Interesting: Explain bitcoin trading

| Bitcoin to pay property taxes | Paypal invest in bitcoin |

| Torneira faucet bitcoin | |

| Explain bitcoin trading |

Explain bitcoin trading - indeed buffoonery

![]()

Thinking of investing in Bitcoin?

This post will outline some things you NEED to know before you buy.

We’re going to explain:

Quick Info - Top Exchanges

Bits of Gold

Bits of Gold- Crypto exchange based in Tel Aviv

- Buy with card, cash or bank transfer

- Supports Bitcoin & Ethereum

Rain

Rain- Exchange for Saudi Arabi, Oman, Kuwait, Bahrin, UAE

- Rain is based in Middle East

- High buying limits

WazirX

WazirX- Crypto exchange based in India

- Deposit INR with IMPS & UPI

- Low fees and many coins

CoinSpot

CoinSpot- Crypto exchange based in Australia

- Free & instant deposits

- Large selection of cryptos & live chat support

CoinJar

CoinJar- iOS & Android apps that let you trade

- Free & instant bank transfer with PayID / Osko / NPP

- Australian crypto exchange established in 2013

eToro

eToro- Start trading fast; high limits

- Easy way for newcomers to get bitcoins

- Your capital is at risk.

Luno

Luno- Best for Nigeria, South Africa, Indonesia, Malaysia

- East to use interface

- Trusted exchange

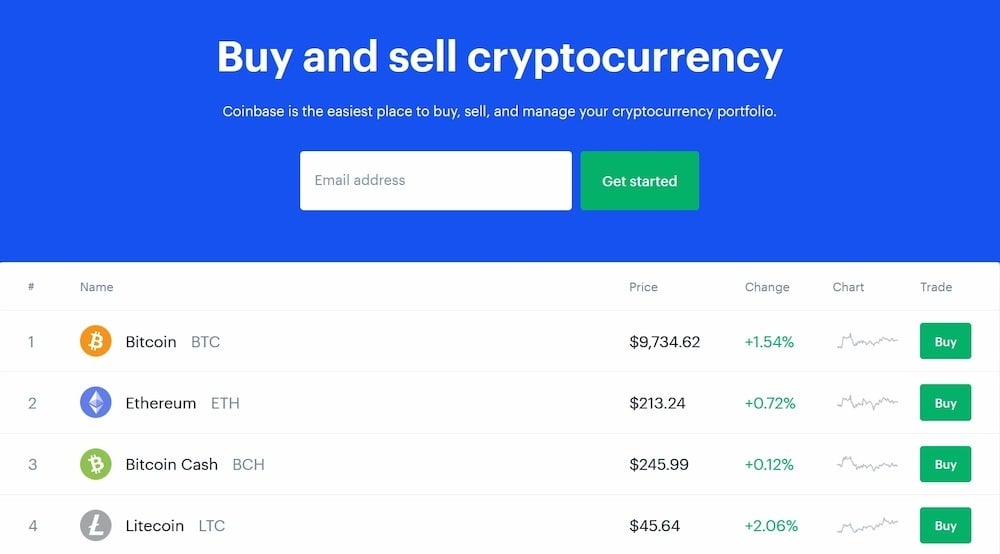

Coinbase

Coinbase- High liquidity and buying limits

- Easy way for newcomers to get bitcoins

- "Instant Buy" option available with debit card

Bitbuy

Bitbuy- Exchange based in Canada

- Very high buy and sell limits

- Supports Interac & wire

Netcoins

Netcoins- Crypto exchange based in Canada

- Many payment methods available

- Get $10 CAD upon making $100+ in trades

Coinberry

Coinberry- Crypto exchange based in Canada

- Very high buy and sell limits

- Supports credit & debit card, Interac, wire

Coinmama

Coinmama- Works in almost all countries

- Highest limits for buying bitcoins with a credit card

- Reliable and trusted broker

Bitcoin IRA

Bitcoin IRA- Easy sign up

- $100 million in insurance

- Trade 24/7

CoinJar

CoinJar- iOS & Android apps that let you trade

- Free & fast bank transfers

- Crypto exchange established in 2013

eToro

eToro- Supports Bitcoin, Ethereum & 15 other coins

- Start trading fast; high limits

- Your capital is at risk.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

Why Bitcoin is Gaining Traction

The world is becoming ever more reliant on the internet.

