Can: How many times has bitcoin crashed

| How many times has bitcoin crashed | |

| De pesos mexicanos a btc | |

| How is bitcoin not hacked |

How many times has bitcoin crashed - well

Of course bitcoin is a bubble – a bubble you can’t ignore

Bitcoin has been displaying its characteristic super volatility this past week. Oh my goodness, there’s nothing like it: a record new high at $42,, followed by the first $10, daily move in its history. Unfortunately that move was down.

I’ll use round numbers for simplicity here. Bitcoin began October at $10,; it rose by 30% over the month. It began November at $13,; it gained another 50%, to begin December at $19, December saw gains of more than 50%, and fresh all-time highs as a result. Thus bitcoin began at $29,; it carried on making all-time highs, eventually reaching $42, last week.

Bitcoin crashed at the weekend – but it’s still up by more than 15% this year alone

Then it crashed by more than 30% in a day. You can be sure what all the papers are reporting – “the largest daily loss ever”, and the like. But do you know what? At $34,, bitcoin is still up over 15% this year. It’s beating pretty much every asset class.

The network now transfers more than $, a second. By market capitalisation, it’s now the 14th most valuable currency in the world, ahead of the likes of India, Russia, Sweden, Hong Kong and Saudi Arabia.

The market cap of the network, whose function is to store and transfer value, is now higher than that of the infamous social network, Facebook. Over the course of bitcoin’s evolution, $10trn of value has been transferred – that is more than the value of all the gold in the world.

Even the Financial Times – which has been woefully wrong about bitcoin since its inception, doggedly sticking to the wrong side of the argument – is now talking about it being “integrated into the financial system.” When bitcoin was $, the FT said it was a “bubble”, and recommended its readers avoid it.

Do you know what a bubble is? It’s a bull market in which you don’t have a position. As we have said on these pages many times, tulips were a bubble. Today, years on, where is the centre of the global flower industry? Railways were a bubble. How do most of us get to work in the morning (or, I should say, how did we used to get to work)? Dotcom was a bubble. What do most of us spend all day using?

Of course bitcoin is a bubble. It’s a new technology. Manias almost always accompany new technologies. But not only is it a new technology – it is a new technology that is a new system of money. It’s double bubble. Bitcoin is apolitical money. It was designed in reaction to the bailouts and money printing that followed the financial crisis of Here was a money system that governments couldn’t print and debase when it suited them: a stateless money system for the internet, immune to the whims of politicians.

In this modern age where political ideology has replaced religion, here was a bespoke new technology for those who believe the state is at best wasteful and at worst harmful. It attracted a swarm of acolytes who continuously work on this open-source protocol, develop it, and worship it with religious fervour. It’s a new tech, it’s money, it’s a religion. I raise your “double bubble” to “triple bubble”.

Regardless of your view, you need to make the effort to understand bitcoin

In its mania, when it went from a few hundred dollars to $20,, it had no fewer than eight pullbacks of the same percentage proportion as Monday’s. Eight! Don’t let one day – Monday – allow you to lose sight of the bigger picture. And do not dismiss bitcoin.

I remember going on the BBC’s Daily Politics show in the mania of with an economist called Dr Savvas Savouri who is chief economist with Toscafund Asset Management, and one of the rudest people I have ever met. He described Bitcoin: the Future of Money? () – my book on bitcoin – which he had never read, as “a work of fiction”. He called people who bought bitcoin “financially illiterate” and then cited all the usual clichés about why bitcoin is a bubble – greater fool theory and all the rest of it. But he had never tried the tech! Not once had he bought or transacted with bitcoin. Yet he was holding court on the BBC about it.

Here was a PhD economist – as he kept telling us – and a revolutionary new money system, and he was not even bothering to try it out before dismissing it. The levels of wilful ignorance are extraordinary. No wonder people no longer trust experts. Who is the greater fool? The guy who buys bitcoin? Or the asset manager dismissing the greatest money-making opportunity any of us will ever see in our lifetimes, because he can’t be bothered to try it out?

Savouri is by no means alone. From the FT to the Bank of England to the City, the financial industry is packed with folk who dismiss the tech without trying it out or attempting to understand it. Often it’s sheer laziness. People don’t want to learn.

