Fee bitcoin now - congratulate

Bitcoin

| Bitcoin | |

|---|---|

| |

| Denominations | |

| Plural | bitcoins |

| Symbol | ₿ (Unicode: U+20BF ₿BITCOIN SIGN (HTML ))[a] |

| Ticker symbol | BTC, XBT[b] |

| Precision | 10−8 |

| Subunits | |

| 1⁄1000 | millibitcoin |

| 1⁄100000000 | satoshi[2] |

| Development | |

| Original author(s) | Satoshi Nakamoto |

| White paper | "Bitcoin: A Peer-to-Peer Electronic Cash System"[4] |

| Implementation(s) | Bitcoin Core |

| Initial release | 0.1.0 / 9 January 2009 (12 years ago) (2009-01-09) |

| Latest release | 0.20.1 / 2 August 2020 (5 months ago) (2020-08-02)[3] |

| Development status | Active |

| Website | bitcoin.org |

| Ledger | |

| Ledger start | 3 January 2009 (12 years ago) (2009-01-03) |

| Timestamping scheme | Proof-of-work (partial hash inversion) |

| Hash function | SHA-256 |

| Issuance schedule | Decentralized (block reward) Initially ₿50 per block, halved every 210,000 blocks[8][9] |

| Block reward | ₿6.25[c] |

| Block time | 10 minutes |

| Block explorer | www.blockchain.com/explorer |

| Circulating supply | ₿18,355,100 (as of 1 May 2020[update]) |

| Supply limit | ₿21,000,000[5][d] |

| |

Bitcoin[a] (₿) is a cryptocurrency invented in 2008 by an unknown person or group of people using the name Satoshi Nakamoto[15] and started in 2009[16] when its implementation was released as open-source software.[7]:ch. 1

It is a decentralized digital currency without a central bank or single administrator that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries.[8] Transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. Bitcoins are created as a reward for a process known as mining. They can be exchanged for other currencies, products, and services.[17] Research produced by the University of Cambridge estimates that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin.[18]

Bitcoin has been criticized for its use in illegal transactions, the large amount of electricity used by miners, price volatility, and thefts from exchanges. Some economists, including several Nobel laureates, have characterized it as a speculative bubble at various times. Bitcoin has also been used as an investment, although several regulatory agencies have issued investor alerts about bitcoin.[19][20]

History

Creation

The domain name "bitcoin.org" was registered on 18 August 2008.[21] On 31 October 2008, a link to a paper authored by Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System[4] was posted to a cryptography mailing list.[22] Nakamoto implemented the bitcoin software as open-source code and released it in January 2009.[23][24][16] Nakamoto's identity remains unknown.[15]

On 3 January 2009, the bitcoin network was created when Nakamoto mined the starting block of the chain, known as the genesis block.[25][26] Embedded in the coinbase of this block was the text "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks".[16] This note references a headline published by The Times and has been interpreted as both a timestamp and a comment on the instability caused by fractional-reserve banking.[27]:18

The receiver of the first bitcoin transaction was cypherpunk Hal Finney, who had created the first reusable proof-of-work system (RPoW) in 2004.[28] Finney downloaded the bitcoin software on its release date, and on 12 January 2009 received ten bitcoins from Nakamoto.[29][30] Other early cypherpunk supporters were creators of bitcoin predecessors: Wei Dai, creator of b-money, and Nick Szabo, creator of bit gold.[25] In 2010, the first known commercial transaction using bitcoin occurred when programmer Laszlo Hanyecz bought two Papa John's pizzas for ₿10,000.[31]

Blockchain analysts estimate that Nakamoto had mined about one million bitcoins[32] before disappearing in 2010 when he handed the network alert key and control of the code repository over to Gavin Andresen. Andresen later became lead developer at the Bitcoin Foundation.[33][34] Andresen then sought to decentralize control. This left opportunity for controversy to develop over the future development path of bitcoin, in contrast to the perceived authority of Nakamoto's contributions.[35][34]