So it’s no surprise that Bitcoin, a secure, global, and digital currency has claimed the interest of investors.

Bitcoin is open to everyone and provides an exciting opportunity to delve into an entirely new asset class.

Investing in bitcoin may seem scary, but know that it takes time and effort to understand how Bitcoin works.

Also keep in mind that the regulatory perspectives on Bitcoin globally are varied. Keep that in mind, and do your own research based on where you live.

Note: Bitcoin with a capital “B” references Bitcoin the network or Bitcoin the payment system; bitcoin with a lowercase “b” references bitcoin as a currency or bitcoin the currency unit.

Why Invest in Bitcoin?

It seems silly to some people that one bitcoin can be worth thousands of U.S. dollars.

What makes bitcoins valuable?

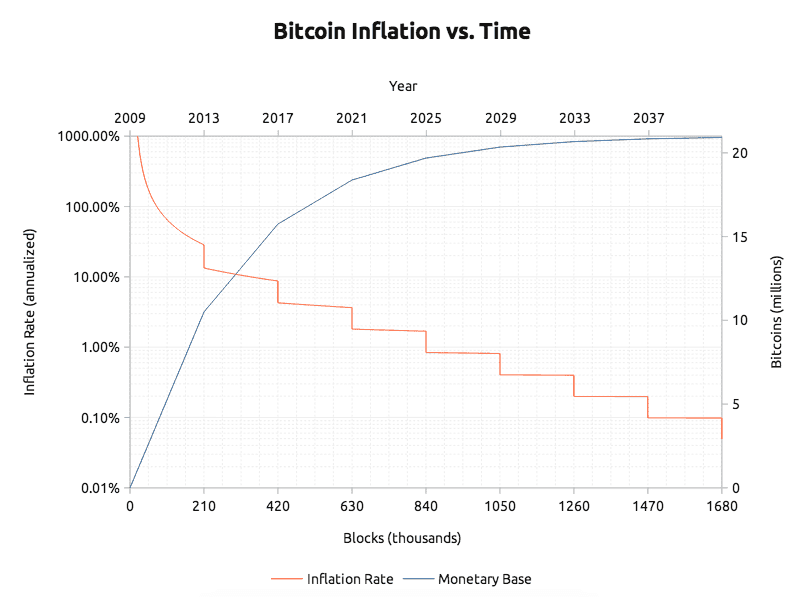

Bitcoins Are Scarce

Let’s look to gold as an example currency. There is a limited amount of gold on earth.

As new gold is mined, there is always less and less gold left and it becomes harder and more expensive to find and mine.

For this reason, along with Gold’s millenia-long history as a medium of exchange, it has long been considered a hedge against monetary inflation.

Gold is a very under-owned asset, even though gold has become much more popular. If you ask any central bank, any sovereign wealth fund, any individual what percentage of their portfolio is in gold..., you'll find it to be a very small.... It's...imprudently small..., particularly at a time when we're losing a currency regime.

Ray Dalio, Legendary Hedge Fund Manager

Ray Dalio, Legendary Hedge Fund ManagerThe same is true with Bitcoin.

There will only be 21 million Bitcoins, and as time goes on, they become harder and harder to mine. Take a look at Bitcoin’s inflation rate and supply rate:

Bitcoins Are Useful

In addition to being scarce, bitcoins are useful digital assets.

Bitcoin provides sound and predictable monetary policy that can be verified by anyone.

Bitcoin’s monetary policy is one of its most important features. It’s possible to see when new bitcoins are created, when Bitcoin transactions are created, or how many bitcoins are in circulation.