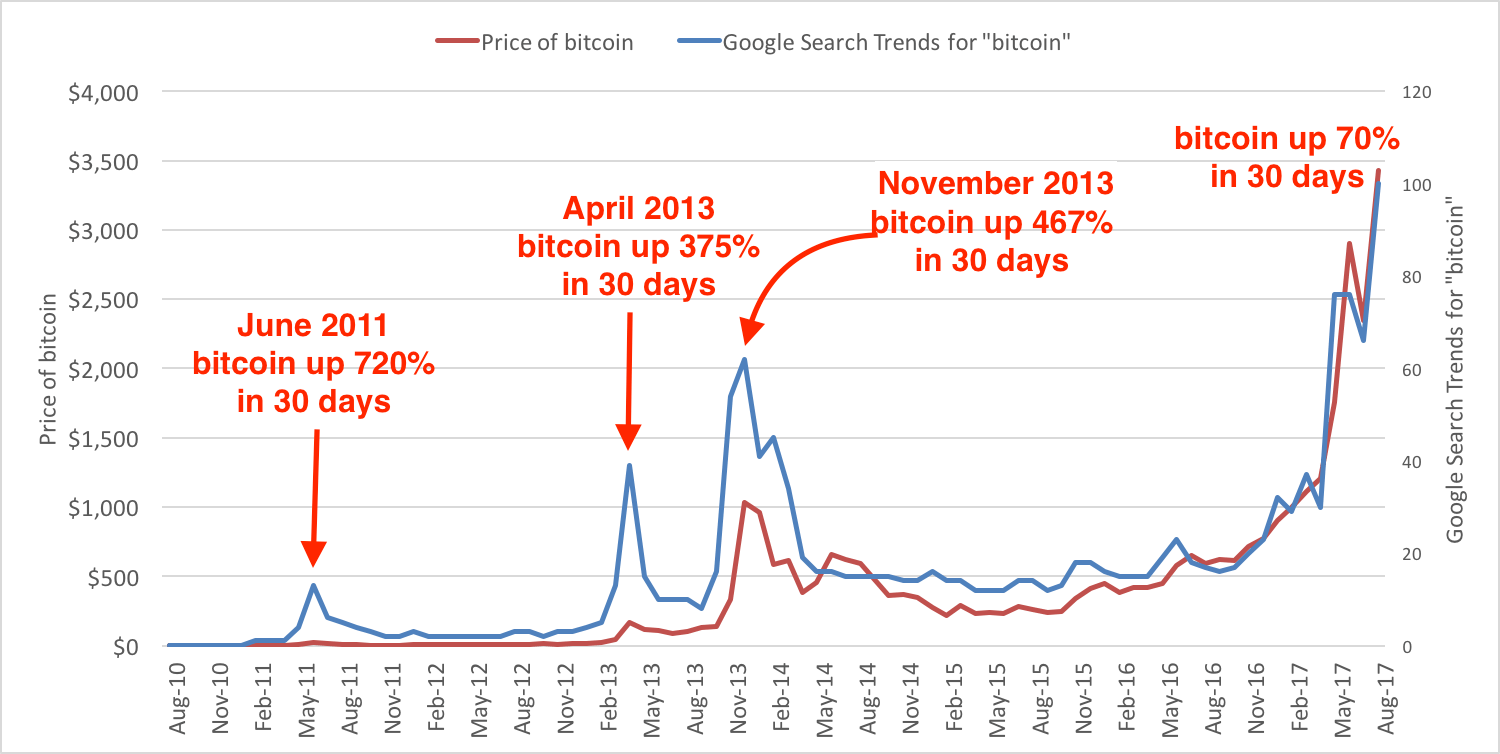

This pattern will repeat and repeat. Bitcoin will go exponential. It will crash. It will go exponential again. All the while the network will grow. Economists and FT journalists (not Merryn obviously! – she and I are recording a MoneyWeek podcast about bitcoin later today) and other “nocoiners” will cry nay. Investors, meanwhile, will cry yay.

As for what happens next, after the run it’s had, it’ll probably go down a bit more before it goes up. Then again, it might just go straight up. Who knows? It’s bitcoin. But you have to have a stake, even at these extraordinary prices. $ seemed extraordinary once upon a time. The potential of bitcoin to become the default store of value for the internet is too huge. The risk is not having a position.

Don’t use leverage. The volatility is too much. Don’t attempt to trade it. Take a position and “HODL” (hold on to it). With the new FCA regulations banning bitcoin derivatives for retail investors, getting exposure to bitcoin just got harder. Owning bitcoin is not like buying a stock. It takes some effort to get used to the tech. It’s worth making this effort. The single most common reason for failing to jump on the bitcoin bandwagon is laziness.

Open an account with an exchange – Gemini, BitPanda, conwaytransport.com.au, Kraken, Binance – whoever. Deposit £20 or £ Get a friend to do the same. Then practise sending each other small amounts of money. That’s the best way to get started.

• Bitcoin: The Future of Money? () by Dominic Frisby available in paperback, on Kindle, and in audiobook, at Amazon.

-

-

-