Bitcoin’s Implied Volatility Rises Ahead of US Election

Bitcoin’s Implied Volatility Rises Ahead of US Election

Both bitcoin and traditional market investors look to be predicting a pick-up in volatility following the U.S. elections.

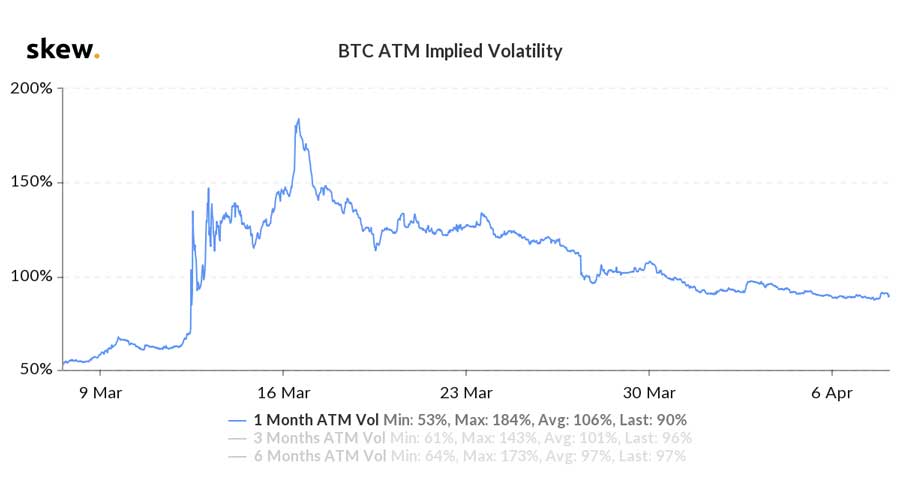

- The cryptocurrency's one-month implied volatility – investors' expectation of how turbulent prices will be over the next four weeks – has risen to a two-week high of 59% in the past three days, according to data source Skew.

- "Bitcoin's price will be sensitive to the outcome of U.S. elections [on Tuesday]," Matthew Dibb, co-founder of Stack Funds, told CoinDesk. "We expect the cryptocurrency to trade volatile in the coming days, and that is being reflected in near-dated implied volatility in the options market."

- The heightened short-term price volatility expectations could be associated with fears that the outcome of the U.S. presidential election may be contested, resulting in a period of political and economic uncertainty.

- While the one-month implied volatility has picked up, the six-month metric remains flat above 60%.

- That suggests the market does not expect a prolonged period of political uncertainty in the world's largest economy.

- Further, the 10-point rise in the one-month implied volatility isn't a big move and indicates a moderate shift in sentiment, according to Vishal Shah, an options trader and founder of derivatives exchange Alpha5.

- More extreme sentiment is seen in the fiat currency markets, where the Chinese yuan's one-week implied volatility has doubled in the past week to the highest since 2011.

- One-week implied volatility gauges for the euro and the yen have also risen to the highest since April.

- Implied volatility is gauged by demand for options as hedging instruments.

- Seasoned traders often buy both call and put options, or hedge buy positions in the spot or futures market by buying put options when expecting uncertainty. That pushes the implied volatility metric higher.

- A call option gives the holder the right to buy the underlying asset at a predetermined price on or before a specific date, and the put option gives the right to sell.

- The traditional markets will likely suffer, aggravating an ongoing technical pullback in bitcoin, if the U.S. elections are contested.

- While Democratic candidate Joe Biden is leading in most polls, online betting markets are more bullish on the odds for President Donald Trump.

- Once the dust settles post-election, the rising pile of negative-yielding bonds across the globe is likely to reignite the bitcoin bull run as investors seek returns.

- Bitcoin is currently trading largely unchanged on the day near $13,550, having fallen back from a fleeting 33-month high of $14,093 over the weekend.

Also read: Bitcoiners Have Trillions and Trillions of Reasons to Ignore US Election

0 thoughts on “Implied volatility btc”