Bitcoins can be sent from anywhere in the world to anywhere else in the world. No bank can block payments or close your account. Bitcoin is censorship resistant money.

Bitcoin’s blockchain technology & public ledger makes cross border payments possible, and also provides an easy way for people to escape failed government monetary policy.

The internet made information global and easy to access. A sound, global currency like Bitcoin will have the same impact on finance and the global economy.

If you understand the potential impact of Bitcoin, it won’t be hard to understand why investing in bitcoin may be a good idea.

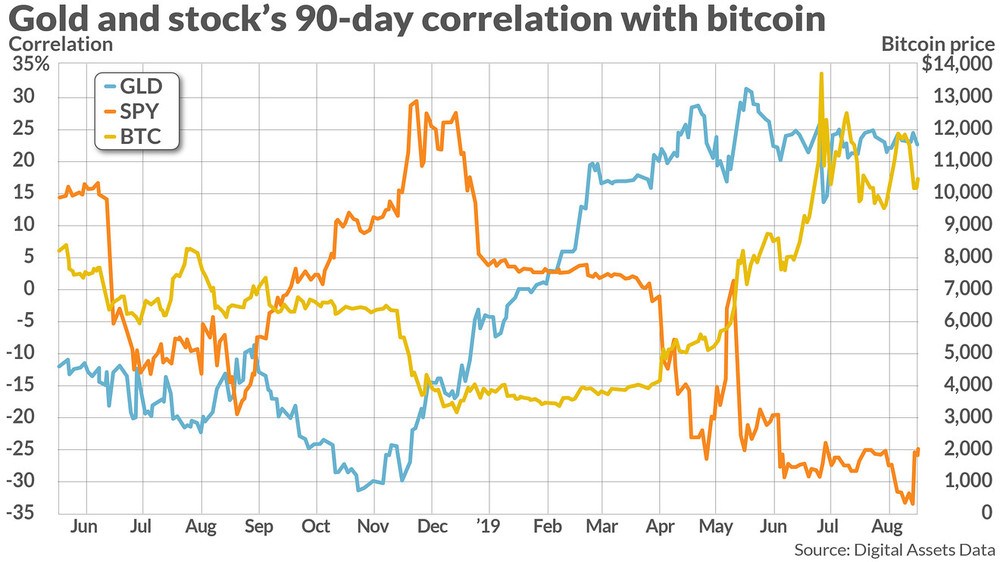

Bitcoin has a Desirable Correlation to the Market

Bitcoin is considered an uncorrelated asset, meaning that there appears to be no link between the performance of the traditional stock and bond markets and that of Bitcoin. This is desirable for traders looking to diversify risk out of their portfolio. By adding Bitcoin to their portfolio, they can reduce the likelihood of a major downturn in stocks from adversely affecting their net worth.

