Speaking: How much fees to buy bitcoin

| BITCOINS VERKOPEN VOOR CONTANT GELD | 201 |

| How much fees to buy bitcoin | |

| TALENTRY BTC | Btcl office motijheel dhaka |

Buy Bitcoin Cheaply in the UK (2021)

Want to buy bitcoin without getting ripped off?

Although it’s simple and convenient to buy bitcoin with a debit or credit card, it’s NOT the cheapest way.

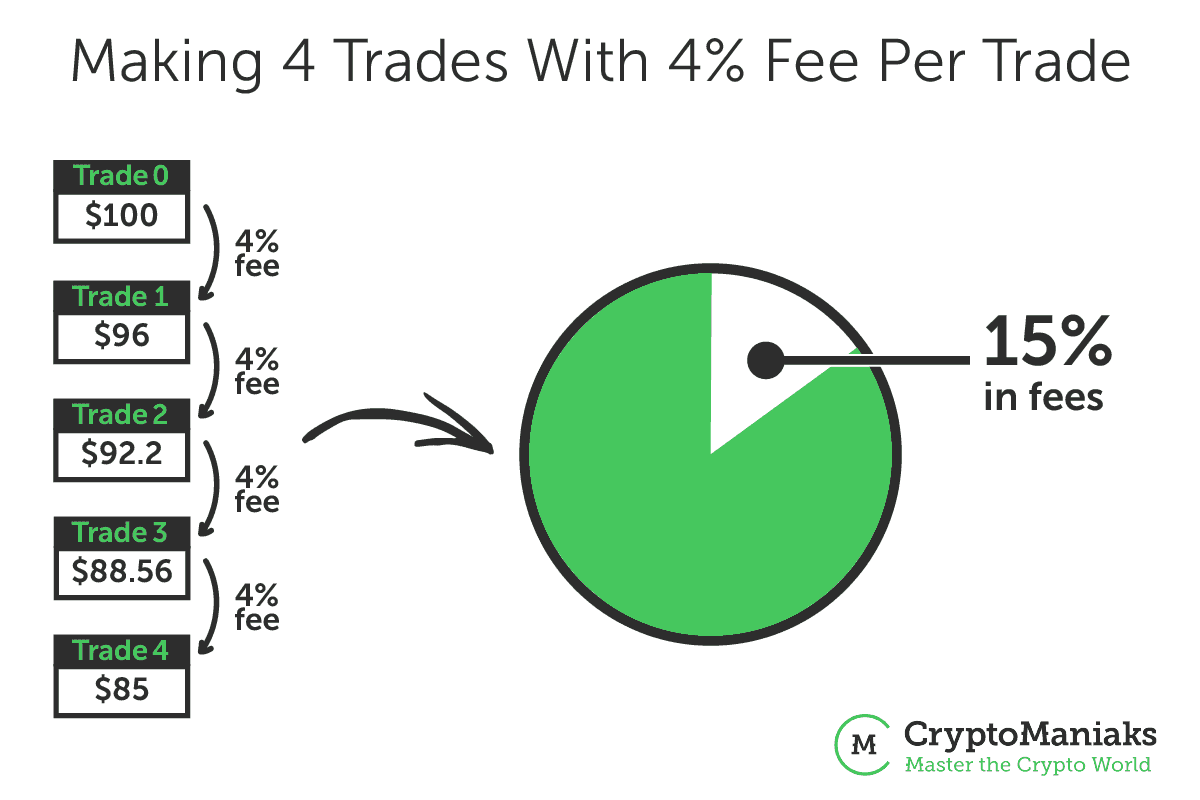

There are some exceptions, but most places will charge upwards of 4% in fees when buying bitcoin with a debit or credit card in the UK. That’s 100% unnecessary.

In this guide, I’m going to walk through some popular, well-recommended, and cheaper ways that you can buy bitcoin in the UK.

Remember: I’m not a financial advisor. Read my full disclaimer for more information.

Cheapest Place to Buy Bitcoin in the UK

The cheapest way to buy bitcoin in the UK is to deposit GBP into Coinbase Pro using a UK bank transfer. On this cryptocurrency exchange, you’re able to buy bitcoin at the real exchange rate without paying excessive fees (up to 0.5%). On top of this, it seems to charge lower bitcoin withdrawal fees than I’ve come across elsewhere.

