulty is practically impossible.

The maximum difficulty is a ridiculously huge number (about 2^224), which quite literally means that to mine a block with this difficulty would require all the energy in the universe.

Electricity Cost

Electricity cost is probably the factor that has the most impact on mining profitability.

After all, Bitcoin's SHA-256 mining algorithm is classified as Proof-of-Work (PoW) because work must be done to validate the network. The 'work' is computational power – therefore electricity is required to validate the network.

Always look at a miner's hashrate/power consumption ratio. Ideally, you want an ASIC that has a high hashrate and low power consumption. Such an ASIC would be efficient and profitable because you'd hopefully validate a block which would be worth more than your electricity costs.

If you don't successfully validate a block, you'll end up spending money on electricity without anything to show for your investment. If you want to maximize your profitability, purchase the most efficient ASIC and mine where electricity is cheap.

In the United States, the average electricity cost is around $0.12 cents per kilowatt-hour. In other countries, electricity cost will vary. Asia's electricity is particularly cheap, which is why China is home to many mining operations.

Taxes

Paying taxes is the one thing that many people forget about when they are trying to figure out if mining is porfitable or not.

Just like any business, miners must also pay taxes on the profits, which makes margins even tighter for the miner.

Make sure that when you are calculating your mining profitability, you also consider what the tax situation on mining is like in your country and use a crypto tax software to help you out.

Conclusion

Bitcoin mining is very competitive. If you are looking to generate passive income by mining Bitcoin, it is possible, but you have to play your cards right.

In order to profitably mine, make sure that you:- Mine with cheap electricity

- Buy the most efficient miner you can

- Join a mining pool

- Have patience

Now you have the tools to make a more informed decision. Mining is competitive, yet rewarding. If you invest in the proper hardware and combine your hashing power with others', your odds of turning a profit will increase considerably.

Happy mining!

0 thoughts on “Profitability btc”