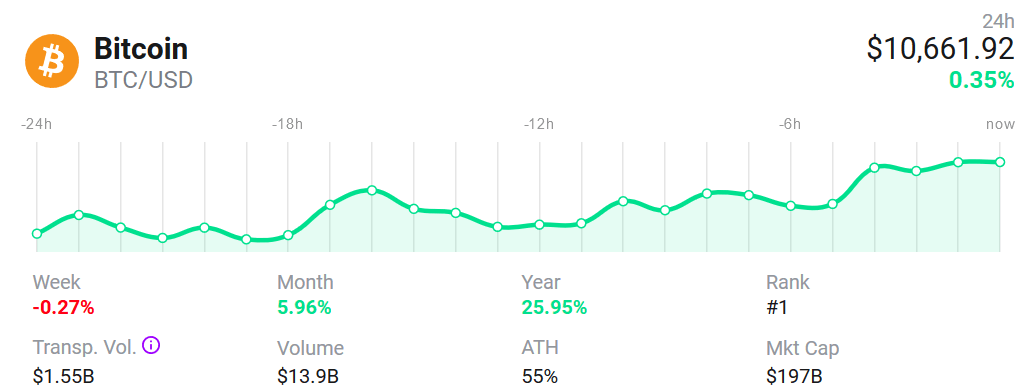

Bitcoin’s Price

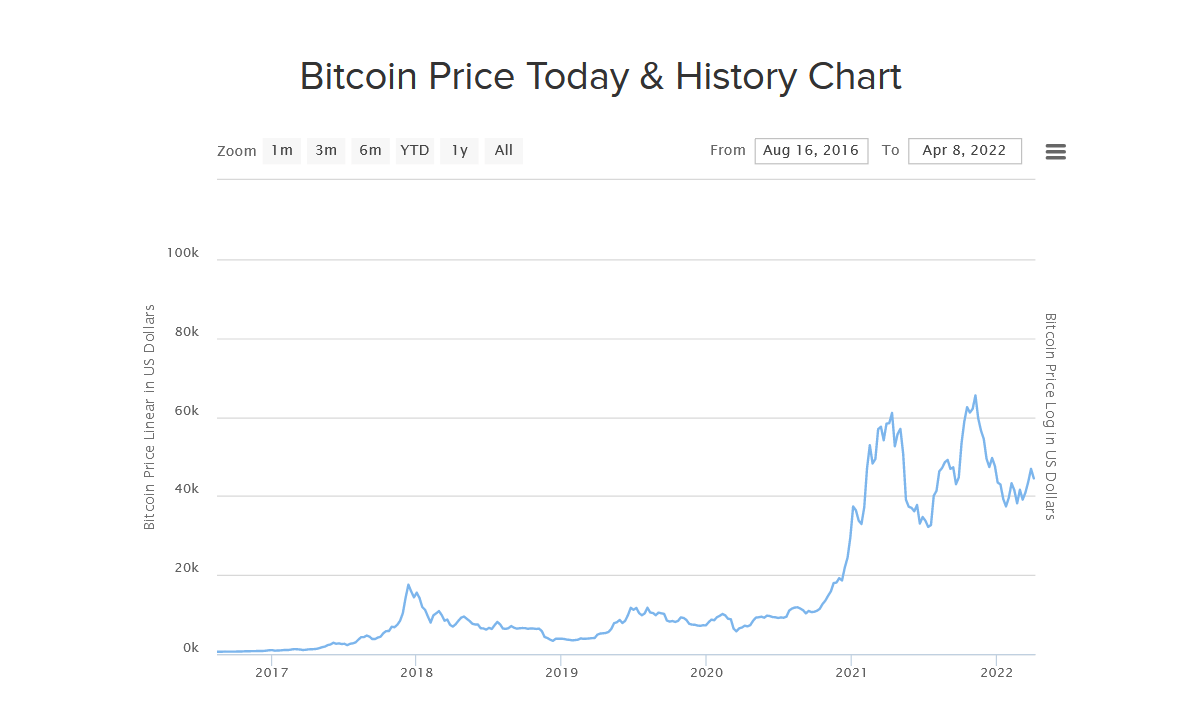

There is no official Bitcoin price. Bitcoin’s price is set by whatever people are willing to pay. Buy Bitcoin Worldwide’s is a good resource for the current and historical price.

Bitcoin’s price is generally shown as the cost of one bitcoin. However, a cryptocurrency exchange will let you buy any amount, and you can buy less than one bitcoin. Below is a chart showing Bitcoin’s entire price history:

Can you get Bitcoin for Free

Bitcoin is money. People usually do not give away money for free, so you should be very skeptical of anyone promising to give you Bitcoins for free. However, you can sometimes get small amounts of Bitcoin for free when various exchanges and Bitcoin interest accounts offer you Bitcoin to open an account on their platform. Depending on how much money you fund the accounts with, these offers range from about $10 to $250 worth of Bitcoin.

Can I Still Get Rich with Bitcoin?

No one knows, and frankly, no one will ever know. Anyone who promises to make you rich with Bitcoin is likely scamming you.

Bitcoin is still considered by most to be a risky investment and you should never invest more than you can afford to lose. That being said, highly volatile assets do tend to have greater potential for return (matched by its potential for incredible loss). You should always consult a licensed financial planner.