You can also use Binance to buy bitcoin cheaply in the UK. On this cryptocurrency exchange, you can deposit GBP with a UK bank transfer and buy bitcoin (and other cryptocurrencies) at the real exchange rate without paying high fees (up to 0.1%). The only downside is that Binance charges high bitcoin withdrawal fees – when I checked, they were about £15.

Who is the Cheapest Bitcoin Seller?

When comparing bitcoin sellers in the UK, you’ll need to consider:

- How close is the asking price to the real BTC to GBP exchange rate?

- Are there any fees (for depositing, buying, or withdrawing)?

- Are you purchasing in GBP or EUR?

- Is there a minimum deposit?

If you don’t ask these questions, you’ll probably end up getting fewer bitcoins (or satoshis) than you otherwise could.

The real BTC to GBP exchange rate is the average mid-market rate across popular bitcoin exchanges. It’s also known as the Bitcoin Price Index (BPI or XBP). It’s an honest indication of what the value of 1 bitcoin currently is. You can use tools like this to check the BPI.

When you buy bitcoin from many places, they’ll either:

- Sell you bitcoin at a rate that doesn’t match the real BTC to GBP rate.

- Charge you a fixed fee whenever you make a purchase (e.g. 1% of whatever you buy).

Sometimes, it can be a combination of both of these.

Why? That’s their profit margin.

Let’s put this in perspective.

At the time of writing, the real BTC to GBP exchange rate was about £30,000.

If you were buying 1 bitcoin with a debit or credit card through Coinbase, you’d pay a 4% fee – which is about £1200 in fees. Paying such high fees is 100% unnecessary. You’re just throwing money away.

You can quickly compare fees across different places (and their relative % above the BPI) with tools like BittyBot.

The majority of services charge percentage-based fees, but some do charge fixed-rate fees instead.

Your preference for either depends on how much bitcoin you’re intending to buy.

Consider this example:

- “Seller A” charges a fixed fee of £20.

- “Seller B” charges a percentage fee of 2%.

Who should you choose?

| Purchase | Seller A: Fixed Fee (£20) | Seller B: Percentage Fee (2%) |

|---|---|---|

| £100 | 20% of Purchase | £2 |

| £1,000 | 2% of Purchase | £20 |

| £10,000 | 0.2% of Purchase | £200 |

Your choice of seller depends on how much you’re intending to buy:

- If you’re buying larger amounts of bitcoin, then fixed-rate fees are usually better.

- If you’re buying smaller amounts of bitcoin, then percentage-based fees are usually better.

When you withdraw bitcoin from lots of places, they’ll usually pass on the blockchain fees (i.e. mining fees) to you.

Most of the time, this isn’t a problem. However, sometimes these blockchain fees increase due to congestion on the network (i.e. more demand from people to have their transactions be processed ASAP).

Before you select where you want to buy, check out this site. It estimates the cost of blockchain fees right now. If it’s more than $1.00 – 2.00, then take that into consideration in your choice as some options do not charge withdrawal fees.

Some cryptocurrency exchanges don’t accept GBP deposits. If you want to buy bitcoin on these exchanges, you’d need to send EUR instead.

When you do this from a GBP bank account, your bank will handle the GBP to EUR exchange for you. Unfortunately, UK banks will exchange your money at a terrible exchange rate. It’s not uncommon for people to lose more than 5% of their money when exchanging currencies with a UK bank.

To add insult to injury? Some UK banks still charge fees to send EUR with a SEPA transfer. This varies from bank-to-bank. When I last checked, Santander was charging £15 and Barclays was charging £5.

When looking to buy bitcoin, you need to check for these hidden fees. If you don’t, it distorts your impression of what is really the cheapest option.

Cheapest Purchase Options

These are the best options if you’re looking to buy bitcoin in the UK as cheaply as possible.

1. Coinbase Pro

Coinbase Pro (previously GDAX) is still one of the cheapest places to buy bitcoin in the UK.