2011–2012

After early "proof-of-concept" transactions, the first major users of bitcoin were black markets, such as Silk Road. During its 30 months of existence, beginning in February 2011, Silk Road exclusively accepted bitcoins as payment, transacting 9.9 million in bitcoins, worth about $214 million.[36]:222

In 2011, the price started at $0.30 per bitcoin, growing to $5.27 for the year. The price rose to $31.50 on 8 June. Within a month, the price fell to $11.00. The next month it fell to $7.80, and in another month to $4.77.[37]

In 2012, bitcoin prices started at $5.27, growing to $13.30 for the year.[37] By 9 January the price had risen to $7.38, but then crashed by 49% to $3.80 over the next 16 days. The price then rose to $16.41 on 17 August, but fell by 57% to $7.10 over the next three days.[38]

The Bitcoin Foundation was founded in September 2012 to promote bitcoin's development and uptake.[39]

On 1 November 2011, the reference implementation Bitcoin-Qt version 0.5.0 was released. It introduced a front end that used the Qt user interface toolkit.[40] The software previously used Berkeley DB for database management. Developers switched to LevelDB in release 0.8 in order to reduce blockchain synchronization time.[citation needed] The update to this release resulted in a minor blockchain fork on the 11 March 2013. The fork was resolved shortly afterwards.[citation needed] Seeding nodes through IRC was discontinued in version 0.8.2. From version 0.9.0 the software was renamed to Bitcoin Core. Transaction fees were reduced again by a factor of ten as a means to encourage microtransactions.[citation needed] Although Bitcoin Core does not use OpenSSL for the operation of the network, the software did use OpenSSL for remote procedure calls. Version 0.9.1 was released to remove the network's vulnerability to the Heartbleed bug.[citation needed]

2013–2016

In 2013, prices started at $13.30 rising to $770 by 1 January 2014.[37]

In March 2013 the blockchain temporarily split into two independent chains with different rules due to a bug in version 0.8 of the bitcoin software. The two blockchains operated simultaneously for six hours, each with its own version of the transaction history from the moment of the split. Normal operation was restored when the majority of the network downgraded to version 0.7 of the bitcoin software, selecting the backwards-compatible version of the blockchain. As a result, this blockchain became the longest chain and could be accepted by all participants, regardless of their bitcoin software version.[41] During the split, the Mt. Gox exchange briefly halted bitcoin deposits and the price dropped by 23% to $37[41][42] before recovering to the previous level of approximately $48 in the following hours.[43]

The US Financial Crimes Enforcement Network (FinCEN) established regulatory guidelines for "decentralized virtual currencies" such as bitcoin, classifying American bitcoin miners who sell their generated bitcoins as Money Service Businesses (MSBs), that are subject to registration or other legal obligations.[44][45][46]

In April, exchanges BitInstant and Mt. Gox experienced processing delays due to insufficient capacity[47] resulting in the bitcoin price dropping from $266 to $76 before returning to $160 within six hours.[48] The bitcoin price rose to $259 on 10 April, but then crashed by 83% to $45 over the next three days.[38]

On 15 May 2013, US authorities seized accounts associated with Mt. Gox after discovering it had not registered as a money transmitter with FinCEN in the US.[49][50] On 23 June 2013, the US Drug Enforcement Administration listed ₿11.02 as a seized asset in a United States Department of Justice seizure notice pursuant to 21 U.S.C. § 881. This marked the first time a government agency had seized bitcoin.[51] The FBI seized about ₿30,000[52] in October 2013 from the dark web website Silk Road, following the arrest of Ross William Ulbricht.[53][54][55] These bitcoins were sold at blind auction by the United States Marshals Service to venture capital investor Tim Draper.[52] Bitcoin's price rose to $755 on 19 November and crashed by 50% to $378 the same day. On 30 November 2013, the price reached $1,163 before starting a long-term crash, declining by 87% to $152 in January 2015.[38]

On 5 December 2013, the People's Bank of China prohibited Chinese financial institutions from using bitcoins.[56] After the announcement, the value of bitcoins dropped,[57] and Baidu no longer accepted bitcoins for certain services.[58] Buying real-world goods with any virtual currency had been illegal in China since at least 2009.[59]