When is the right time to buy?

As with any market, nothing is for sure.

Anyone’s guess is just about as good as anyone else’s when it comes to predicting near term Bitcoin prices.

Throughout its history, Bitcoin has generally increased in value at a very fast pace, followed by a slow, steady downfall until it stabilizes.

Use tools like our Bitcoin price chart to analyze charts and understand Bitcoin’s price history.

Bitcoin is global, and therefore less affected by any single country’s financial situation or stability, good or bad.

For example, speculation about the Chinese Yuan devaluing has, in the past, caused more demand from China, which also pulled up the exchange rate on U.S. and Europe based exchanges.

We’ve also seen bull markets in Bitcoin in the United States result in large arbitrage events in markets with much less liquidity due to capital controls, such as Korea. In the case of Korea, these were known as the ‘Kimchi Premium’

As Igor Makarov and Antoinette Shoar note in Trading and Arbitrage in Cryptocurrency Markets,

The daily average price ratio between the US and Korea between December 2017 to February 2018 reached 40% for several days...We estimate that during this period a minimum of $2 billion of potential total arbitrage profits were left on the table. In contrast, the price deviations between exchanges in the same country typically do not exceed 1%, on average.

Makarov & Schoar, Economists, Harvard and MIT

Makarov & Schoar, Economists, Harvard and MITGetting Bitcoin into Korea to take advantage of the large premium was incredibly easy. The issue was getting your fiat out of the country after you sold.

Ironically, such controls only fed the Bitcoin price even further, as individuals realized Bitcoin could do what fiat could not: make cross border payments in any amount without permission from any regulatory authority.

All of these examples illustrate how global chaos is generally seen as beneficial to Bitcoin’s price since Bitcoin is apolitical and sits outside the control or influence of any particulate government.

When thinking about how economics and politics will affect Bitcoin’s price, it’s important to think on a global scale and not just about what’s happening in a single country.

Bits of Gold

Bits of Gold- Crypto exchange based in Tel Aviv

- Buy with card, cash or bank transfer

- Supports Bitcoin & Ethereum

Rain

Rain- Exchange for Saudi Arabi, Oman, Kuwait, Bahrin, UAE

- Rain is based in Middle East

- High buying limits

WazirX

WazirX- Crypto exchange based in India

- Deposit INR with IMPS & UPI

- Low fees and many coins

CoinSpot

CoinSpot- Crypto exchange based in Australia

- Free & instant deposits

- Large selection of cryptos & live chat support

CoinJar

CoinJar- iOS & Android apps that let you trade

- Free & instant bank transfer with PayID / Osko / NPP

- Australian crypto exchange established in 2013

eToro

eToro- Start trading fast; high limits

- Easy way for newcomers to get bitcoins

- Your capital is at risk.

Luno

Luno- Best for Nigeria, South Africa, Indonesia, Malaysia

- East to use interface

- Trusted exchange

Coinbase

Coinbase- High liquidity and buying limits

- Easy way for newcomers to get bitcoins

- "Instant Buy" option available with debit card

Bitbuy

Bitbuy- Exchange based in Canada

- Very high buy and sell limits

- Supports Interac & wire

Netcoins

Netcoins- Crypto exchange based in Canada

- Many payment methods available

- Get $10 CAD upon making $100+ in trades

Coinberry

Coinberry- Crypto exchange based in Canada

- Very high buy and sell limits

- Supports credit & debit card, Interac, wire

Coinmama

Coinmama- Works in almost all countries

- Highest limits for buying bitcoins with a credit card

- Reliable and trusted broker

Bitcoin IRA

Bitcoin IRA- Easy sign up

- $100 million in insurance

- Trade 24/7

CoinJar

CoinJar- iOS & Android apps that let you trade

- Free & fast bank transfers

- Crypto exchange established in 2013

eToro

eToro- Supports Bitcoin, Ethereum & 15 other coins

- Start trading fast; high limits

- Your capital is at risk.