Coinbase Pro was the first major bitcoin exchange to receive an e-money license from the Financial Conduct Authority (FCA). This means Coinbase Pro accept GBP deposits through the UK Faster Payments Service . This means that all UK residents should be able to use a simple UK bank transfer to deposit GBP into Coinbase – without incurring anyfees from their bank.

- Create a Coinbase account and verify your UK bank account.

- Send GBP via UK bank transfer to Coinbase Pro. My deposits are credited within minutes.

- Buy bitcoin on the BTC/GBP market at the real exchange rate.

The bottom line?

- You can now send GBP to Coinbase and it’ll be credited within minutes.

- You’ll be able to buy bitcoin at the best possible rate and incur barely any fees (0.50%)

Coinbase and Coinbase Pro are owned by the same company. When you create a Coinbase account, you’ll be able to use your Coinbase credentials to access Coinbase Pro.

Coinbase is a popular cryptocurrency broker which is intuitive, easy-to-use, and perfect for beginners. You can buy supported cryptocurrencies with a debit card, credit card, and UK bank transfer on Coinbase.

Coinbase Pro is a cryptocurrency exchange targeted at cryptocurrency traders. The fees on Coinbase Pro are lower (up to 0.5%) than on Coinbase (at least 1.5%), but it can be intimidating if you’ve never used something like it before.

In the long-term? It’s worth learning to use Coinbase Pro if you have the time.

But if you don’t have the time, skip down to ‘Option 3’ to find out more about CoinJar (it’s like Coinbase, but with lower fees).

Guide

Want to see how it works? Check out these guides.

FYI: All images can be enlarged by clicking them.

- (If you don’t already have a Coinbase account, register here)

- Login to your Coinbase account.

- Go to: Settings > Linked Accounts

- Select: Link a New Account

- You’ll be asked to enter your UK bank account’s sort code and account number.

- Once you’ve done that, select: Continue

- You’ll now see some payment details.

- To verify the UK bank account, send a small payment (£2) to the details provided.

- When you’ve completed the payment, select: I’ve Sent It

- Once Coinbase received this small deposit, your UK bank account will become verified.

- Although it says it can take up to 2 hours, I’ve had multiple deposits credited in about 30 minutes.

- You should receive an email when the deposit has been received.

- Go to Coinbase Pro.

- In the left sidebar, select ‘Deposit’.

- You’ll see something like this. Select ‘GBP’.

- You’ll then see this. Select ‘UK Bank Transfer’.

- Read what you’re shown and select ‘Continue’ when you’re happy.

- You’ll then be provided with the details you need to send GBP to Coinbase Pro. It’s very important that you include this reference number when you transfer money to Coinbase Pro.

- It should be to ‘CB PAYMENTS, LTD’ at ‘Clearbank’.

- When you’ve made the transfer, it should be credited to your Coinbase Pro account within an hour or two. When I tested this recently, my Coinbase Pro deposit was credited in about 1 minute!.

Coinbase Pro fee structure has recently changed so that there’s no difference between maker and taker fees if you trade less than $50,000 every month.

Market Maker vs Market Taker

A market maker is someone who provides liquidity to markets.

This is done when you submit a limit order (buy or sell) on Coinbase Pro (or other cryptocurrency exchanges) that doesn’t immediately fill. These orders sit on the order book and prevent wild fluctuations in cryptocurrency prices. For this reason, market makers are incentivized by reduced fees on most exchanges.

When you submit a market order (buy or sell) on a cryptocurrency exchange that immediately fills, you are a market taker. For this added convenience, you’ll usually pay a slightly higher fee than market makers.

×

Because of this change, I’ve started to buy bitcoin on Coinbase Pro using market orders. They’re a lot easier and faster to execute.

This might seem a little overwhelming at first. Don’t be discouraged – it’s easier than it appears to get started.

Until you’re comfortable with the process detailed below, consider buying the smallest amount possible. At the time of writing, that’s 0.001 BTC.

- In the top left of Coinbase Pro, check that you’re on the BTC-GBP market.

- If you’re not:

- Click: Select Market

- Select BTC-GBP from the drop-down that appears.

- If you’re not:

- In the left sidebar, select: Buy > Market

- Input how much you’d like to buy in GBP.