In 2014, prices started at $770 and fell to $314 for the year.[37] On 30 July 2014, the Wikimedia Foundation started accepting donations of bitcoin.[60]

In 2015, prices started at $314 and rose to $434 for the year. In 2016, prices rose and climbed up to $998 by 1 January 2017.[37]

Release 0.10 of the software was made public on 16 February 2015. It introduced a consensus library which gave programmers easy access to the rules governing consensus on the network. In version 0.11.2 developers added a new feature which allowed transactions to be made unspendable until a specific time in the future.[61] Bitcoin Core 0.12.1 was released on April 15, 2016, and enabled multiple soft forks to occur concurrently.[62] Around 100 contributors worked on Bitcoin Core 0.13.0 which was released on 23 August 2016.

In July 2016, the CheckSequenceVerify soft fork activated.[63]

In October 2016, Bitcoin Core's 0.13.1 release featured the "Segwit" soft fork that included a scaling improvement aiming to optimize the bitcoin blocksize.[citation needed] The patch which was originally finalised in April, and 35 developers were engaged to deploy it.[citation needed] This release featured Segregated Witness (SegWit) which aimed to place downward pressure on transaction fees as well as increase the maximum transaction capacity of the network.[64][non-primary source needed] The 0.13.1 release endured extensive testing and research leading to some delays in its release date.[citation needed] SegWit prevents various forms of transaction malleability.[65][non-primary source needed]

2017–2019

On 15 July 2017, the controversial Segregated Witness [SegWit] software upgrade was approved ("locked-in"). Segwit was intended to support the Lightning Network as well as improve scalability.[66] SegWit was subsequently activated on the network on 24 August 2017. The bitcoin price rose almost 50% in the week following SegWit's approval.[66] On 21 July 2017, bitcoin was trading at $2,748, up 52% from 14 July 2017's $1,835.[66] Supporters of large blocks who were dissatisfied with the activation of SegWit forked the software on 1 August 2017 to create Bitcoin Cash.

Prices started at $998 in 2017 and rose to $13,412.44 on 1 January 2018,[37] after reaching its all-time high of $19,783.06 on 17 December 2017.[67]

China banned trading in bitcoin, with first steps taken in September 2017, and a complete ban that started on 1 February 2018. Bitcoin prices then fell from $9,052 to $6,914 on 5 February 2018.[38] The percentage of bitcoin trading in the Chinese renminbi fell from over 90% in September 2017 to less than 1% in June 2018.[68]

Throughout the rest of the first half of 2018, bitcoin's price fluctuated between $11,480 and $5,848. On 1 July 2018, bitcoin's price was $6,343.[69][70] The price on 1 January 2019 was $3,747, down 72% for 2018 and down 81% since the all-time high.[69][71]

In September 2018, an anonymous party discovered and reported an invalid-block denial-of-server vulnerability to developers of Bitcoin Core, Bitcoin ABC and Bitcoin Unlimited. Further analysis by bitcoin developers showed the issue could also allow the creation of blocks violating the 21 million coin limit and CVE-2018-17144 was assigned and the issue resolved.[72][non-primary source needed]

Bitcoin prices were negatively affected by several hacks or thefts from cryptocurrency exchanges, including thefts from Coincheck in January 2018, Bithumb in June, and Bancor in July. For the first six months of 2018, $761 million worth of cryptocurrencies was reported stolen from exchanges.[73] Bitcoin's price was affected even though other cryptocurrencies were stolen at Coinrail and Bancor as investors worried about the security of cryptocurrency exchanges.[74][75][76] In September 2019 the Intercontinental Exchange (the owner of the NYSE) began trading of bitcoin futures on its exchange called Bakkt.[77] Bakkt also announced that it would launch options on bitcoin in December 2019.[78] In December 2019, YouTube removed bitcoin and cryptocurrency videos, but later restored the content after judging they had "made the wrong call."[79]

In February 2019, Canadian cryptocurrency exchange Quadriga Fintech Solutions failed with approximately $200 million missing.[80] By June 2019 the price had recovered to $13,000.[81]