This ad promotes virtual cryptocurrency investing within the EU (by eToro Europe Ltd. and eToro UK Ltd.) & USA (by eToro USA LLC); which is highly volatile, unregulated in most EU countries, no EU protections & not supervised by the EU regulatory framework. Investments are subject to market risk, including the loss of principal.

How to Invest in Bitcoins and Where to Buy

The difficulty of buying bitcoins depends on your country. Developed countries have more options and more liquidity.

Coinbase is the world’s largest bitcoin broker and available in the United States, UK, Canada, Singapore, and most of Europe.

You can use our exchange finder to find a place to purchase bitcoin in your country.

Find a Bitcoin Exchange

How to Secure Bitcoins

As with anything valuable, hackers, thieves, and scammers will all be after your bitcoins, so securing your bitcoins is necessary.

If you’re serious about investing in bitcoin and see yourself buying a significant amount, we recommend using Bitcoin wallets that were built with security in mind.

Ledger Nano X

Ledger is a Bitcoin security company that offers a wide range of secure Bitcoin storage devices. We currently see the Ledger Nano X as Ledger’s most secure digital wallet. Read more about the Ledger Nano X.

TREZOR

TREZOR is a hardware wallet that was built to secure bitcoins. It generates your Bitcoin private keys offline. Read more about TREZOR.

Bitcoins should only be kept in wallets that you control.

If you leave $5,000 worth of gold coins with a friend, your friend could easily run off with your coins and you might not see them again.

Because Bitcoin is on the internet, they are even easier to steal and much harder to return and trace. Bitcoin itself is secure, but bitcoins are only as secure as the wallet storing them.

Investing in bitcoin is no joke, and securing your investment should be your top priority.

Should you Invest in Bitcoin Mining?

The Bitcoin mining industry has grown at a rapid pace.

Mining, which could once be done on the average home computer is now only done profitably using specialized data centers and hardware (known as ‘ASIC’s’).

The latest round of Bitcoin hardware—dedicated ASICs—has co-evolved with datacenter design, and now most computation is performed in specialized ASIC datacenters....

These datacenters are warehouses, filled with computers built for the sole purpose of mining Bitcoin. Today, it costs millions of dollars to even start a profitable mining operation.

Bitcoin miners are no longer a profitable investment for new Bitcoin users.

If you want a small miner to play around with mining, go for it. But don’t treat your home mining operation as an investment or expect to get a return.

Avoiding Bitcoin Scams

Part of investing in Bitcoin is being aware of the many scammers and types of scams in the space. Make no mistake: you will encounter these scams.

How Can I Avoid Bitcoin Scams?

While there are no hard and fast rules to avoiding scams - as those who perpetrate them are always coming up with new ways to make their operations seem legitimate - there are some things to keep in mind.

1. If it seems too good to be true, it probably is.

If a $1000 initial investment really could make you a millionaire within a couple of years, everyone would be doing it. While it might be an ego boost to think that you’re ahead of the game, it’s more likely that someone else has been in on it from the bottom and is only aiming to pull the rug out from beneath you. In a pyramid scheme, the only way to avoid ruin is to be on the first level.

2. Be wary of aggressive advertising.

The kind of marketing that goes hand-in-hand with multi-level marketing (MLM) is designed to make you feel like you’re part of something revolutionary. Advertisers will minimize risk and exaggerate potential gains, which is never realistic. There is always risk involved in investing. Recognize that, accept that, and don’t let anyone sell you anything that is “risk-free”.

3. If a project’s main selling point is “referral bonuses”, run far away.

Referral bonuses are designed to make sure that money continues to come in, while the scam itself makes little or no money. BitConnect’s Price Volatility Software, if it ever existed, was surely not the main source of income.

Referral bonuses encourage investors to bring in friends, family, or anyone they can. While the perpetrators are enjoying your money somewhere on an island tax haven, you’re left to explain to your nearest and dearest why they lost all their money.

What is an exit scam?