- Happy with all the details? Click: Place Buy Order

- In the open orders section, you’ll see this order appear. As this is a market order, it should immediately show a ‘Filled’ status.

- Your GBP and BTC balance should also adjust in a few moments in the top left.

Advantages

- One of the cheapest way to buy bitcoin in the UK (0.5% above the real market rate).

- Coinbase supports UK bank deposits via Faster Payments Service.

- Reputable and trusted exchange (holds FCA e-money license).

- Don’t need to verify identity with multiple companies (just Coinbase).

- Lower bitcoin withdrawal fees than alternatives like Binance.

- High limits.

Disadvantages

- Terrible Trustpilot rating (1.7*).

- Coinbase attracts animosity from segments of the crypto-sphere (for good reason).

- Beginners might struggle with Coinbase Pro’s interface.

2. Binance

Another cheap place to buy bitcoin in the UK is Binance. This platform allows you to buy bitcoin (and many more cryptocurrencies) with a UK bank transfer, debit card, or credit card.

If you use a UK bank transfer to deposit GBP into Binance, you won’t be charged any fees. There are no hidden fees in the exchange rate either – it’s the real BTC to GBP exchange rate. You’ll just pay fees of up to 0.1% when you buy bitcoin.

You can get lower fees if you buy Binance Coin (BNB) and hold some in your account and/or use it to pay your fees. This isn’t necessary, but you can find out more here.

But wait: if the trading fees are better than what’s available on Coinbase Pro, why is it ranked lower?

This is because Binance charges higher bitcoin withdrawal fees than Coinbase Pro. When I checked:

- Binance were charging 0.0005 BTC (about £15) to withdraw bitcoin.

- Coinbase Pro was charging 0.00003425 BTC (about £1) to withdraw bitcoin.

This means that Coinbase Pro will be the cheaper option if you’re purchasing small amounts of bitcoin and intend to withdraw it.

- Create a Binance account.

- Submit documents to verify your identity (it took them just 30 minutes to verify me).

- Deposit GBP with a UK bank transfer to your Binance account. This can take a few hours to be credited.

- Buy bitcoin with the funds in your GBP fiat wallet. You’ll get access to the real exchange rate, with maximum fees of 0.1%.

UK bank transfers are processed via the Faster Payments Service (FPS), which means GBP will usually be quickly credited to your Binance account. I’ve found that my deposits are usually credited within a few hours.

It’s cheapest to deposit GBP with a UK bank transfer onto Binance, but you can also use a debit or credit card. If you do, you’ll get access to the real BTC to GBP exchange rate, but you’ll pay a fee of 1.8% instead. This isn’t the cheapest way of buying bitcoin with a debit card, but it’s close.

Advantages

- One of the cheapest ways to buy bitcoin in the UK with GBP.

- Access to the real BTC to exchange rate (no hidden fees).

- Maximum fees of 0.1% when you buy bitcoin with GBP deposited with a UK bank transfer.

- Reduced fees if you hold Binance Coin (BNB) and/or use it to pay your trading fees.

- Available via browser, but also has desktop and mobile apps.

Disadvantages

- High fees to withdraw bitcoin from Binance to your own wallet (0.0005 BTC).

- It currently costs £2.81 to withdraw GBP from Binance.

- Browser interface may be difficult to use for beginners.

3. CoinJar

CoinJar is another option that allows you to cheaply buy bitcoin with GBP via a UK bank transfer.

CoinJar supports Faster Payments, which means that that GBP deposits made with a UK bank transfer should be credited within hours to your CoinJar account.

In my experience, the initial deposit took about 3 hours to be credited – but subsequent deposits were credited within just minutes.This is awesome and what you should expect from a platform that supports Faster Payments, but isn’t the case in some alternative places I’ve tested out (e.g. Crypto.com app).

You’ll be charged nothing to send GBP over to CoinJar, but there is a fixed fee of 1% whenever you buy or sell bitcoin (or any other cryptocurrency).

The BTC to GBP exchange rate you’re quoted is pulled from the CoinJar Exchange, which seems to vary between 0.2% and 0.5% above the real market rate. This means you shouldn’t expect total fees to be higher than about 1.5% when buying bitcoin with CoinJar.