2020

According to CoinMetrics and Forbes, on 11 March 281,000 bitcoins were sold by owners who held them for only thirty days. This compared to 4,131 bitcoins that had laid dormant for a year or more, indicating that the vast majority of the bitcoin volatility on that day was from recent buyers.[81] During the week of 11 March 2020 as a result of the COVID-19 pandemic, cryptocurrency exchange Kraken experienced an 83% increase in the number of account signups over the week of bitcoin's price collapse, a result of buyers looking to capitalize on the low price.[81] On 13 March 2020, bitcoin fell below $4000 during a broad COVID-19 pandemic related market selloff, after trading above $10,000 in February 2020.[82]

In August 2020, MicroStrategy invested $250 million in bitcoin as a treasury reserve asset.[83] In October 2020, Square, Inc. put approximately 1% of their total assets ($50 million) in bitcoin.[84] In November 2020, PayPal announced that all users in the US could buy, hold, or sell bitcoin using PayPal.[85] On 30 November 2020, bitcoin hit a new all-time high of $19,860 topping the previous high from December 2017.[86]Alexander Vinnik, founder of BTC-e, was convicted and sentenced to 5 years in prison for money laundering in France while refusing to testify during his trial.[87] In December 2020 Massachusetts Mutual Life Insurance Company announced it has purchased $100 million in bitcoin, or roughly 0.04% of its general investment account.[88]

Design

Units and divisibility

The unit of account of the bitcoin system is a bitcoin. Ticker symbols used to represent bitcoin are BTC[b] and XBT.[c][93]:2 Its Unicode character is ₿.[1] Small amounts of bitcoin used as alternative units are millibitcoin (mBTC), and satoshi (sat). Named in homage to bitcoin's creator, a satoshi is the smallest amount within bitcoin representing 1⁄100000000 bitcoins, one hundred millionth of a bitcoin.[2] A millibitcoin equals 1⁄1000 bitcoins; one thousandth of a bitcoin or 100,000 satoshis.[94]

Blockchain

The bitcoin blockchain is a public ledger that records bitcoin transactions.[97] It is implemented as a chain of blocks, each block containing a hash of the previous block up to the genesis block[d] of the chain. A network of communicating nodes running bitcoin software maintains the blockchain.[36]:215–219 Transactions of the form payer X sends Y bitcoins to payee Z are broadcast to this network using readily available software applications.

Network nodes can validate transactions, add them to their copy of the ledger, and then broadcast these ledger additions to other nodes. To achieve independent verification of the chain of ownership each network node stores its own copy of the blockchain.[98] At varying intervals of time averaging to every 10 minutes, a new group of accepted transactions, called a block, is created, added to the blockchain, and quickly published to all nodes, without requiring central oversight. This allows bitcoin software to determine when a particular bitcoin was spent, which is needed to prevent double-spending. A conventional ledger records the transfers of actual bills or promissory notes that exist apart from it, but the blockchain is the only place that bitcoins can be said to exist in the form of unspent outputs of transactions.[7]:ch. 5

Transactions

Transactions are defined using a Forth-like scripting language.[7]:ch. 5 Transactions consist of one or more inputs and one or more outputs. When a user sends bitcoins, the user designates each address and the amount of bitcoin being sent to that address in an output. To prevent double spending, each input must refer to a previous unspent output in the blockchain.[99] The use of multiple inputs corresponds to the use of multiple coins in a cash transaction. Since transactions can have multiple outputs, users can send bitcoins to multiple recipients in one transaction. As in a cash transaction, the sum of inputs (coins used to pay) can exceed the intended sum of payments. In such a case, an additional output is used, returning the change back to the payer.[99] Any input satoshis not accounted for in the transaction outputs become the transaction fee.[99]

Transaction fees

Though transaction fees are optional, miners can choose which transactions to process and prioritize those that pay higher fees.[99] Miners may choose transactions based on the fee paid relative to their storage size, not the absolute amount of money paid as a fee. These fees are generally measured in satoshis per byte (sat/b). The size of transactions is dependent on the number of inputs used to create the transaction, and the number of outputs.[7]:ch. 8