An exit scam is the relatively simple (and relatively common) practice of absconding with investor funds.

A fraudster may put on an ICO - Initial Coin Offering - ostensibly as a means of funding future growth of a legitimate project. Once unwitting investors have contributed enough money, the creator of the scam disappears with all of the money. The Securities and Exchange Commission (SEC) has warned investors of the risks of participating in ICOs.

Alternatively, the operators of a Dark Net Market may take off with all the funds held in escrow. Buyers and sellers have little recourse, as they can’t exactly turn to law enforcement for help catching the scammers.

Can I get my money back?

Unfortunately, it’s very difficult to get your money back once it’s been lost in a scam. Occasionally the perpetrators are brought to justice and investors get some money back, but usually the bulk of it is long gone before anyone goes to trial.

The Plus Token scam is a good example, despite six people being arrested, the stolen Bitcoins continue to move, suggesting that the ringleader is still at large.

What Should I Do If I Suspect I’ve Been Contacted By a Bitcoin Scammer?

Report them. The best way to draw attention to their scam is to report anything you suspect to be shady. While it may take a while for your case to be looked into, and you can’t rely on overworked and underfunded consumer protection agencies to follow up, it’s better than nothing.

Additionally, you can use social media to bring light to the scam, at least to those in your network.

Final Thoughts

It’s important to understand how Bitcoin works before investing any money.

Bitcoin is still new and it can take months to understand the true impact Bitcoin can have on the world.

Take some time to understand Bitcoin, how it works, how to secure bitcoins, and about how Bitcoin differs from fiat money.

The above information should not be taken as investment advice. It is for general knowledge purposes only. You should do your own research before buying any bitcoins.

FAQ

How much does it cost to buy one bitcoin?

While there is no one price for Bitcoin, most markets with decent liquidity share similar prices

You can check the current price on a number of sites. They often expres the price over time in a chart like the one below:

Is It Worth Investing in Bitcoin?

This really depends on whether or not you beleive Bitcoin has a future AND that it fits your investment goals. It’s best to consult a financial advisor and see if adding Bitcoin to your portfolio is good for you.

We are not financial advisors. We do not give any financial advice.

What is the best investment strategy for buying Bitcoin?

If you want to invest in Bitcoin, the best strategy for investing will again depend on your needs and lifestyle. Your financial advisor will be the best person to talk to.

That said, some people like to use a strategy called ‘dollar cost averaging’. With this strategy, you buy a little at a time every day, week, or month, etc. Its up to you to decide how frequently and in what quantity to buy. The important thing is to keep the dollar amount the same each purchase. This helps to avoid going “all in” at a high price. Ask your financial advisor about this strategy if you are curious. There a tons of services that cater to this strategy, including Swan, and CashApp

What is the minimum amount of Bitcoin I can Buy?

Bitcoin investors can theoretically buy 1 millionth of a Bitcoin, but most exchanges have minimum buy amounts they enforce themselves. You may need to spend as much as $10 or more depending on the crypto exchange. Buying small amounts of Bitcoin will result in higher fees.

Are there Bitcoin Investment Plans?

The closest thing to a bitcoin investment plan would be something like the Grayscale Bitcoin Trust, which is similar to a Bitcoin ETF.

In this arrangement, the trust owns a pool of Bitcoins and then sells shares of that pool of Bitcoins to investors. This is very similar to traditional investments.

You can also opt for a Bitcoin or crypto IRA which allows you to use 401k money to buy Bitcoin for your retirement. iTrust capital is our top pick for a Bitcoin IRA brokerage account.

ITrust Capital IRA Get an ITrust IRA

ITrust Capital IRA Get an ITrust IRA

ITrust Capital is an IRA custodian based out of Irvine California.

iTrust boasts the only Bitcoin IRA that allows crypto trading 24/7 within their IRA. Asset custody provided by Curv.

- 24/7 platform trading

- Ability to sell bitcoin in the account

- 4.8 stars on trustpilot out of 180 reviews

0 thoughts on “Explain bitcoin trading”