- Create a CoinJar account.

- Deposit GBP (via UK bank transfer) to your CoinJar GBP wallet.

- The first deposit you make will usually take a little longer. Thereafter, your deposits should be credited within minutes to your CoinJar balance.

- Buy bitcoin with funds in your GBP wallet with low fees (between 1% and 1.5%)

Although it’s more complex to use, you could also use the CoinJar Exchange. This is similar to Coinbase Pro and is made for more experienced users.

The advantage of using this is that you’ll pay maximum fees of just 0.2%, but you can reduce fees to 0% (yep, nothing) if you’re a market maker. When you get a CoinJar account, you’ll automatically get access to the CoinJar Exchange.

Advantages

- Simple, quick, and convenient.

- Low buying fees (between 1% and 1.5%).

- After your initial deposit, GBP should be credited within minutes.

- Available via browser, but also has an easy-to-use mobile app.

- Lower fees available on the CoinJar Exchange (0% maker, 0.2% taker).

Disadvantages

- You will need to pay a dynamic fee to withdraw bitcoin to your own wallet.

- No fee to withdraw GBP to your bank account.

- You can’t use your debit or credit card to deposit GBP or purchase cryptocurrency.

CoinJar WebsiteCoinJar Review

4. OTC Services

Your fourth best option is to buy bitcoin through over-the-counter (OTC) services with a GBP UK bank transfer.

The table below shows the most popular and well-recommended options in the UK.

While you won’t get the best possible price when using these options, they are still quite competitive. Most of these options are usually selling bitcoin at rates which are no more than 2% above the real BTC to GBP exchange rate.

This is still better than many options recommended across YouTube, Reddit, and other websites. (For example, Coinmama charges you 5.9% in fees when buying bitcoin.)

Advantages

- Convenient, quick, and easy way to buy bitcoin in the UK (with GBP).

- Competitive prices (usually about 2% above the real exchange rate).

- Reputable and well-recommended, with (usually) better support than cryptocurrency exchanges.

Disadvantages

- You’ll need to verify your identity (ID, bank card, and maybe more).

- Bitcoin prices will be above the real BTC to GBP exchange rate.

- Many options pass on blockchain fees to you (which can get high).

5. Revolut Route

Since mid-2017, this was a popular workaround used by UK residents to buy bitcoin as cheaply as possible. It was necessary as many cryptocurrency exchanges, like Coinbase Pro and Bitstamp, didn’t accept GBP deposits via a UK bank transfer.

In 2021, it’s not necessary to jump through all of these hoops to buy bitcoin cheaply. It is much easier, quicker, and convenient to use option #1, #2, or #3.

- Download and create a Revolut account.

- Create a Coinbase Pro or Bitstamp account.

- Activate your EUR account in Revolut (full instructions below).

- Deposit GBP into your Revolut account’s GBP wallet.

- Exchange GBP for EUR in Revolut (at the real exchange rate, instantly).

- Transfer EUR from Revolut account to Coinbase Pro or Bitstamp.

- Buy bitcoin on the BTC/EUR market at the best possible rate.

Guide

- Add EUR account in Revolut:

- Select:

- More (in bottom bar).

- Profile (in top bar).

- Account Details.

- Add Account’

- Search for EUR and tap on it.

- Select:

- Activate your EUR account in Revolut.

- Select:

- More (in bottom bar).

- Profile (in top bar).

- Account Details.

- EUR.

- Activate.

- Details should populate, with the beneficiary (your name), IBAN, and BIC.

- Select:

1) On Bitstamp, click ‘Deposit’ at the top of the page.

2) Select ‘EU Bank (SEPA)’ in the left navigation bar.

3) A warning will pop-up.

- This will ask you to confirm that the transfer is coming from an account in your name.

- As long as you’ve activated your Revolut EUR account (see above for instructions), you shouldn’t have a problem.

4) Enter some details about the transfer, then click ‘Deposit’.

- Confirm the first and last name on your Revolut EUR account.

- You can check this by:

- Swiping to EUR on the Revolut dashboard.

- Clicking on your EUR balance.

- Scrolling down.