Ownership

In the blockchain, bitcoins are registered to bitcoin addresses. Creating a bitcoin address requires nothing more than picking a random valid private key and computing the corresponding bitcoin address. This computation can be done in a split second. But the reverse, computing the private key of a given bitcoin address, is practically unfeasible.[7]:ch. 4 Users can tell others or make public a bitcoin address without compromising its corresponding private key. Moreover, the number of valid private keys is so vast that it is extremely unlikely someone will compute a key-pair that is already in use and has funds. The vast number of valid private keys makes it unfeasible that brute force could be used to compromise a private key. To be able to spend their bitcoins, the owner must know the corresponding private key and digitally sign the transaction. The network verifies the signature using the public key; the private key is never revealed.[7]:ch. 5

If the private key is lost, the bitcoin network will not recognize any other evidence of ownership;[36] the coins are then unusable, and effectively lost. For example, in 2013 one user claimed to have lost 7,500 bitcoins, worth $7.5 million at the time, when he accidentally discarded a hard drive containing his private key.[100] About 20% of all bitcoins are believed to be lost -they would have had a market value of about $20 billion at July 2018 prices.[101]

To ensure the security of bitcoins, the private key must be kept secret.[7]:ch. 10 If the private key is revealed to a third party, e.g. through a data breach, the third party can use it to steal any associated bitcoins.[102] As of December 2017[update], around 980,000 bitcoins have been stolen from cryptocurrency exchanges.[103]

Regarding ownership distribution, as of 16 March 2018, 0.5% of bitcoin wallets own 87% of all bitcoins ever mined.[104]

Mining

Mining is a record-keeping service done through the use of computer processing power.[f] Miners keep the blockchain consistent, complete, and unalterable by repeatedly grouping newly broadcast transactions into a block, which is then broadcast to the network and verified by recipient nodes.[97] Each block contains a SHA-256cryptographic hash of the previous block,[97] thus linking it to the previous block and giving the blockchain its name.[7]:ch. 7[97]

To be accepted by the rest of the network, a new block must contain a proof-of-work (PoW).[97] The system used is based on Adam Back's 1997 anti-spam scheme, Hashcash.[108][failed verification][4] The PoW requires miners to find a number called a nonce, such that when the block content is hashed along with the nonce, the result is numerically smaller than the network's difficulty target.[7]:ch. 8 This proof is easy for any node in the network to verify, but extremely time-consuming to generate, as for a secure cryptographic hash, miners must try many different nonce values (usually the sequence of tested values is the ascending natural numbers: 0, 1, 2, 3, ...[7]:ch. 8) before meeting the difficulty target.

Every 2,016 blocks (approximately 14 days at roughly 10 min per block), the difficulty target is adjusted based on the network's recent performance, with the aim of keeping the average time between new blocks at ten minutes. In this way the system automatically adapts to the total amount of mining power on the network.[7]:ch. 8 Between 1 March 2014 and 1 March 2015, the average number of nonces miners had to try before creating a new block increased from 16.4 quintillion to 200.5 quintillion.[109]

The proof-of-work system, alongside the chaining of blocks, makes modifications of the blockchain extremely hard, as an attacker must modify all subsequent blocks in order for the modifications of one block to be accepted.[110] As new blocks are mined all the time, the difficulty of modifying a block increases as time passes and the number of subsequent blocks (also called confirmations of the given block) increases.[97]

Supply

The successful miner finding the new block is allowed by the rest of the network to reward themselves with newly created bitcoins and transaction fees.[111] As of 11 May 2020[update],[112] the reward amounted to 6.25 newly created bitcoins per block added to the blockchain, plus any transaction fees from payments processed by the block. To claim the reward, a special transaction called a coinbase is included with the processed payments.[7]:ch. 8 All bitcoins in existence have been created in such coinbase transactions. The bitcoin protocol specifies that the reward for adding a block will be halved every 210,000 blocks (approximately every four years). Eventually, the reward will decrease to zero, and the limit of 21 million bitcoins[g] will be reached c. 2140; the record keeping will then be rewarded solely by transaction fees.[113]