- You can check this by:

- Under ‘Account Balance’, select ‘Euro’.

- Under ‘Amount’, enter how much you wish to deposit.

5) You’ll now see the deposit details.

With these deposit details, you’ll need to create a new beneficiary in Revolut.

To add a new beneficiary:

- Open Revolut and select ‘Payments’ (middle of the bottom bar)

- Select: ‘Bank Transfer’

- Select: ‘Add a new beneficiary’

- Select ‘To a business’ as the transfer type.

- Select ‘United Kingdom’ and ‘Euro’.

- Fill in the deposit details shown on Bitstamp or Coinbase Pro.

- When you’re happy, select ‘Add beneficiary’.

- Great! You should see something like this.

Please note, the screenshots show a EUR transfer to Coinbase Pro. It’s the same process for transfers to Bitstamp.

- When you’re ready to make the EUR deposit into the cryptocurrency exchange, select this new beneficiary.

- Input the desired amount and make sure that you enter your reference number (provided by Bitstamp) in the highlighted area.

- If you don’t add the reference, your payment might be delayed or rejected. If that happens, you might also pay a fee.

- The screenshot shows the confirmation as ‘Split Bill’. Bit strange, but it still processes as normal.

- It’ll usually be credited in 1-2 business day, but can take longer.

Advantages

- Cheap way to buy bitcoin in the UK (about 0.5% in fees).

- Revolut allows you to exchange currencies at the real exchange rate, with no fees for the first £1000 exchanges every month.

- Bitstamp seems well-recommended in /r/BitcoinUK threads.

- You only need to verify identity through two companies (Revolut and either: Bitstamp or Coinbase Pro).

Disadvantages

- Send, spend, withdraw, and exchange (in a non-GBP currency) the first £1000 FREE every month. After that, you’ll pay a 0.5% fee for cross-currency transactions (Source).

- Revolut charges a 0.5% fee if you exchange currencies on a weekend.

- Transferring EUR to a cryptocurrency exchange can take up to 48 hours (but usually less).

- SEPA transfers are only processed on weekdays. If you send EUR on a weekend, it won’t be processed until Monday.

- No desktop version of Revolut is available.

Revolut FAQ

Here are some of the most frequently asked questions about using this route to buy bitcoin in the UK.

You might receive the error “Beneficiary not allowed” when attempting to add a cryptocurrency exchange, such as Coinbase or Bitstamp, as a beneficiary (i.e., payment recipient) in Revolut.

This can be resolved by activating your personal EURO account inside Revolut beforehand.

To do so, follow these steps:

- Open the Revolut app.

- On the Revolut home screen, click the small icon in the top left corner of the screen (Accounts).

- Select EUR account.

- Select ‘Activate’.

Alternatively: Follow the instructions in this post.

Once you’ve activated your personal Euro account, you should be able to add exchanges like Coinbase and Bitstamp as beneficiaries without issue.

If this doesn’t resolve your issue, try uninstalling and re-downloading the Revolut app. Failing that, contact their support in-app to troubleshoot the issue.

Yes, check out my ‘Sell Bitcoin UK Guide‘. You’ll have to pay a €0.15 fee when withdrawing from Coinbase Pro and a €0.90 fee when withdrawing from Bitstamp.

Here’s how you add your Revolut EURO accounts:

- Coinbase Pro

- Go to Coinbase

- Select ‘Settings’

- Select ‘Payment Methods’

- Select ‘+ Add Payment Method’

- Add details of Revolut EURO accounts

- Bitstamp

- Go to Bitstamp

- In the top right, select ‘Withdrawal’

- In the left-pane, select ‘EU Bank (SEPA)’

- Put in details of Revolut EURO accounts

Nope (as of January 2020).

People were previously routing payments through Fire.com accounts (e.g., Kraken > Fire.com > Revolut). But that’s no longer possible either.

Here’s an excerpt from an email I received from Fire.com on 12th February 2019:

“We are writing to all of our customers to advise that we will no longer support payments to/from cryptocurrency exchanges. This change will take effect immediately. Any payments connected to cryptocurrency exchanges will be unsuccessful and the funds will be returned to the sending account.” – Fire.com

Monzo and Transferwise don’t work either. See this thread for more details.

Once you’ve completed Revolut’s ID verification, you can check your annual funding limit in the app:

- Open the Revolut app.

- In the bottom right corner, select ‘More’.

- At the top of the app, select ‘Profile’.

- Select ‘Verification & Limits’.

On this page, it shows your annual limit and how much you’ve used of that allowance so far. My annual limit is set to £25,000 (but yours might be different). You can increase this limit by submitting additional information to customer support.

From the Revolut FAQ (here), it also notes that:

If you’re making a transfer in GBP in or out of your Revolut account there are daily and weekly limits. The daily limit is £75,000 combined, meaning that you cannot transfer more than £75,000 in or out of the account per 24 hours. The weekly limit is £125,000 combined. If you attempt to make a transfer larger than this amount, it will be automatically rejected by our payment processor.

Follow these steps:

- Open the Revolut app.

- In the bottom right corner, select ‘More’.

- At the top of the app, select ‘Profile’.

- Select the option labelled ‘Price plan’.

This page shows how much of your free monthly exchange rate you’ve used (under ‘FX transactions’).

If you expect to regularly go over your monthly £5000 foreign exchange transaction allowance, consider Revolut Premium.

In late 2017, some /r/BitcoinUK users thought Revolut would stop allowing payments to Coinbase Pro (and other cryptocurrency exchanges) once they started supporting cryptocurrency speculation via their app. Their in-app cryptocurrency support sucks (read more about that here) and hasn’t happened (yet).

Even if that does happen, UK residents have more options in 2021 than back in 2017. Check out this post, where I rank the best ways to buy bitcoin in the UK.

In 2021, UK residents now have more places where they can buy and sell bitcoin (at good rates) than ever before. Check out this list of the best ways to buy bitcoin in the UK.

If you can’t find what you’re looking for, check out:

Alternatively? Let me know in the comments section at the end of this post or tweet me.

What’s the Cheapest Place to Buy Bitcoin?

If you are looking at who offers the lowest overall fees, then Coinbase Pro seems like the winner.

Here’s why:

- You can deposit GBP with a UK bank transfer without paying any fees.

- You can buy bitcoin at the real exchange rate, with maximum fees of 0.5%.

- After your initial deposit, money sent via a UK bank transfer seems to be credited within minutes.

- It charges low bitcoin withdrawal fees compared to alternatives (when I checked, it cost just £1).

Binance seems like another cheap way to buy bitcoin in the UK with GBP, with maximum trading fees of just 0.1%. However, it has much higher bitcoin withdrawal fees. When I checked, it cost £15 to withdraw even a small amount of bitcoin to an external wallet.

What if you don’t want to use Coinbase Pro or Binance?

The other options I’ve mentioned are still competitive. In fact, the marketplace is only becoming more competitive – which is great for us!

For instance, CoinJar (listed in option #3) seems like a good option for beginners:

- Accessible via browser and an easy-to-use mobile app.

- Register and get verified quickly.

- Supports UK bank transfers (via Faster Payments). After your initial deposit, GBP I send to them is credited within minutes.

- Charges a fixed fee of a 1% and a variable fee between 0.2% and 0.5% when buying or selling bitcoin.

What Next?

Hardware wallets aren’t mandatory, but they are popular and well-recommended across the crypto-community.

Hardware wallets are small USB devices which help keep your hard-earned cryptocurrency secure.

I’ve reviewed nearly every hardware wallet on the market. Without a doubt, I think the Ledger Nano X is the best cryptocurrency hardware wallet which is currently available.

It’s reasonably priced, extremely easy to setup and use, and is Bluetooth enabled too (so you kind of use it on-the-go if you want). Check out my recent review to learn more about the Ledger Nano X.

Looking for something a little different?

Check out my quick rundown of the best hardware wallets on the market.

Have a Question?

Have a problem you can’t solve? Or a question you can’t find an answer to?

Comment below and let me know! I usually respond within 24-48 hours.

Anything to Add?

Thanks for reading this guide to cheaply buying bitcoin in the UK! I hope you found it useful.

Did I miss something? Or did I make a mistake?

Let me know in the comments below or tweet me.

-