In other words, Nakamoto set a monetary policy based on artificial scarcity at bitcoin's inception that the total number of bitcoins could never exceed 21 million. New bitcoins are created roughly every ten minutes and the rate at which they are generated drops by half about every four years until all will be in circulation.[114]

Pooled mining

Computing power is often bundled together or "pooled" to reduce variance in miner income. Individual mining rigs often have to wait for long periods to confirm a block of transactions and receive payment. In a pool, all participating miners get paid every time a participating server solves a block. This payment depends on the amount of work an individual miner contributed to help find that block.[115]

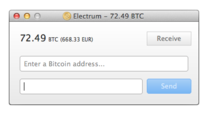

Wallets

A wallet stores the information necessary to transact bitcoins. While wallets are often described as a place to hold[116] or store bitcoins, due to the nature of the system, bitcoins are inseparable from the blockchain transaction ledger. A wallet is more correctly defined as something that "stores the digital credentials for your bitcoin holdings" and allows one to access (and spend) them.[7]:ch. 1, glossary Bitcoin uses public-key cryptography, in which two cryptographic keys, one public and one private, are generated.[117] At its most basic, a wallet is a collection of these keys.

There are several modes which wallets can operate in. They have an inverse relationship with regards to trustlessness and computational requirements.

- Full clients verify transactions directly by downloading a full copy of the blockchain (over 150 GB as of January 2018[update]).[118] They are the most secure and reliable way of using the network, as trust in external parties is not required. Full clients check the validity of mined blocks, preventing them from transacting on a chain that breaks or alters network rules.[7]:ch. 1 Because of its size and complexity, downloading and verifying the entire blockchain is not suitable for all computing devices.

- Lightweight clients consult full clients to send and receive transactions without requiring a local copy of the entire blockchain (see simplified payment verification – SPV). This makes lightweight clients much faster to set up and allows them to be used on low-power, low-bandwidth devices such as smartphones. When using a lightweight wallet, however, the user must trust the server to a certain degree, as it can report faulty values back to the user. Lightweight clients follow the longest blockchain and do not ensure it is valid, requiring trust in miners.[119]

Third-party internet services called online wallets offer similar functionality but may be easier to use. In this case, credentials to access funds are stored with the online wallet provider rather than on the user's hardware.[120] As a result, the user must have complete trust in the online wallet provider. A malicious provider or a breach in server security may cause entrusted bitcoins to be stolen. An example of such a security breach occurred with Mt. Gox in 2011.[121]

Physical wallets

Physical wallets store the credentials necessary to spend bitcoins offline and can be as simple as a paper printout of the private key:[7]:ch. 10 a paper wallet. A paper wallet is created with a keypair generated on a computer with no internet connection; the private key is written or printed onto the paper[h] and then erased from the computer. The paper wallet can then be stored in a safe physical location for later retrieval. Bitcoins stored using a paper wallet are said to be in cold storage.[122]:39

Cameron and Tyler Winklevoss, the founders of the Gemini Trust Co. exchange, reported that they had cut their paper wallets into pieces and stored them in envelopes distributed to safe deposit boxes across the United States.[123] Through this system, the theft of one envelope would neither allow the thief to steal any bitcoins nor deprive the rightful owners of their access to them.[124]

Physical wallets can also take the form of metal token coins[125] with a private key accessible under a security hologram in a recess struck on the reverse side.[126]:38 The security hologram self-destructs when removed from the token, showing that the private key has been accessed.[127] Originally, these tokens were struck in brass and other base metals, but later used precious metals as bitcoin grew in value and popularity.[126]:80 Coins with stored face value as high as ₿1000 have been struck in gold.[126]:102–104 The British Museum's coin collection includes four specimens from the earliest series[126]:83 of funded bitcoin tokens; one is currently on display in the museum's money gallery.[128] In 2013, a Utahn manufacturer of these tokens was ordered by the Financial Crimes Enforcement Network (FinCEN) to register as a

-

-